Key Takeaways

- Intensifying EV competition and shifting mobility trends threaten GM's traditional market dominance, pressuring margins and long-term revenue stability.

- Delays in EV innovation, rising costs, and reliance on trucks and SUVs increase vulnerability to regulations, input volatility, and market transitions.

- GM's gains in market share, EV technology, and subscription services, supported by manufacturing flexibility, position it for resilient growth and improved profitability globally.

Catalysts

About General Motors- Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

- Intensifying global competition in electric vehicles, particularly from established EV players and new entrants-including Chinese manufacturers-threatens to erode GM's market share and drive significant price and margin pressure, directly undermining future revenue growth and gross profitability.

- Structural shifts in mobility preferences, as urbanization and shared transportation models expand, are poised to shrink the traditional individual vehicle ownership market on which GM relies, causing persistent stagnation or decline in core automotive revenues over the long term.

- Persistent delays and underperformance in GM's EV and autonomous vehicle initiatives compared to more agile technology-driven rivals risk obsolescence, while higher-than-expected warranty and software-related costs from initial EV rollouts further compress net margins and drag on earnings growth.

- Escalating supply chain localization mandates and geopolitical risks-including ongoing and unpredictable U.S.-China tensions, resource nationalism, and uncertain tariff environments-are increasing input costs and driving up capital expenditures well beyond historical levels, constraining cash flow and reducing GM's ability to reinvest profitably.

- An overreliance on high-margin truck and SUV segments makes GM highly vulnerable to tightening emissions regulations and cyclical downturns, which could result in abrupt revenue declines and sustained margin erosion as policy incentives shift and consumer demand normalizes in favor of lower-emission, shared, or alternative mobility solutions.

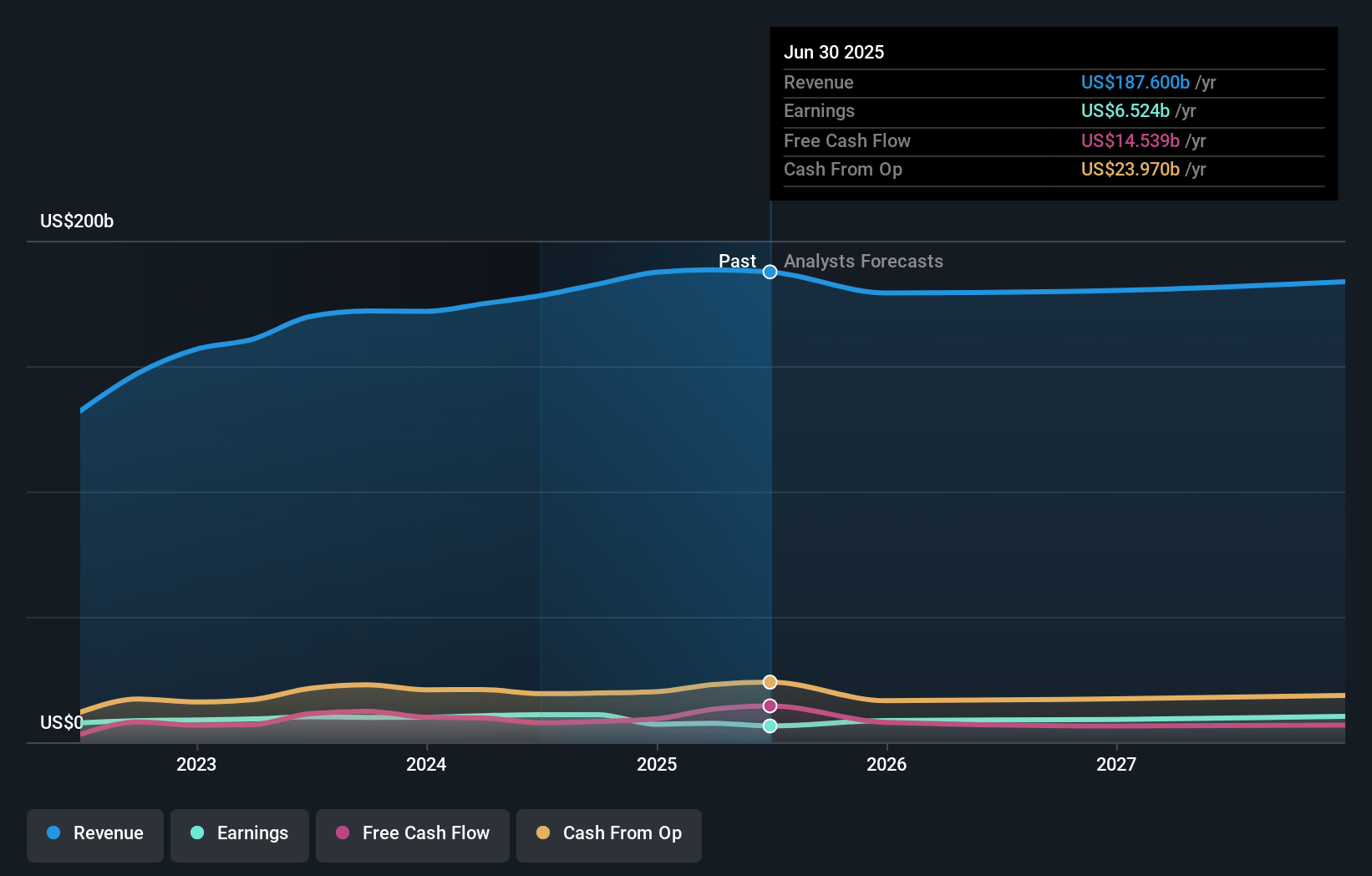

General Motors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on General Motors compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming General Motors's revenue will decrease by 3.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 4.0% today to 3.9% in 3 years time.

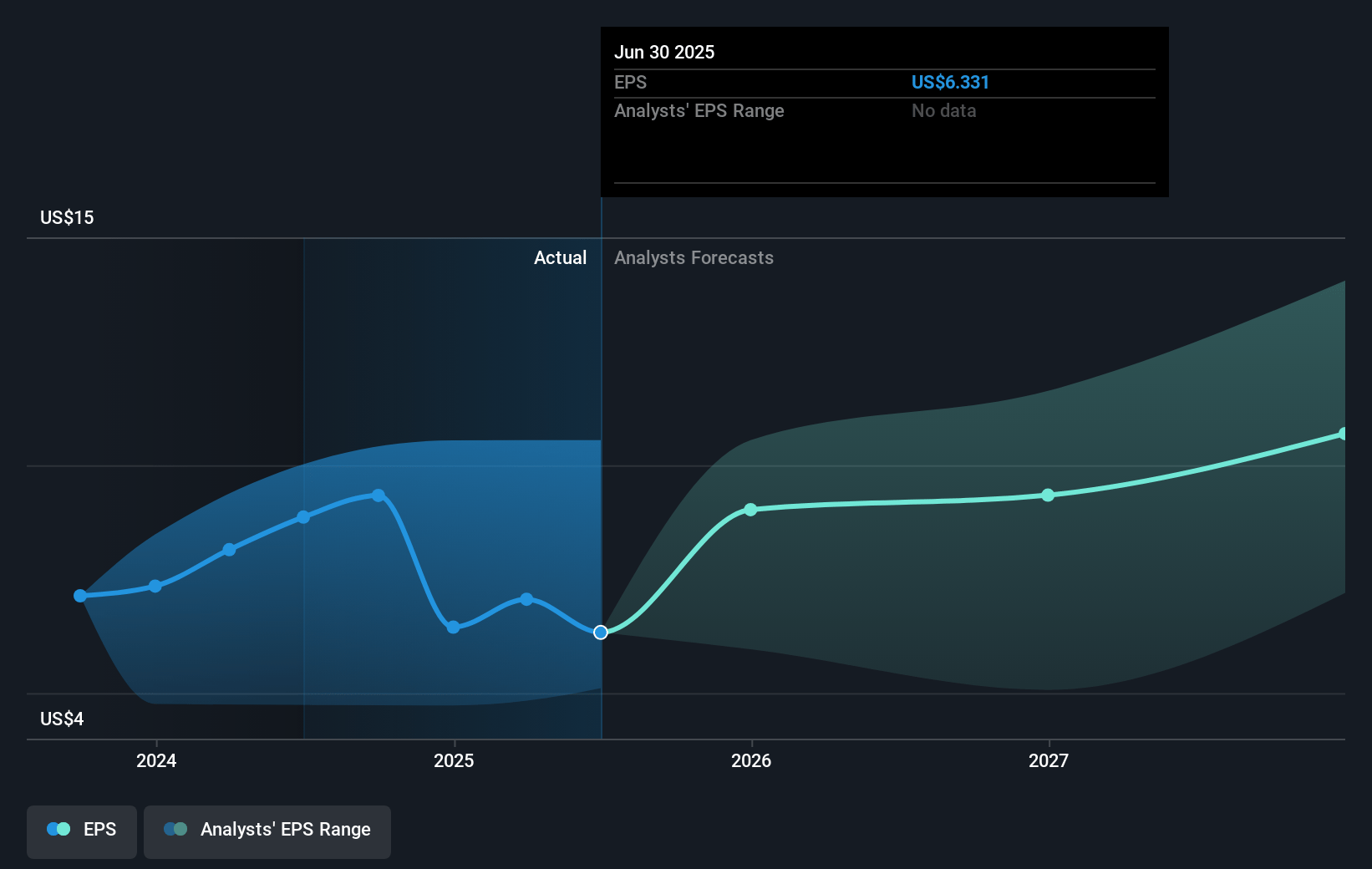

- The bearish analysts expect earnings to reach $6.7 billion (and earnings per share of $7.53) by about July 2028, down from $7.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.9x on those 2028 earnings, down from 6.7x today. This future PE is lower than the current PE for the US Auto industry at 15.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

General Motors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- GM is gaining U.S. and international market share in both ICE and EV segments, outpacing competitors and driving strong top-line revenue growth, which could underpin share price appreciation.

- The company's robust advancements in battery technology, including in-house Ultium cells, LFP and LMR chemistries, and expanding JV partnerships position GM to significantly lower EV costs and improve long-term EV margin and earnings potential.

- GM is rapidly growing software and ancillary service revenues, booking $4 billion in deferred revenue from Super Cruise, OnStar, and other subscription services, which provides a recurring revenue base to support higher net margins and future earnings growth.

- A flexible manufacturing footprint enables GM to dynamically adjust its ICE/EV production mix in response to market demand, reducing downside risk from macro or regulatory changes and supporting sustained profitability and resilient free cash flow.

- Strong execution in China and other international markets, including share gains and positive equity income from new energy vehicles, indicates GM can maintain or improve overseas revenues and counterbalance challenges in North America.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for General Motors is $36.62, which represents two standard deviations below the consensus price target of $56.86. This valuation is based on what can be assumed as the expectations of General Motors's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $170.2 billion, earnings will come to $6.7 billion, and it would be trading on a PE ratio of 5.9x, assuming you use a discount rate of 11.6%.

- Given the current share price of $53.13, the bearish analyst price target of $36.62 is 45.1% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.