Key Takeaways

- Strategic deposit growth and reduced reliance on costly funding are expected to improve net interest margins and decrease funding expenses.

- Investments in wealth management and LIHTC lendings are enhancing revenue streams and liquidity, supporting future growth and earnings stability.

- Macroeconomic uncertainty affects loan growth and revenue, with interest rate cap expiration and credit quality concerns potentially impacting net margins and earnings.

Catalysts

About QCR Holdings- A multi-bank holding company, provides commercial and consumer banking, and trust and asset management services.

- Significant deposit growth has allowed QCR Holdings to reduce reliance on higher-cost wholesale funding, which is expected to improve future net interest margins and reduce funding costs.

- The company's strategic investments in wealth management are driving consistent revenue growth, projected at 14% for the quarter, suggesting potential for future increases in noninterest income.

- The ongoing LIHTC lending program provides a stable source of capital markets revenue, and future LIHTC loan securitizations are expected to enhance liquidity, improve TCE, and support earnings growth.

- Prudent expense management, including adjustments to variable compensation, has reduced noninterest expenses by 13%, potentially improving future net margins and operational efficiency.

- Strong asset quality, characterized by low levels of criticized loans and a stable allowance for credit losses, indicates a controlled credit risk environment that supports continued strong earnings.

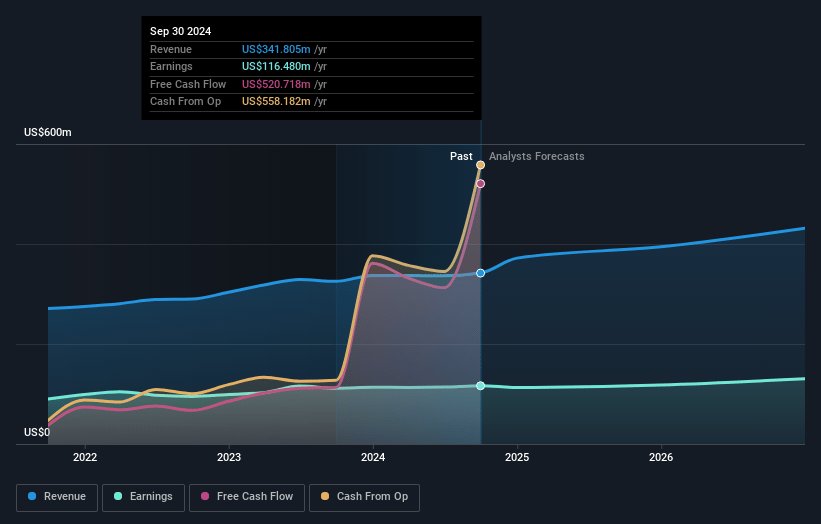

QCR Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming QCR Holdings's revenue will grow by 11.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 34.5% today to 28.5% in 3 years time.

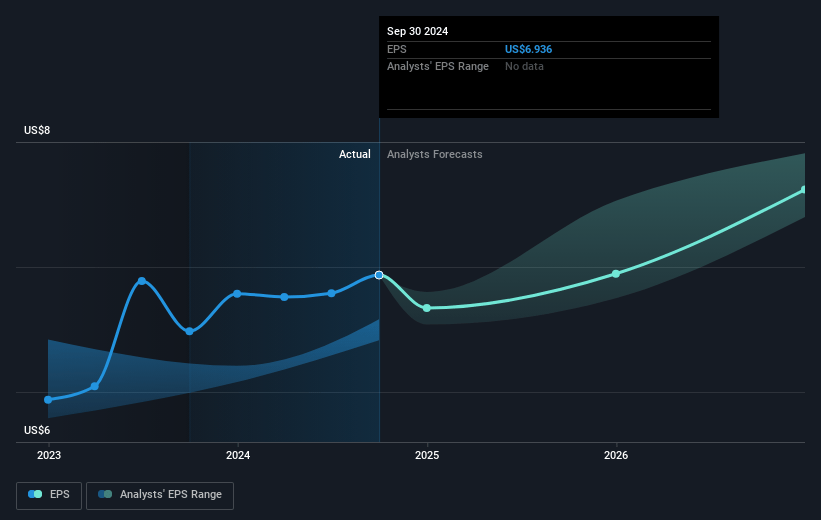

- Analysts expect earnings to reach $131.9 million (and earnings per share of $7.7) by about April 2028, up from $113.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 10.1x today. This future PE is greater than the current PE for the US Banks industry at 10.7x.

- Analysts expect the number of shares outstanding to grow by 0.56% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.23%, as per the Simply Wall St company report.

QCR Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macroeconomic uncertainty, particularly related to legislative actions and tariffs, is influencing client behavior, causing hesitation in making capital decisions, which could negatively impact loan growth and ultimately affect revenue.

- Elevated traditional loan payoffs, driven by clients selling properties or businesses, resulted in modest loan growth in the first quarter, potentially impacting net interest income.

- Delays in LIHTC (Low-Income Housing Tax Credit) lending projects due to macroeconomic uncertainty have led to lower capital markets revenue, a significant part of noninterest income, which could affect overall earnings.

- The expiration of interest rate caps has diluted net interest margin, and while adjustments have been made to counteract this, the situation could still pose a challenge to sustaining net margins.

- Credit quality could become a concern, as highlighted by discussions of potential impacts from tariffs on specific industries, which may lead to increased provision for credit losses or impact earnings if economic conditions deteriorate further.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $92.8 for QCR Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $99.0, and the most bearish reporting a price target of just $82.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $462.3 million, earnings will come to $131.9 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.2%.

- Given the current share price of $68.02, the analyst price target of $92.8 is 26.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.