Key Takeaways

- Integration of advanced data platforms and AI enhances product adoption, accuracy, and recurring revenue opportunities in freight finance and payment automation.

- Expanding digital financial products and efficient risk management drive margin growth, improved asset quality, and sustained top-line and earnings momentum.

- Triumph Financial faces revenue instability, margin pressure, and increased credit risk due to industry concentration, tech investment risks, heightened competition, and rising regulatory and cybersecurity costs.

Catalysts

About Triumph Financial- A financial holding company, provides banking, factoring, payments, and intelligence services in the United States.

- Integration of Greenscreens into Triumph's platform-with its $40B in proprietary audit and payment data-is significantly improving product accuracy and penetration within the top freight brokers, accelerating adoption, elevating average contract value, and positioning the intelligence business as Triumph's fastest-growing segment, supporting higher fee-based revenue and improved earnings growth.

- The continued scaling of TriumphPay and related payment services is driving strong revenue growth and efficiency, as evidenced by rising EBITDA margins (with a stated long-term goal of 40%), benefiting from network effects and the digitalization of freight finance, which is expected to further boost net margins and overall profitability.

- Triumph's leadership and innovation in digital freight factoring and payment automation position it to capture secular growth in e-commerce logistics and rising demand for faster, tech-enabled financial services to small

- and mid-sized carriers-likely resulting in sustained loan and transaction volume growth and stable to rising non-interest income.

- Expansion in financial products-including rapid LoadPay account growth and supply chain finance capabilities-addresses the large, underserved small trucker and broker segments, leveraging Triumph's data advantage to deepen relationships and create new recurring revenue streams, directly enhancing top-line growth and supporting net margin expansion.

- Investments in AI and data-driven risk management reduce charge-offs and improve credit quality, as demonstrated by normalized net charge-offs below $1M this quarter and ongoing improvements, directly supporting asset quality, lowering provision expenses, and driving consistent long-term earnings improvement.

Triumph Financial Future Earnings and Revenue Growth

Assumptions

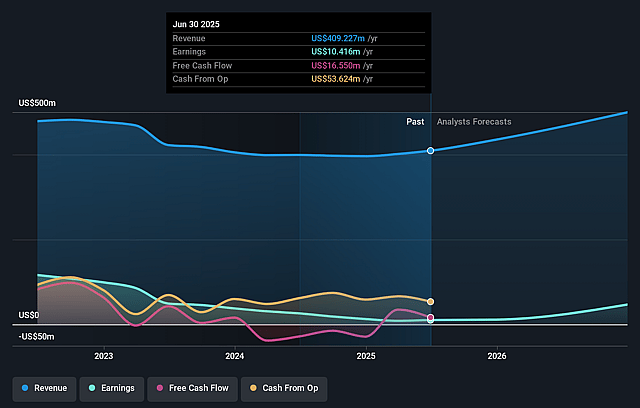

How have these above catalysts been quantified?- Analysts are assuming Triumph Financial's revenue will grow by 13.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 21.8% in 3 years time.

- Analysts expect earnings to reach $131.3 million (and earnings per share of $5.39) by about July 2028, up from $10.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, down from 142.6x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 1.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Triumph Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on transportation-focused segments (factoring, payments, intelligence) exposes Triumph Financial to freight cycle volatility and secular downturns in trucking or logistics, which could lead to unpredictable revenues and compressed net margins during industry slowdowns.

- Integration risks and ongoing technology investments-such as the Greenscreens acquisition, intelligence product development, and enhanced security infrastructure-could outpace near-term revenue growth, applying downward pressure on efficiency ratios and earnings if expected scale and monetization don't materialize rapidly.

- Increasing competition from incumbents (e.g., DAT's entry into factoring and payments, other intelligence platform providers) and potential new fintech challengers may erode Triumph's market share and slow both loan growth and fee-based revenue opportunities, particularly if customers purchase intelligence/lending/payment products from multiple sources.

- Growing compliance, information security, and regulatory expense, especially related to intensified cyberattack risks and the company's role in disbursing significant funds, could further inflate non-interest expenses and limit future margin expansion, particularly if criminal or state-sponsored attacks disrupt operations or erode customer trust.

- The company's relatively concentrated exposure to small and mid-sized freight carriers and logistics providers increases credit and counterparty risk during regional or sectoral economic weakness, potentially resulting in higher credit losses and reduced net income in downturns or times of muted business formation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $60.5 for Triumph Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $602.4 million, earnings will come to $131.3 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.4%.

- Given the current share price of $62.56, the analyst price target of $60.5 is 3.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.