Narratives are currently in beta

Key Takeaways

- Growth in SBA lending and strategic loan portfolio shifts are set to enhance noninterest income and improve earnings.

- Cost management and liquidity deployment aim to strengthen net interest margins and support earnings expansion.

- Increased nonperforming loans, competition, and economic uncertainties could pressure net margins, while strong deposit growth and rising expenses impact profitability.

Catalysts

About First Internet Bancorp- Operates as the bank holding company for First Internet Bank of Indiana that provides commercial, small business, consumer, and municipal banking products and services to individuals and commercial customers in the United States.

- The company's SBA lending platform has experienced significant growth, with year-to-date SBA loan originations up 35% and sold loan volume up almost 60%, reinforcing growth in noninterest income. This is expected to support future revenue growth.

- Excess liquidity from strong deposit growth provides balance sheet flexibility, anticipated to be utilized for loan growth and the reduction of high-cost CDs and wholesale funding. This should positively impact the net interest margin.

- Continued improvements in net interest income and a potential rebound in net interest margin from deploying liquidity and maturing high-cost CDs are projected to drive earnings growth.

- First Internet Bancorp plans to reposition its loan portfolio towards higher-yielding, variable-rate loans, likely enhancing net interest income and margin, contributing to earnings growth.

- Cost reductions are anticipated from trending down deposit costs, driven by the inflection point in CD pricing and overall expected declines following Fed rate cuts, positively impacting net margins.

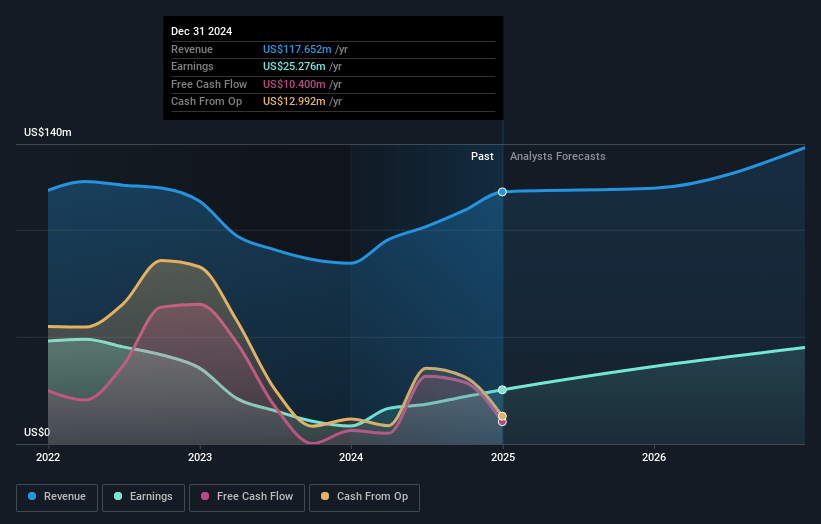

First Internet Bancorp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Internet Bancorp's revenue will grow by 6.4% annually over the next 3 years.

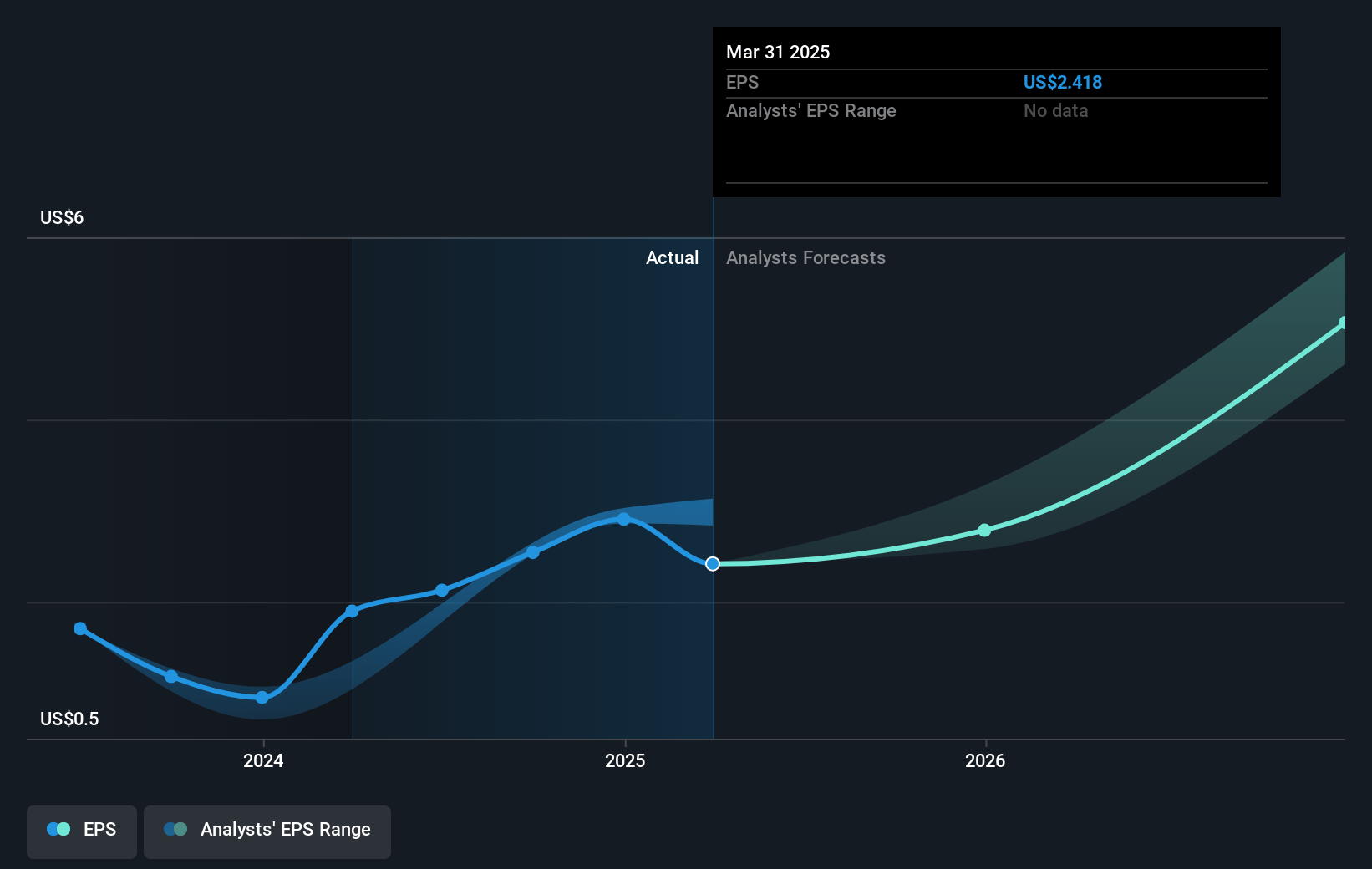

- Analysts assume that profit margins will increase from 20.3% today to 43.6% in 3 years time.

- Analysts expect earnings to reach $57.2 million (and earnings per share of $6.43) by about November 2027, up from $22.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.3x on those 2027 earnings, down from 15.5x today. This future PE is lower than the current PE for the US Banks industry at 12.8x.

- Analysts expect the number of shares outstanding to grow by 0.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

First Internet Bancorp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased nonperforming loans in franchise finance, small business lending, and residential mortgage could lead to higher provisions for credit losses, impacting net margins.

- The strong deposit growth resulting in excess liquidity has caused a short-term drag on net interest margin, which may continue to impact earnings if not effectively deployed.

- The volatility in gain on sale premiums for SBA loans and potential softness in the secondary market could negatively impact noninterest income.

- Economic uncertainties like potential future Fed rate cuts and unpredictable market conditions could affect deposit pricing and net interest margin expansion efforts, impacting net income growth projections.

- Heightened competition and the need to invest in technology and staffing could drive up noninterest expenses, affecting overall profitability and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $42.1 for First Internet Bancorp based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $47.0, and the most bearish reporting a price target of just $38.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $131.2 million, earnings will come to $57.2 million, and it would be trading on a PE ratio of 7.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of $39.5, the analyst's price target of $42.1 is 6.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives