Key Takeaways

- Conservative credit management and reduced loan origination may constrain revenue growth in the commercial loan segment.

- Increasing expenses and credit risks in the office space market could pressure margins and impact future earnings.

- Effective financial management and strategic growth initiatives in loans, deposits, and wealth management suggest stable and diversified future earnings for Washington Trust Bancorp.

Catalysts

About Washington Trust Bancorp- Operates as the bank holding company for The Washington Trust Company, of Westerly that provides various banking and financial services to individuals and businesses.

- The company's margin is currently not where they want it to be, and while it has stabilized, any delay in expected rate cuts by the Fed would limit their ability to expand margins and improve net interest income. This could impact future earnings growth.

- The company has stated that they have been pulling back on loan origination activity and managing credit more conservatively, which could limit future revenue growth in their commercial loan segment.

- Their noninterest income has slightly decreased, and while some gains were adjusted with sales, any continued decrease in noninterest income or slower recovery in their wealth management and mortgage banking segments may suppress future revenue growth.

- The company's expenses continue to increase, slightly up from previous quarters, and any inability to control expenses further could negatively impact their net margins and overall earnings.

- The unresolved $10.5 million commercial real estate loan and potential unresolved office loans, coupled with the exposure to the office space market, represent credit risk that could impact loan recovery rates and potentially lead to increased provisions or write-offs, affecting net income and margins.

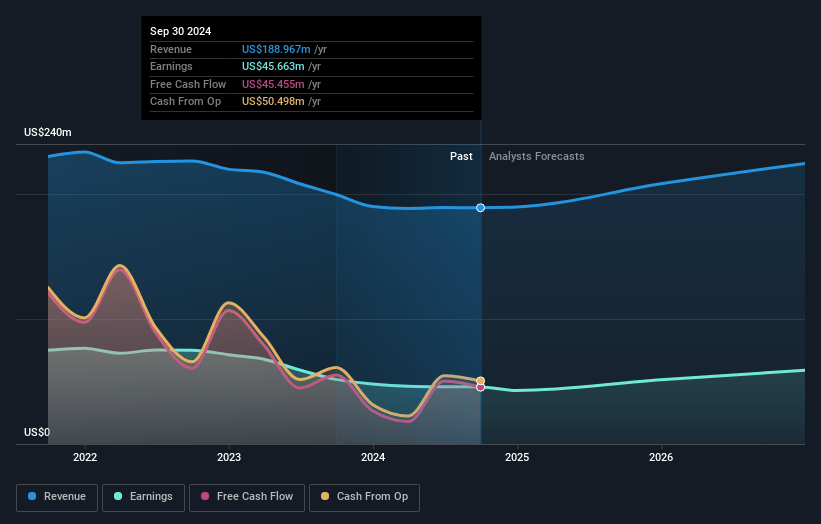

Washington Trust Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Washington Trust Bancorp's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.2% today to 23.4% in 3 years time.

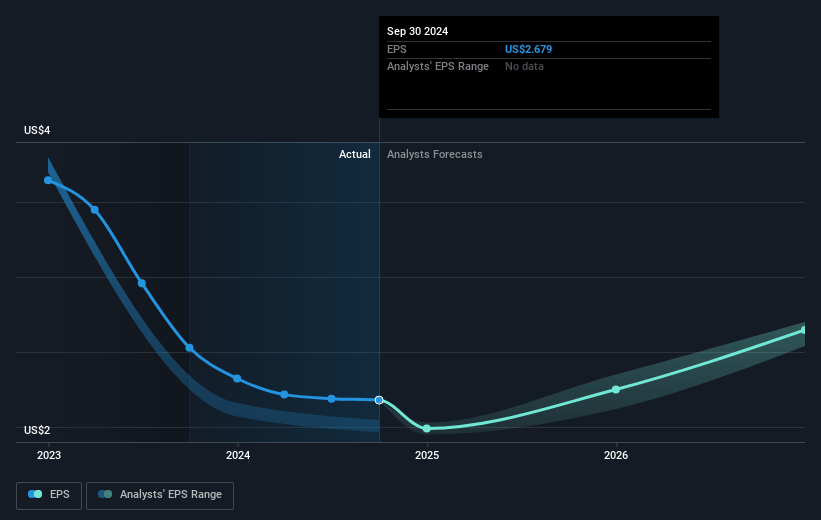

- Analysts expect earnings to reach $52.6 million (and earnings per share of $3.07) by about December 2027, up from $45.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.5x on those 2027 earnings, up from 13.7x today. This future PE is greater than the current PE for the US Banks industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.18%, as per the Simply Wall St company report.

Washington Trust Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has shown an ability to stabilize its net interest margin despite economic fluctuations, which could support steady earnings in the future.

- Prudently managing credit and proactive management are highlighted as strengths, which may lead to improved credit quality and reduced credit-related expenses, potentially stabilizing or enhancing net margins.

- The increase in commercial and mortgage pipelines suggests potential for future loan growth and revenue expansion as these pipelines materialize.

- Strong customer-focused teams and targeted marketing efforts have led to deposit growth and community engagement, potentially boosting revenue and customer retention.

- Wealth management and fee businesses are performing well, which could contribute to noninterest income stability and diversified revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.5 for Washington Trust Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $224.8 million, earnings will come to $52.6 million, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 8.2%.

- Given the current share price of $36.66, the analyst's price target of $35.5 is 3.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.