Key Takeaways

- Margin expansion and improved cash flow are driven by shifting production to high-profit North American vehicle segments and leveraging flexible manufacturing and proprietary EV technology.

- Growth in software, services, and strategic electrification initiatives positions GM for resilient, high-quality earnings and expanded revenue beyond traditional automotive sales.

- Sluggish EV adoption, rising supply chain costs, mounting competition, quality challenges, and dependence on trucks threaten GM's margins, revenue, and long-term market position.

Catalysts

About General Motors- Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

- Analyst consensus expects GM to offset some tariff exposure by increasing U.S. production, but this underestimates the margin uplift and structural cash flow improvement that will occur as over 2 million annual units shift from vulnerable imports to highly profitable North American SUVs, pickups, and crossovers-offering the potential to restore and expand net margin to pre-tariff highs and beyond.

- While consensus sees GM's EV strategy as a way to enhance net margin through cost focus and efficiency, it fails to fully capture how next-generation Ultium technology, investments in flexible manufacturing, and proprietary battery chemistries (like LMR and LFP) can drive steep variable cost reduction, enabling affordable EVs to achieve both scale and structural profitability well ahead of industry peers-significantly boosting long-term earnings.

- GM's rapid growth in high-margin, recurring software and data services driven by OnStar and Super Cruise-already $4 billion in deferred revenue and expected to more than double by 2026-foreshadows a shift toward a resilient annuity-like earnings stream, enhancing both topline growth and GM's blended EBITDA margin profile over the coming decade.

- The company's unique U.S. dealer and service network, combined with robust brand loyalty programs and an aging global vehicle fleet, positions GM to capture outsized share of replacement demand and aftermarket services, underpinning stable and rising revenue even in cyclical downturns.

- GM's surging presence in global mobility, EV charging infrastructure, and energy storage-including strategic agreements with energy partners for battery repurposing-creates new high-growth adjacencies that leverage secular electrification and urbanization trends, providing upside to consolidated revenue and future free cash flow.

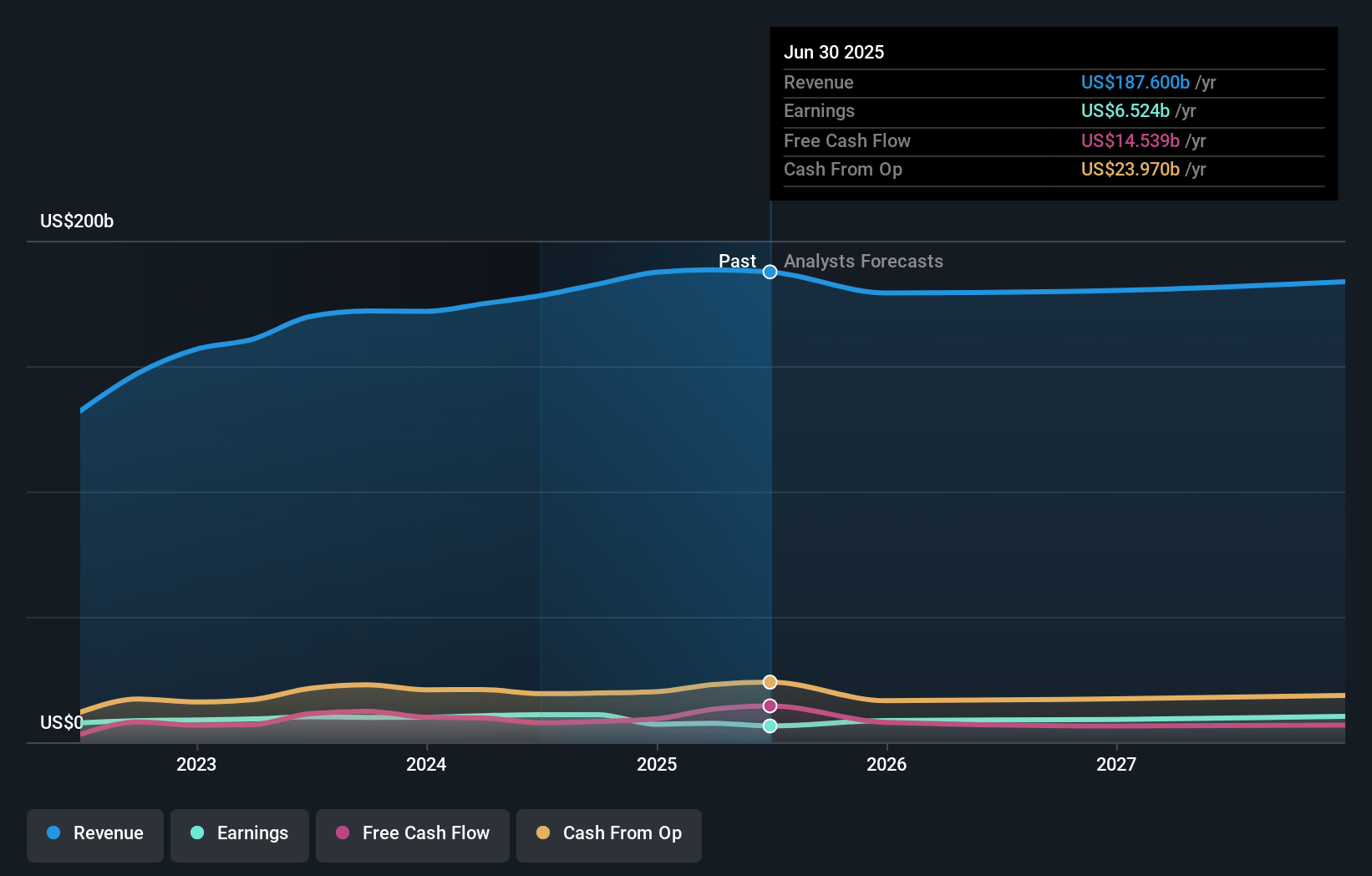

General Motors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on General Motors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming General Motors's revenue will grow by 1.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.0% today to 6.4% in 3 years time.

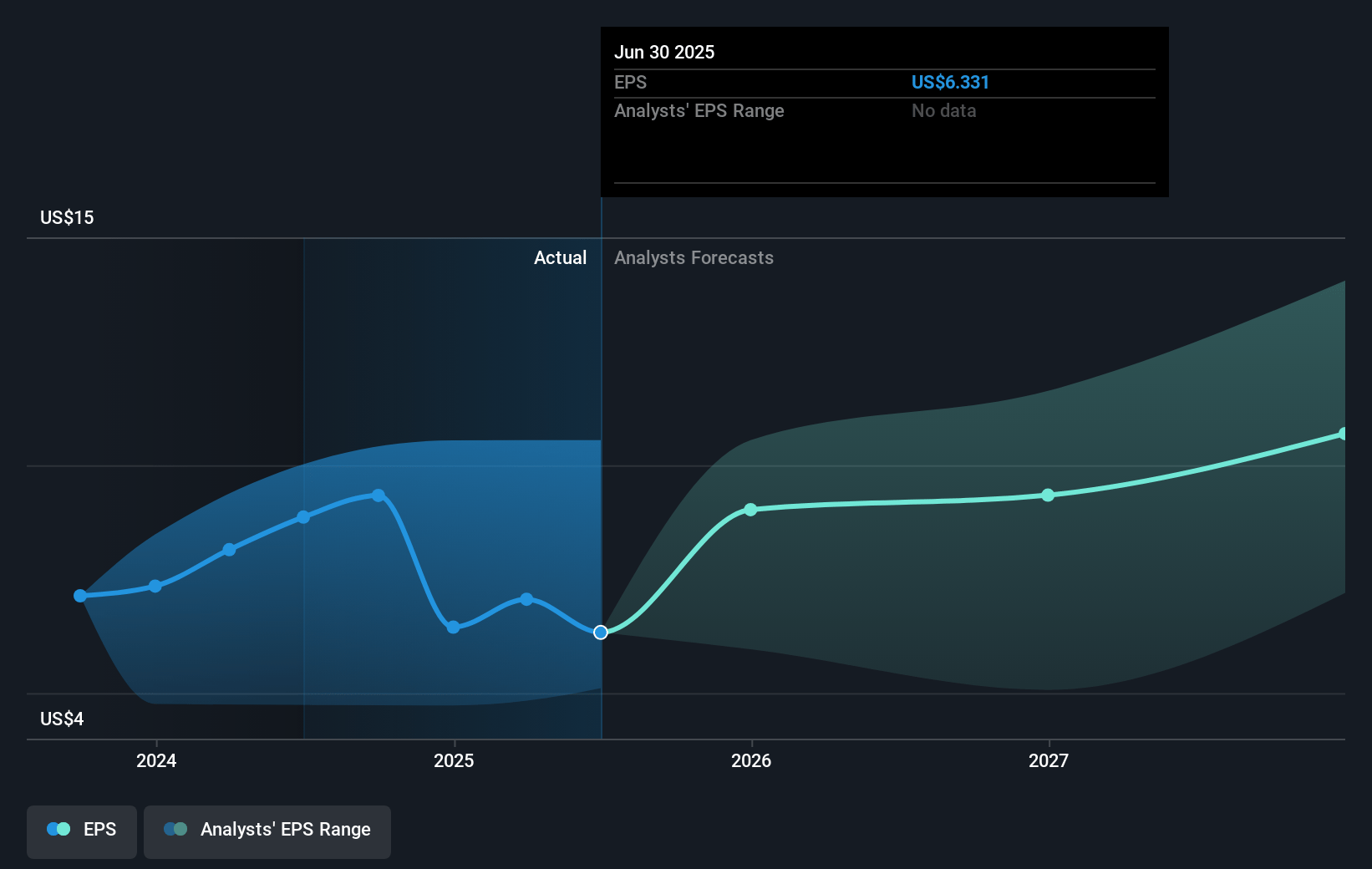

- The bullish analysts expect earnings to reach $12.9 billion (and earnings per share of $15.09) by about July 2028, up from $7.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.5x on those 2028 earnings, up from 6.2x today. This future PE is lower than the current PE for the US Auto industry at 15.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

General Motors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- GM's EV profitability remains under pressure due to slower industry adoption, execution challenges from early EV launches, and the removal of government incentives, which raises the risk of continued negative pressure on margins and earnings for several years.

- Persistent multi-billion dollar annual tariff impacts and ongoing geopolitical tensions threaten to increase supply chain costs and disrupt production, weighing directly on GM's net margins and free cash flow.

- Increasing competition from both established rivals and aggressive new EV entrants risks driving down vehicle prices and shrinking market share, which could ultimately lower GM's future revenues and profitability.

- Elevated warranty expenses and recurring quality issues-particularly in software and early EV rollouts-present a significant risk to net margins by increasing costs and potentially damaging GM's reputation.

- GM's heavy reliance on high-margin trucks and SUVs in North America exposes it to abrupt declines in revenue and earnings if consumer preferences accelerate toward smaller, more efficient vehicles or shared mobility solutions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for General Motors is $78.24, which represents two standard deviations above the consensus price target of $56.61. This valuation is based on what can be assumed as the expectations of General Motors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $83.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $199.6 billion, earnings will come to $12.9 billion, and it would be trading on a PE ratio of 6.5x, assuming you use a discount rate of 11.6%.

- Given the current share price of $48.89, the bullish analyst price target of $78.24 is 37.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.