Narratives are currently in beta

Key Takeaways

- Rising costs and competitive pressures could undermine GM's profitability, as cost inflation and market challenges impact margins and earnings.

- Ambitious EV targets and potential inventory excess may misalign with actual market demand, affecting revenue and cash flow.

- GM's strategic focus on market share growth, EV profitability, cost management, and share repurchases is poised to enhance profitability and shareholder value.

Catalysts

About General Motors- Designs, builds, and sells trucks, crossovers, cars, and automobile parts; and provide software-enabled services and subscriptions worldwide.

- The anticipated cost inflation in labor and materials, alongside the ongoing pressure to invest in EV capabilities, could compress GM's net margins, leading to potential decreased profitability in future quarters.

- GM's slated increase in production and wholesale of EVs, coupled with ambitious sales targets, may not align with the actual market demand, potentially impacting revenue and leading to excess inventory or aggressive discounting.

- The competitive pressure from rising Chinese automakers and the need for restructuring in China suggest potential challenges in maintaining or growing market share, which could adversely impact GM's earnings from a key international market.

- GM's warranty cost adjustments, driven by quality issues in high-volume vehicles, have led to higher provisions, which might continue to drag on net margins and profitability if inflationary pressures on parts and labor persist.

- While GM's focus on fixed cost discipline and capital efficiency are positive goals, any unforeseen delays or cost overruns in these areas could affect earnings and result in lower free cash flow than anticipated.

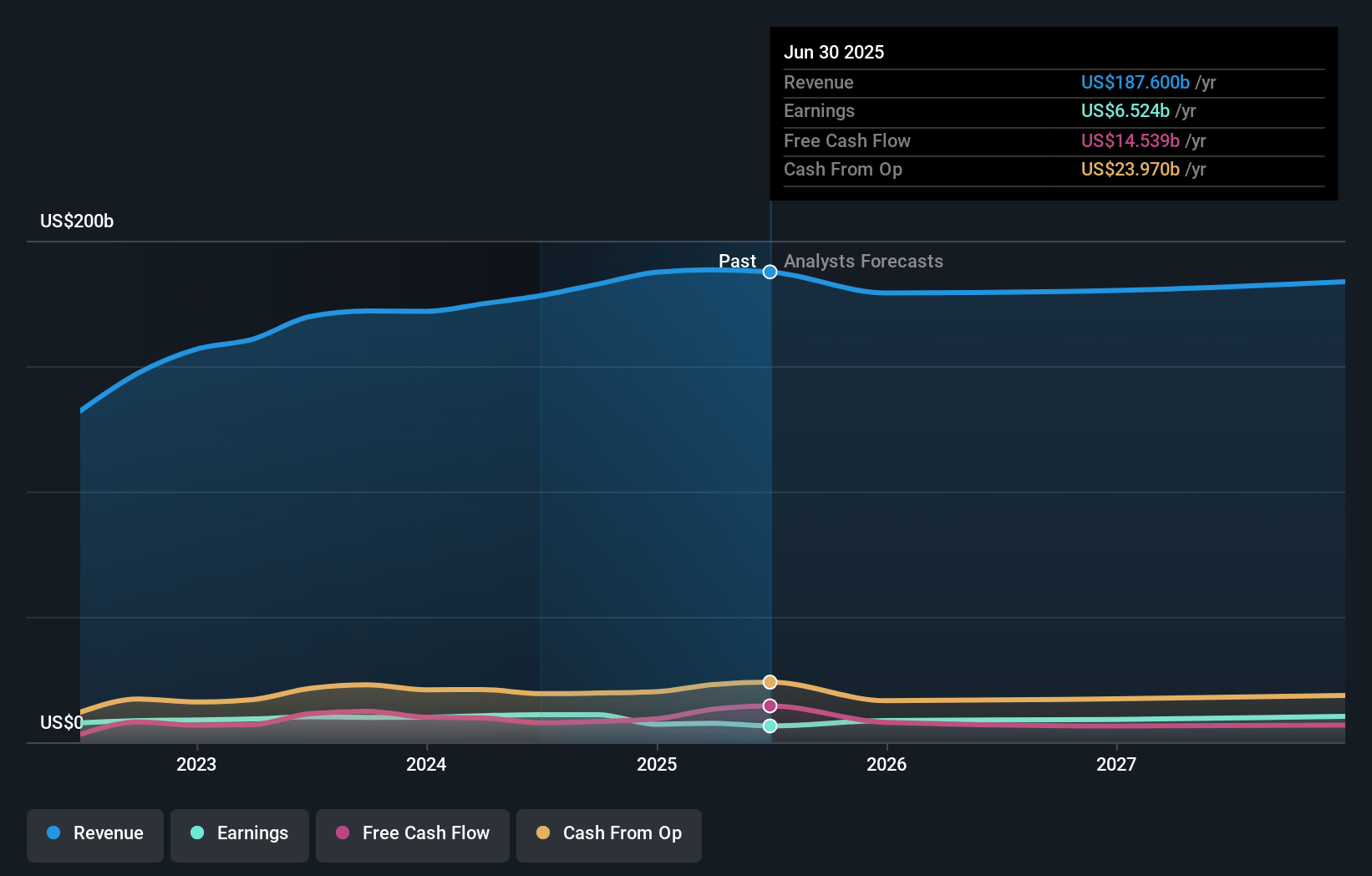

General Motors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming General Motors's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 6.0% today to 4.2% in 3 years time.

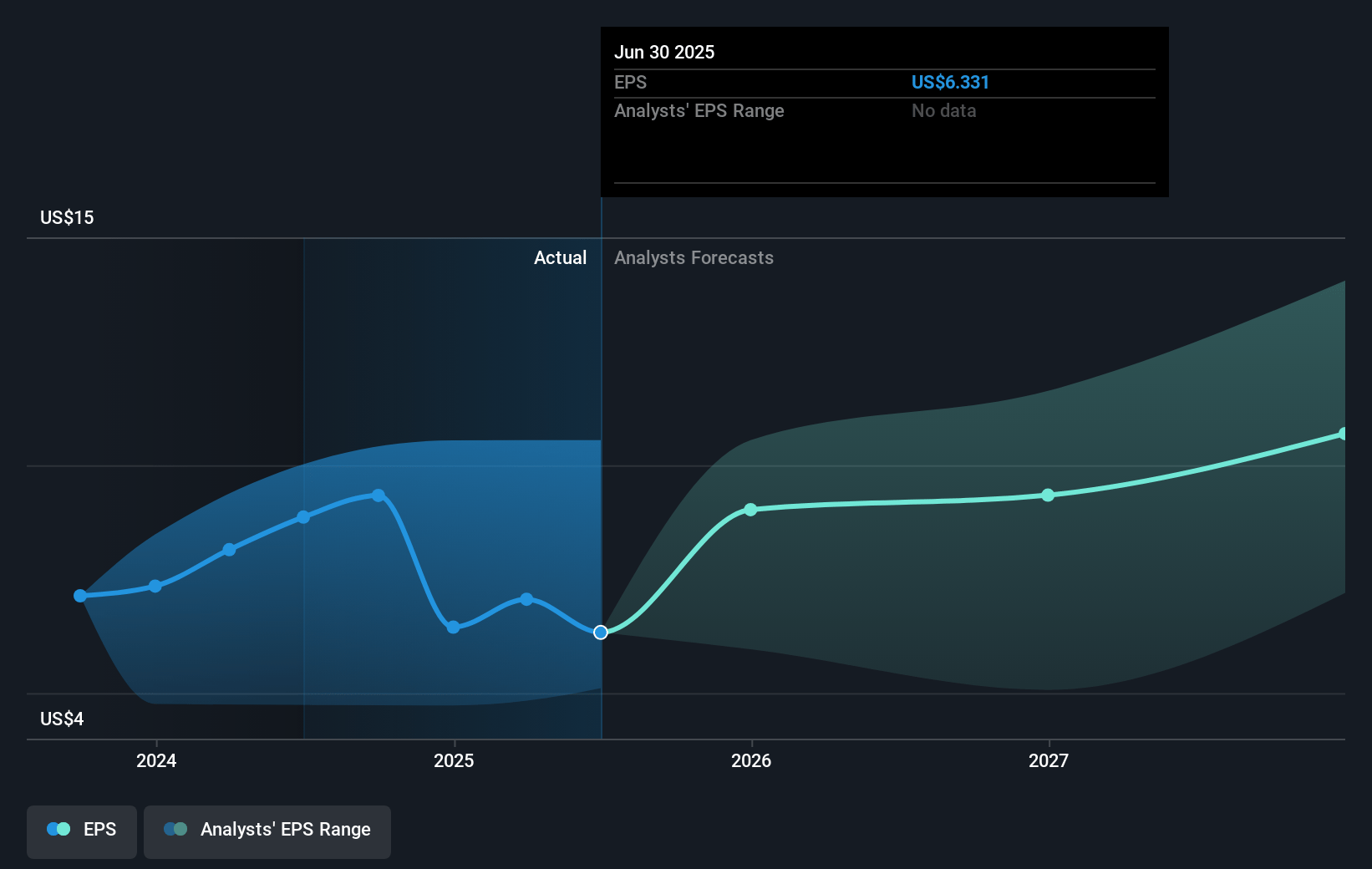

- Analysts expect earnings to reach $8.1 billion (and earnings per share of $8.77) by about November 2027, down from $11.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $11.6 billion in earnings, and the most bearish expecting $4.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.2x on those 2027 earnings, up from 5.8x today. This future PE is lower than the current PE for the US Auto industry at 15.8x.

- Analysts expect the number of shares outstanding to decline by 5.82% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

General Motors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- GM has achieved growth in its retail market share and maintained strong pricing in the U.S., supported by its robust ICE vehicle portfolio and disciplined go-to-market strategy. This could positively impact revenue and profit margins if maintained.

- GM is on track to reach variable profit-positive in its EV portfolio by Q4 2024 and aims for profitable EVs on an EBIT basis soon after. Improvements in EV profitability could lead to an increase in overall earnings.

- The company has successfully reduced its inventory levels in China by more than 50%, which should aid in better pricing management and cost reduction. This might support net margins if executed effectively.

- GM’s ongoing commitment to capital efficiency and disciplined cost management, including a fixed cost discipline program, positions the company to potentially sustain profit margins despite economic challenges.

- GM's focus on consistent share repurchase programs, aiming to reduce outstanding shares to less than 1 billion by early 2025, may enhance shareholder value and support earnings per share growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $59.26 for General Motors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $85.0, and the most bearish reporting a price target of just $38.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $191.3 billion, earnings will come to $8.1 billion, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 10.9%.

- Given the current share price of $57.71, the analyst's price target of $59.26 is 2.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives