Key Takeaways

- Strategic partnerships and innovative products are driving revenue growth, particularly in the aftermarket and RV sectors.

- Operational improvements aim for higher margins, while strategic M&A and manufacturing excellence support market share and earnings growth.

- Persistent softness in RV and marine markets along with inventory and tariff challenges may significantly hinder LCI Industries' revenue and growth prospects.

Catalysts

About LCI Industries- Manufactures and supplies engineered components for the manufacturers of recreational vehicles (RVs) and adjacent industries in the United States and internationally.

- LCI Industries is targeting to achieve $5 billion in total revenue by 2027, leveraging its diversified business presence in various end markets such as building products international and aftermarket, which should bolster revenue growth.

- The company expects a significant boost in sales from innovative products like the CURT Touring Coil Suspension, Furrion Chill Cube air conditioner, and Lippert Anti-Lock Brake Systems, which could drive organic content revenue growth in towable RVs.

- LCI Industries plans to upfit approximately 100 additional Camping World stores with different merchandizing, capitalizing on a new partnership projected to drive an increase in in-store and online aftermarket parts sales, potentially enhancing revenue.

- With strong operational improvements, cost savings, and a focus on optimizing overhead and G&A cost structures, LCI aims to return to double-digit margins, impacting the operating profit positively.

- The company's strategy to leverage its best-in-class manufacturing to expand cross-selling opportunities, coupled with the potential for strategic M&A, underscores its approach to sustain market share gains and enhance overall earnings growth.

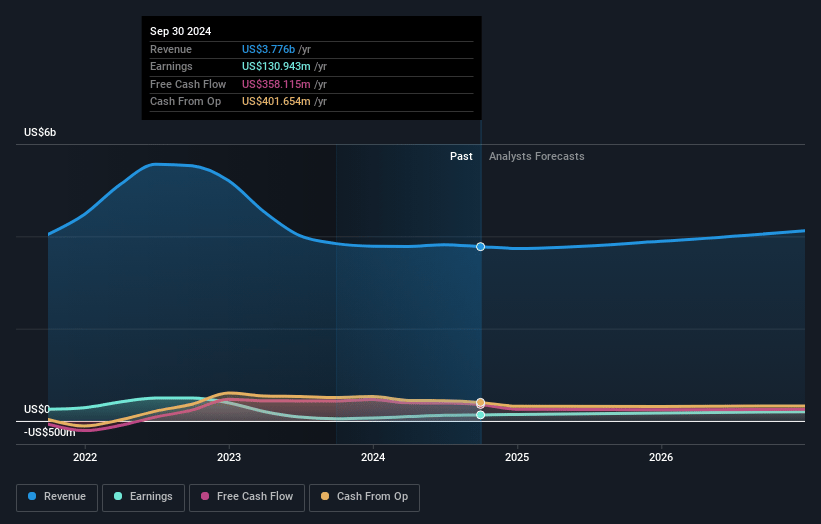

LCI Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LCI Industries's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.8% today to 5.4% in 3 years time.

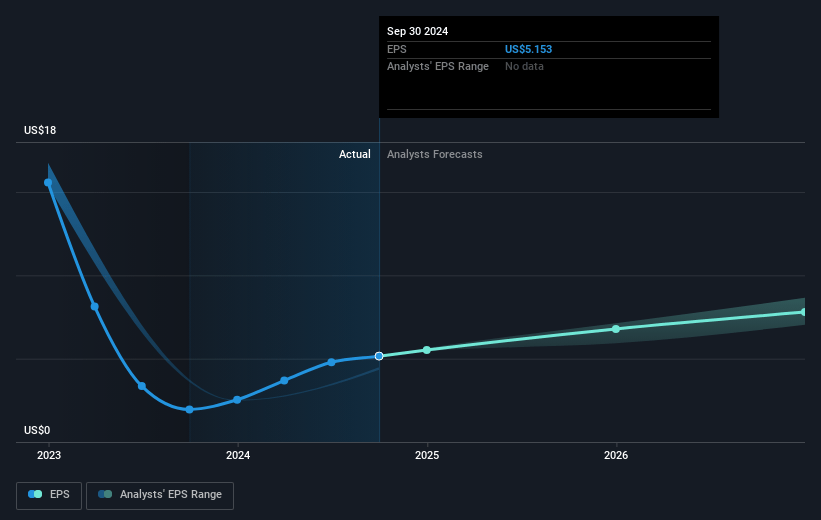

- Analysts expect earnings to reach $228.3 million (and earnings per share of $8.79) by about March 2028, up from $142.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, down from 17.1x today. This future PE is lower than the current PE for the US Auto Components industry at 16.9x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.98%, as per the Simply Wall St company report.

LCI Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The RV and marine markets are experiencing persistent softness in retail demand, which could negatively impact LCI Industries' revenue and future growth prospects.

- There is a significant shift in the mix towards lower-content single-axle travel trailers, which could reduce the content per unit and adversely affect revenue.

- High inventory levels and weak demand in the marine segment are expected to continue into the first half of 2025, potentially affecting sales and profitability in adjacent markets.

- A potential lack of clarity and ongoing changes regarding tariffs on materials and international sourcing could increase costs, affecting net margins adversely.

- There is a risk that dealer inventories may remain constrained, impacting LCI's ability to convert expected retail demand into actual sales, which could limit revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $118.333 for LCI Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $91.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $228.3 million, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 8.0%.

- Given the current share price of $96.07, the analyst price target of $118.33 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives