Key Takeaways

- Lear’s innovative seating and electronics solutions position it for above-market growth and margin expansion as automakers demand more advanced features.

- Strategic investments in automation, smart E-Systems, and focus on China strengthen competitiveness and shift revenue toward higher-margin, recurring streams.

- Slower EV adoption, OEM caution, rising Chinese exposure, and intense competition threaten Lear’s sales growth, margins, and long-term profitability amid increasing market and supply chain risks.

Catalysts

About Lear- Designs, develops, engineers, manufactures, assembles, and supplies automotive seating, and electrical distribution systems and related components for automotive original equipment manufacturers in North America, Europe, Africa, Asia, and South America.

- Lear is set to benefit from automakers’ accelerating integration of advanced comfort and safety features, as evidenced by major contract wins for modular and thermal comfort seating solutions like ComfortFlex and ComfortMax with Ford and General Motors; these innovative products command higher pricing and content-per-vehicle, positioning Lear for above-market revenue growth and net margin expansion over the next several years.

- The company’s focused expansion in the Chinese domestic auto market, where its share of revenue is expected to rise from 33% in 2024 to over 37% in 2025 and potentially 50% by 2027, will materially expand Lear’s addressable market and revenue base, especially as emerging market automakers ramp up investments in premium interiors and electrification.

- Strategic investments in automation, AI, and manufacturing efficiency, including the adoption of in-house capital equipment and the IDEA by Lear platform, are driving durable and scalable reductions in labor and production costs, setting up a multi-year improvement in operating and free cash flow margins and enabling enhanced returns to shareholders through sustained buybacks and dividends.

- Lear’s push into smart E-Systems, software, and vehicle connectivity, highlighted by growing electronics-related content and contract wins (including with Bentley for INTU health and wellness software), will shift more revenue toward high-margin, recurring streams, smoothing earnings growth and supporting a higher valuation multiple on future earnings.

- As OEMs accelerate the shift to electric and tech-enabled vehicles—despite temporary EV demand uncertainty—Lear’s leadership in both advanced seating and electrical systems ensures it will capture a greater share of value as global vehicle production normalizes and automaker outsourcing intensifies, supporting a rebound and sustained growth in consolidated revenues and net income beyond 2025.

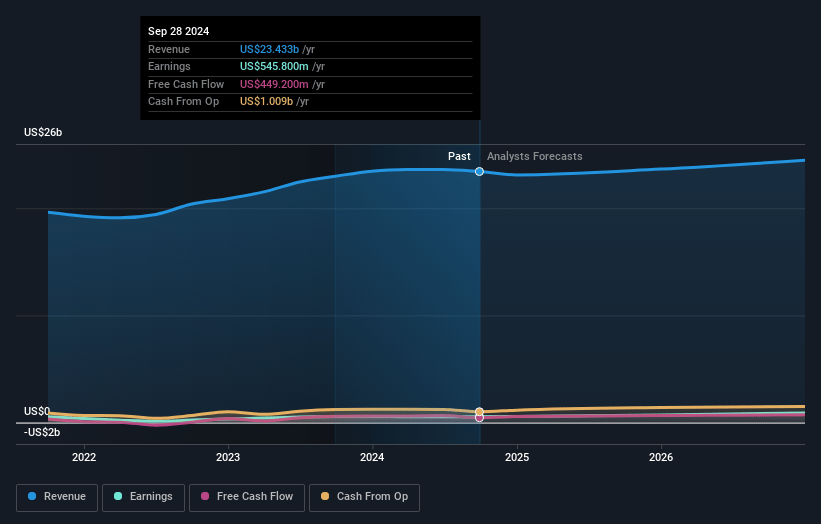

Lear Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lear compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lear's revenue will grow by 1.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.2% today to 3.7% in 3 years time.

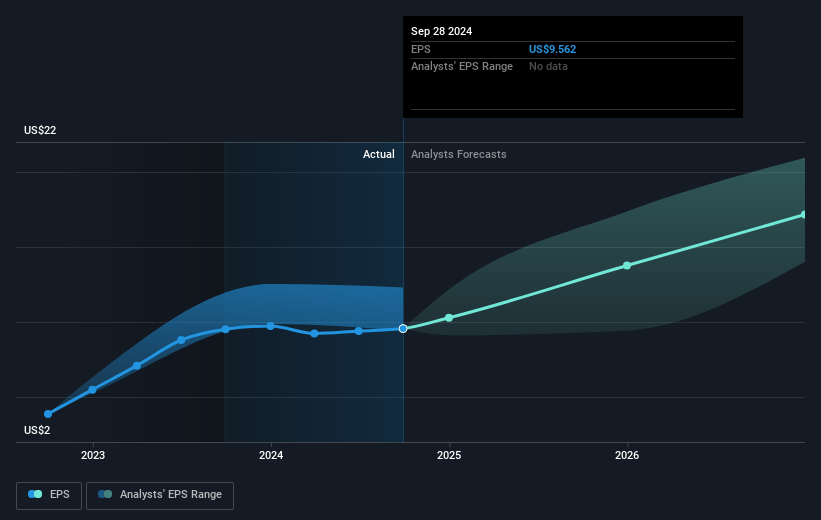

- The bullish analysts expect earnings to reach $917.9 million (and earnings per share of $19.53) by about April 2028, up from $506.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.7x on those 2028 earnings, up from 8.7x today. This future PE is lower than the current PE for the US Auto Components industry at 13.0x.

- Analysts expect the number of shares outstanding to decline by 5.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.59%, as per the Simply Wall St company report.

Lear Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of electric vehicles has resulted in significant delays, program cancellations, and reduced production assumptions for key EV platforms, such as GM EVs, Volvo EX90, and Polestar 3, which has led to a shrinking near-term sales backlog and directly reduces Lear’s long-term revenue potential.

- OEM customers have become increasingly cautious and are reassessing product and powertrain strategies in response to shifting market demand and regulatory uncertainty, resulting in slower new program sourcing, decreased visibility into future vehicle launches, and greater risk for volatile revenues and unpredictable earnings in the coming years.

- Chinese domestic automakers now account for a growing portion of Lear's revenue, but this increased exposure also brings heightened geopolitical and supply chain risk, while ongoing onshoring pressures and potential tariff increases could challenge Lear’s ability to maintain margins and market share among global OEMs.

- Lear continues to face intense industry competition, including from low-cost Asian and tech-centric suppliers, driving down pricing and requiring constant investment in automation and innovation; this ongoing margin pressure threatens the company's ability to sustain net margins and grow earnings as expected.

- Heavy concentration among a small set of large OEM customers, combined with the industry trend toward vertical integration and cost-cutting by automakers, increases pricing pressure and counterparty risk for Lear, potentially leading to compressed net margins and weaker bargaining power that can adversely affect long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lear is $154.94, which represents two standard deviations above the consensus price target of $105.72. This valuation is based on what can be assumed as the expectations of Lear's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $174.0, and the most bearish reporting a price target of just $83.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $24.6 billion, earnings will come to $917.9 million, and it would be trading on a PE ratio of 9.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of $82.0, the bullish analyst price target of $154.94 is 47.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:LEA. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.