Narratives are currently in beta

Key Takeaways

- Strong loan growth and repricing benefits in a higher rate environment are expected to enhance net interest margins and overall earnings.

- Modernization of digital banking and share buyback program could improve customer retention and earnings per share.

- Financial challenges are evident due to decreased deposits, increased credit provisions, and pressure on earnings and returns, impacting future stability and growth.

Catalysts

About Popular- Through its subsidiaries, provides various retail, mortgage, and commercial banking products and services in Puerto Rico, the United States, and the British Virgin Islands.

- Popular is experiencing strong loan growth, particularly in the commercial segment, which could drive future revenue increases as higher loan balances contribute to net interest income.

- The bank expects continued benefits from the repricing of its investment portfolio and loans in a higher interest rate environment, likely to result in improved net interest margins and overall earnings.

- There is significant economic activity expected in Puerto Rico due to committed federal funds that have not yet been disbursed. This could stimulate further growth in the local economy, resulting in increased revenue and loan demand.

- Popular is actively modernizing its consumer digital banking and personalizing its offerings to enhance customer experiences, which can lead to increased customer retention and potentially higher revenues.

- Popular's share buyback program indicates management's belief in the undervaluation of their stock, which could improve earnings per share (EPS) if repurchases continue at attractive prices.

Popular Future Earnings and Revenue Growth

Assumptions

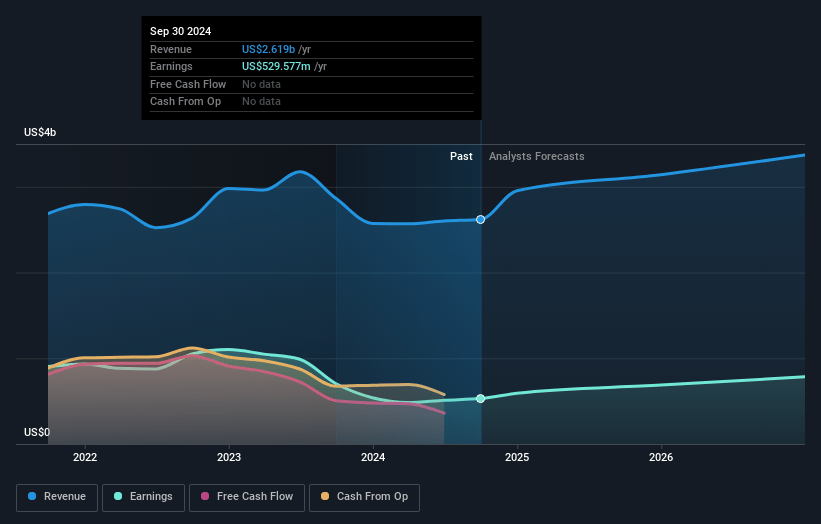

How have these above catalysts been quantified?- Analysts are assuming Popular's revenue will grow by 11.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.2% today to 24.4% in 3 years time.

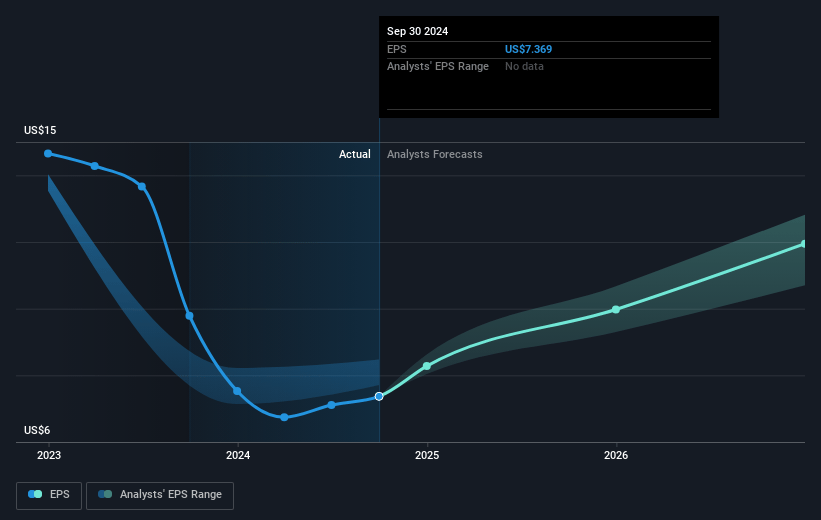

- Analysts expect earnings to reach $885.8 million (and earnings per share of $13.84) by about November 2027, up from $529.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.7x on those 2027 earnings, down from 13.3x today. This future PE is lower than the current PE for the US Banks industry at 12.9x.

- Analysts expect the number of shares outstanding to decline by 3.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Popular Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in net income by $23 million due to a higher provision for credit losses and a reduction in deposit levels could be a sign of underlying financial challenges, which might impact overall earnings.

- The $1.8 billion reduction in deposit levels at BPPR, driven by rate-seeking behavior and retail client expenditures, reflects vulnerability in deposit stability, potentially affecting future net interest income and margins.

- The increase in provision for credit losses by $25 million in part due to loan growth indicates potential credit quality concerns that may lead to higher future expenses and reduced net margins.

- Continued pressure on net interest income due to high deposit costs and decreased average balances of tax-exempt securities reveals issues in maintaining assets' profitability, impacting future earnings.

- The inability to achieve the previously anticipated 14% ROTCE by Q4 2025, now expected to be at least 12%, highlights challenges in achieving projected financial returns, impacting shareholder value and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $103.44 for Popular based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.6 billion, earnings will come to $885.8 million, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 5.9%.

- Given the current share price of $98.34, the analyst's price target of $103.44 is 4.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives