Last Update 27 Nov 25

SMBC: Shares Will Benefit From Ongoing Financial Stability And Consistent Business Trends

Narrative Update on Southern Missouri Bancorp

Analysts have raised their price target for Southern Missouri Bancorp to $63 from $61, citing ongoing positive trends and stable financial metrics.

Analyst Commentary

Following the recent price target adjustment, analysts have provided key insights into the current state and outlook for Southern Missouri Bancorp. Their remarks highlight both opportunities and areas of concern that could impact the stock's future performance.

Bullish Takeaways

- Bullish analysts cite the company's consistent financial stability as a supporting factor for the upward price target revision.

- Ongoing positive business trends are seen as indicators of management’s effective execution and ability to generate sustainable growth.

- The valuation adjustment reflects confidence in the bank’s ability to maintain, and potentially expand, its current performance metrics over the coming quarters.

- Stable industry dynamics are viewed as providing a supportive environment for Southern Missouri Bancorp’s continued expansion.

Bearish Takeaways

- Despite the increased price target, some caution remains as analysts retain a neutral rating, pointing to potential limitations in near-term upside.

- There are concerns around possible headwinds from broader macroeconomic factors, which could impact growth momentum.

- Analysts note that while fundamentals remain solid, execution risks related to competitive pressures in the regional banking sector still exist.

What's in the News

- The Board of Directors approved amended and restated bylaws, which include updates such as changing the annual meeting to the fourth Monday in October, allowing electronic notice and communications, enabling board meetings via video conference, and modernizing officer appointment procedures (Key Developments).

- The company reported net charge-offs of $3.7 million for the quarter ended September 30, 2025. This amount was primarily due to a $2.8 million charge-off related to a special-purpose commercial real estate relationship that had been previously reserved for (Key Developments).

- Between July 1, 2025 and September 30, 2025, the company repurchased 8,415 shares for $0.45 million as part of its ongoing buyback program. This brings total repurchases to 239,835 shares, or 2.39%, for $10.42 million since May 2021 (Key Developments).

Valuation Changes

- Fair Value remains unchanged at $63.50, indicating no revision in the core valuation estimate.

- Discount Rate has decreased marginally from 6.956% to 6.956%, reflecting a minor adjustment in cost of capital assumptions.

- Revenue Growth remains steady at approximately 10.81%, with no notable changes in growth projections.

- Net Profit Margin is stable at about 35.57%, signaling consistent profitability expectations.

- Future P/E holds at roughly 8.97x, showing no movement in anticipated valuation multiples.

Key Takeaways

- Population shifts to core regions and technological investments are driving sustained growth in loans, deposits, efficiency, and customer relationships.

- Lower funding costs, strong loan pipelines, and disciplined credit strategies are expanding margins and supporting profitability despite sector-specific risks.

- Rising credit and asset quality risks, margin pressure, and industry consolidation threaten profitability and growth, while operational efficiency depends on successful technology investments.

Catalysts

About Southern Missouri Bancorp- Operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States.

- Migration of Americans to suburban and rural areas of the Midwest/South is increasing demand for community banking and lending services in Southern Missouri Bancorp's core regions, supporting sustained loan and deposit growth-positively impacting revenue and overall earnings.

- Enhanced adoption of digital banking among older/rural customers, supported by ongoing investments in technology and platform upgrades, is improving efficiency and deepening customer relationships, creating opportunities for cost reductions and higher net margins.

- Recent and expected future easing of deposit competition allows the bank to lower funding costs, as seen with reduced CD rates and a stable deposit base, leading to potential net interest margin expansion and improved profitability through fiscal 2026.

- Strong loan origination pipeline, with new loans being booked at higher yields than the existing portfolio, alongside the ability to reprice loan assets upward as they mature, is supporting further net interest income and net margin growth.

- The company's disciplined approach to credit, proactive reserving for ag exposure, and readiness to leverage federal support programs in agriculture mitigates risk from temporary sector headwinds, supporting long-term asset quality and earnings resilience.

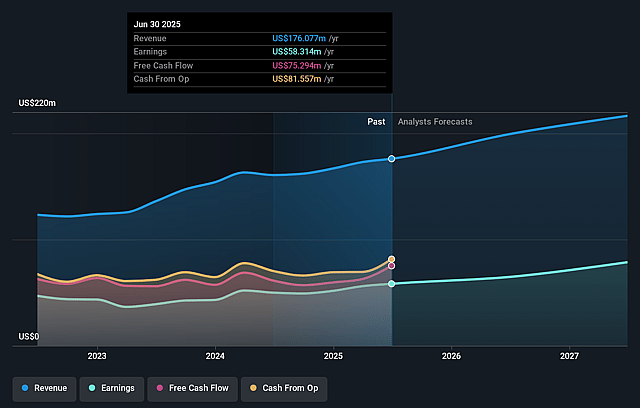

Southern Missouri Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Southern Missouri Bancorp's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 32.4% today to 36.8% in 3 years time.

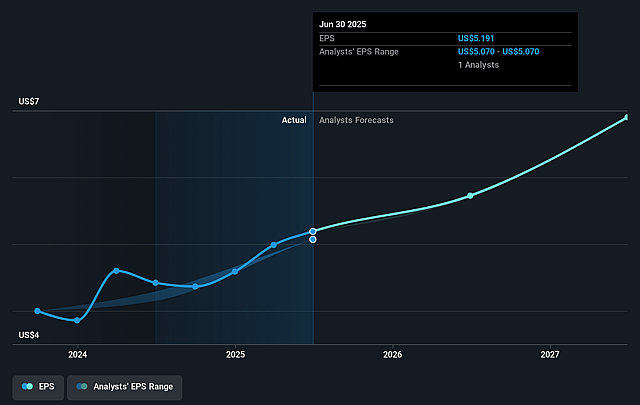

- Analysts expect earnings to reach $85.9 million (and earnings per share of $7.54) by about September 2028, up from $56.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, down from 11.3x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Southern Missouri Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Deteriorating credit quality and increasing levels of nonperforming loans (NPLs)-notably within special purpose CRE and agricultural portfolios-pose a risk of further write-downs and loan loss provisions, which could pressure future earnings and profitability.

- The agricultural loan segment faces significant stress due to persistently low commodity prices, rising input costs, and weaker collateral coverage, raising the risk of higher delinquencies and asset quality deterioration, negatively impacting earnings and capital reserves.

- Ongoing margin expansion is partly dependent on continued loan growth and repricing, but anticipated higher prepayment activity (especially in nonowner-occupied CRE) could slow net loan growth, potentially limiting revenue and net interest income growth in the near-to-medium term.

- Increased reliance on technology investments and third-party data processing expenses, if not properly managed or if expected efficiencies fail to materialize, could elevate cost-to-income ratios and weigh on net margins over time.

- Industry consolidation pressures remain elevated, and Southern Missouri Bancorp may be compelled to pursue potentially dilutive M&A, or risk falling behind larger competitors, which could impact scale advantages, revenue growth, and long-term margin sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $67.0 for Southern Missouri Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $233.5 million, earnings will come to $85.9 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 6.8%.

- Given the current share price of $56.24, the analyst price target of $67.0 is 16.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.