Narratives are currently in beta

Key Takeaways

- New contracts and strategic focus on EV components could enhance revenue and improve net margins, while solidifying presence in the EV market.

- Divesting non-core assets and optimizing R&D spending aims to bolster financial flexibility and focus on higher-margin growth areas, boosting future earnings.

- Operational inefficiencies, rising costs, and external risks such as currency fluctuations pose challenges to revenue growth and profitability for American Axle & Manufacturing Holdings.

Catalysts

About American Axle & Manufacturing Holdings- Designs, engineers, and manufactures driveline and metal forming technologies that supports electric, hybrid, and internal combustion vehicles.

- The announcement of a new contract to supply an electric beam axle to a Chinese OEM, launching in 2025, could boost future revenue from international sales and strengthen their position in the electric vehicle market.

- Winning contracts with European OEMs for electric vehicle components signals growth in the high-demand EV space, which could increase revenue and improve net margins due to typically higher margins associated with EV parts.

- Continued investment in hybrid and ICE programs, alongside EV initiatives, could leverage AAM's existing product portfolio, sustaining revenue from traditional vehicles and potentially enhancing net margins through optimized costs with existing production facilities.

- The sale of the India commercial vehicle axle business provides increased financial flexibility and focuses resources on higher-margin, growth-oriented segments such as light vehicles and EVs, which might improve future earnings and net margins.

- Efforts to optimize R&D spending while maintaining a leadership position in multiple propulsion systems could lead to cost efficiencies, thereby improving net margins and contributing to more sustainable earnings growth.

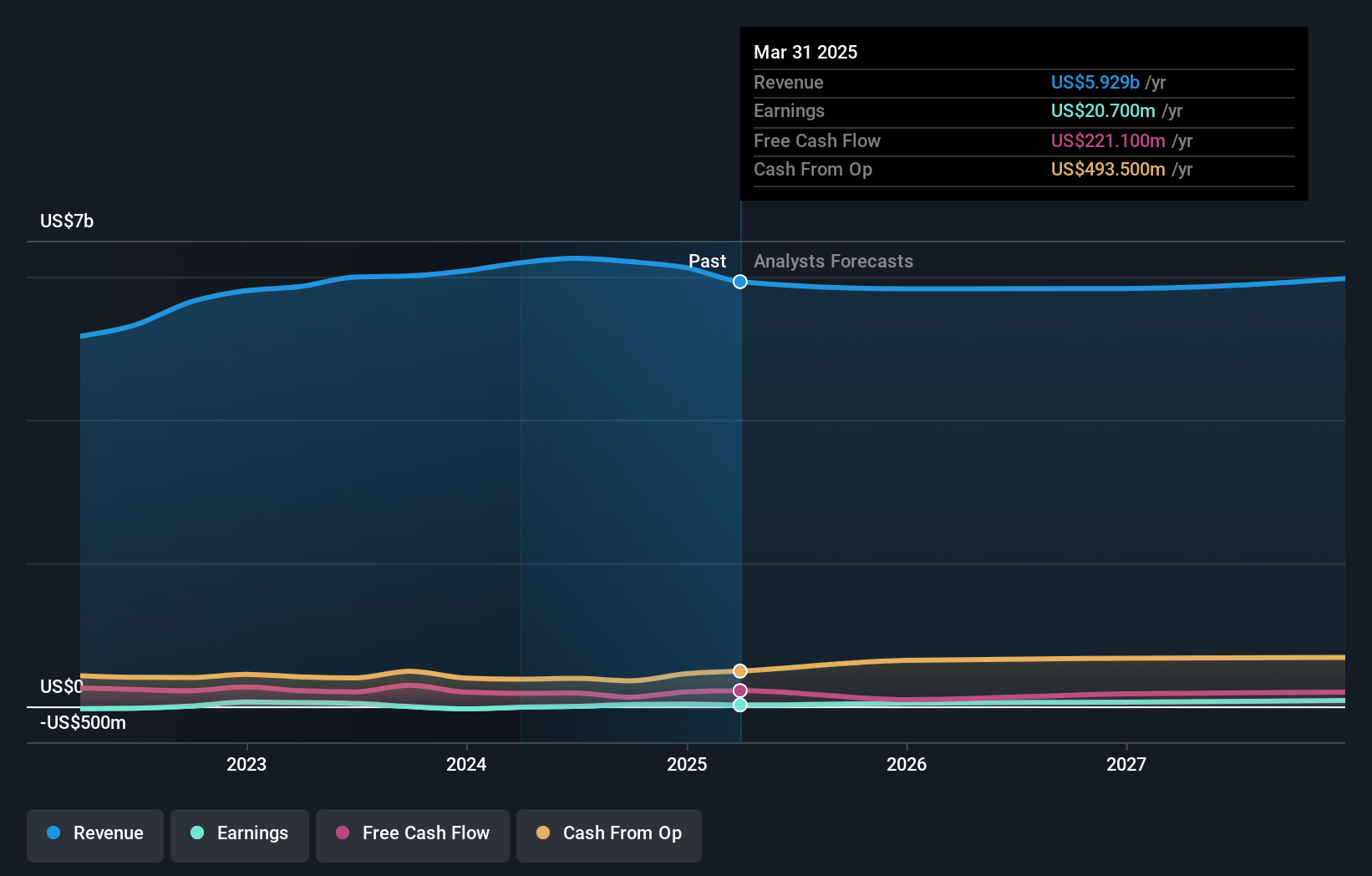

American Axle & Manufacturing Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Axle & Manufacturing Holdings's revenue will decrease by -1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.4% today to 1.6% in 3 years time.

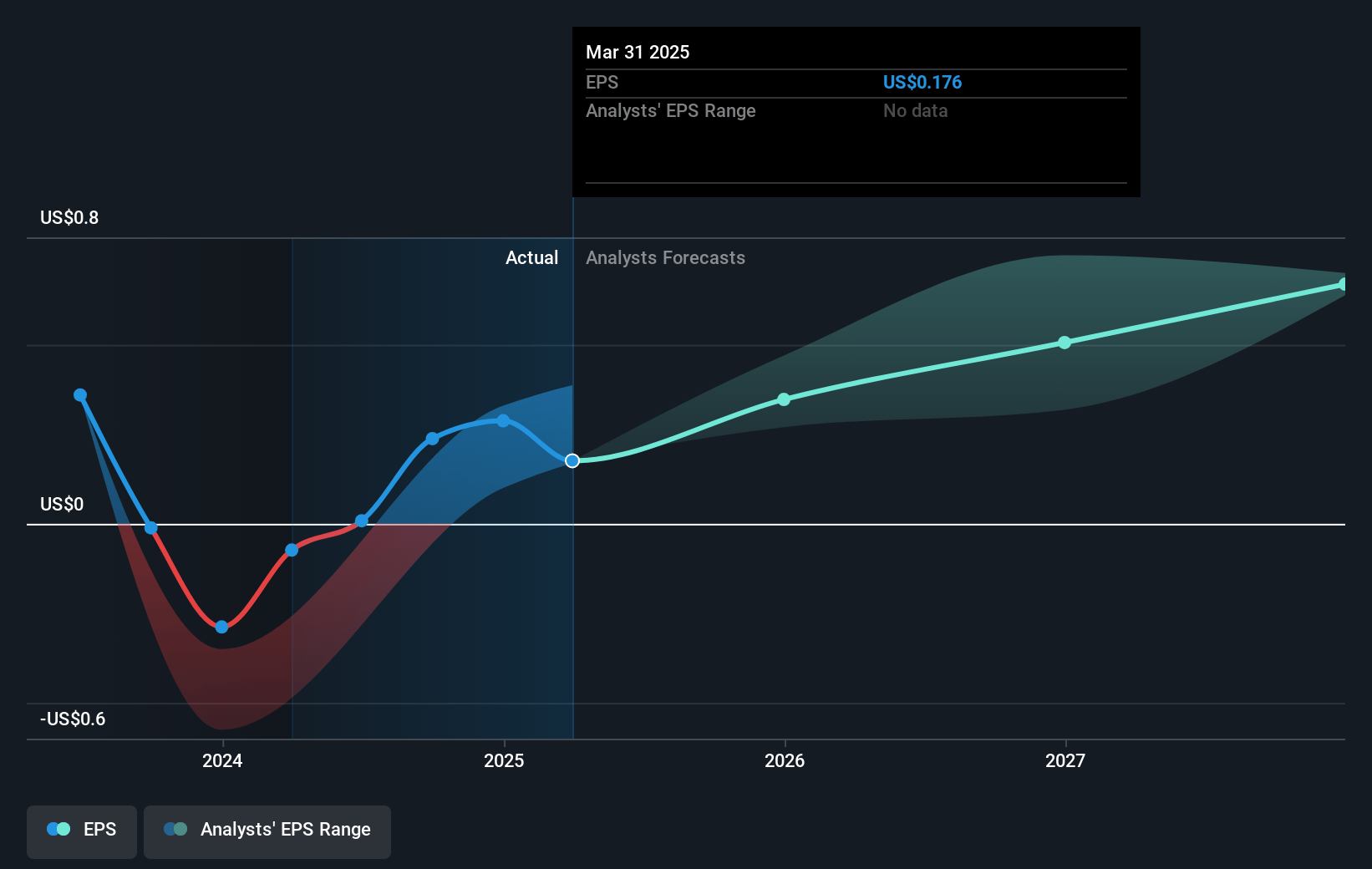

- Analysts expect earnings to reach $95.0 million (and earnings per share of $0.77) by about November 2027, up from $27.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2027 earnings, down from 27.6x today. This future PE is lower than the current PE for the US Auto Components industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

American Axle & Manufacturing Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The North American automotive industry's production volumes were down approximately 5% year-over-year, impacting sales and potentially leading to lower revenue in the future.

- The transition of two major programs into different stages of launch may result in operational inefficiencies and potential delays, affecting both revenue and net margins if not managed effectively.

- Rising SG&A expenses, including a significant increase in R&D costs, could strain net margins if revenue growth does not keep pace.

- Increasing inventories and the ongoing monitoring of transaction prices, incentive spending, and interest rates could indicate future demand challenges, negatively impacting revenue and earnings.

- Lower volume mix and the impact of currency fluctuations and metal market pass-throughs reduced sales year-over-year, suggesting exposure to external risks that could continue to affect revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.69 for American Axle & Manufacturing Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $6.0 billion, earnings will come to $95.0 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 10.9%.

- Given the current share price of $6.54, the analyst's price target of $7.69 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives