Key Takeaways

- Growth in emerging markets and innovation in new mobility segments are expanding revenue streams and bolstering market share amid shifting industry trends.

- Operational efficiencies, regulatory-driven demand, and effective cost management are enhancing margins, supporting consistent shareholder returns and stable earnings growth.

- Trade uncertainty, slowing vehicle production, pricing pressure, and unfavorable product trends threaten margins, revenue growth, and profitability, especially amid cost recovery and regulatory risks.

Catalysts

About Autoliv- Through its subsidiaries, develops, manufactures, and supplies passive safety systems to the automotive industry in Europe, the Americas, China, Japan, and rest of Asia.

- Recent success with new product launches in China and strengthening relationships with major Chinese OEMs suggest Autoliv is poised to benefit from rising vehicle ownership in emerging markets, leading to outsized revenue growth and market share gains in high-growth regions.

- Heightened global focus on vehicle safety and increasingly strict automotive safety regulations are driving higher safety content per vehicle, which is expected to support sustained top-line growth and incremental margin improvement as Autoliv leverages its leadership in advanced airbags and seatbelts.

- Ongoing efficiency initiatives-including automation, digitalization, and direct labor reductions-are structurally lowering the cost base, which is likely to result in enhanced net margins and improved operating leverage even if end market volumes are flat or slightly down.

- Expansion of Autoliv's business into new mobility segments (such as safety solutions for smaller Japanese K-cars and innovative EV platforms) demonstrates the company's ability to adapt to shifting industry trends, opening up additional revenue streams and counterbalancing cyclical weakness in other segments.

- Successful navigation and partial pass-through of significant tariff costs to customers, combined with robust free cash flow, enable continued high levels of shareholder returns (dividends and buybacks), which should provide a floor to earnings per share growth and support valuation re-rating.

Autoliv Future Earnings and Revenue Growth

Assumptions

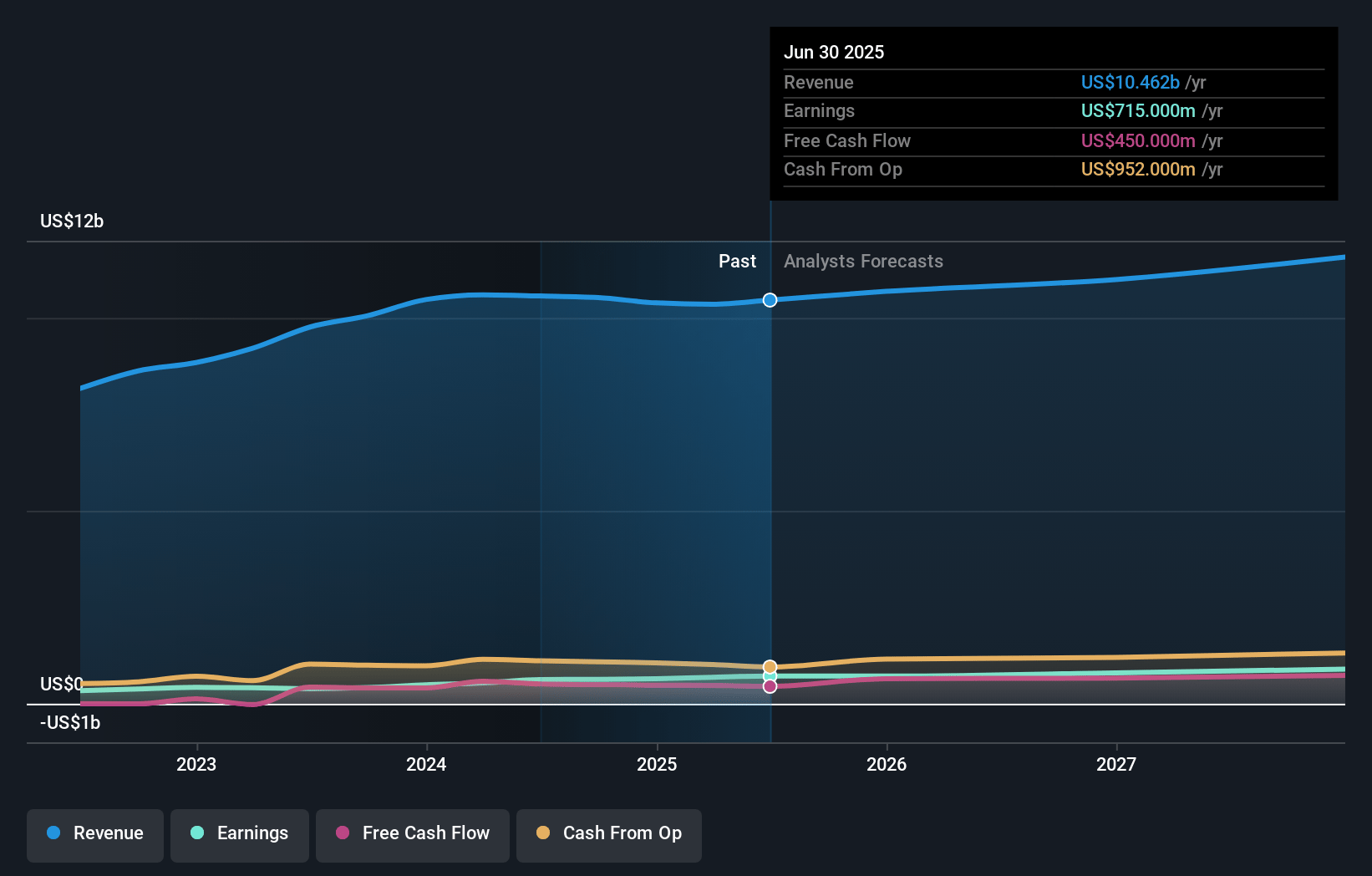

How have these above catalysts been quantified?- Analysts are assuming Autoliv's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.8% today to 7.6% in 3 years time.

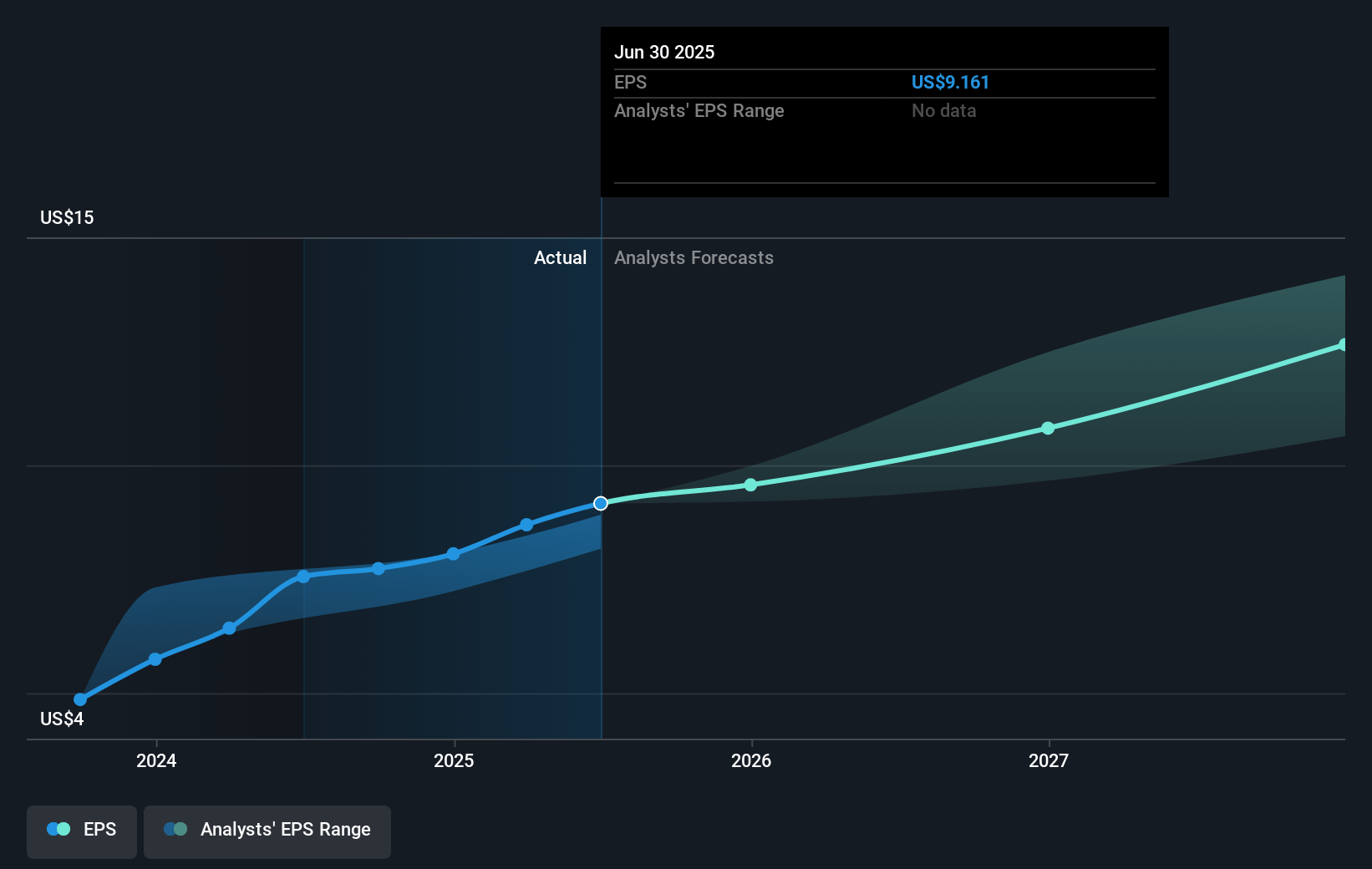

- Analysts expect earnings to reach $895.6 million (and earnings per share of $12.64) by about July 2028, up from $715.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.0 billion in earnings, and the most bearish expecting $781.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, down from 12.2x today. This future PE is lower than the current PE for the US Auto Components industry at 14.9x.

- Analysts expect the number of shares outstanding to decline by 4.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.68%, as per the Simply Wall St company report.

Autoliv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing global tariffs and persistent trade uncertainty, particularly in North America, create significant unpredictability in demand and operating costs, which may lead to depressed sales growth and pressure on operating margins over time if not fully mitigated.

- Slowing global light vehicle production growth, with notable declines forecasted for the second half of 2025 and uncertainty in major markets (North America, Europe, Japan, and South Korea), poses a risk to revenue growth and could translate into lower operating leverage and earnings pressure.

- Ongoing pricing pressure from large automotive OEMs, exacerbated by competitive domestic dynamics in China and customer bargaining power, threatens to erode Autoliv's gross margins and increase revenue volatility, especially if key contracts are renegotiated or lost.

- Product mix shifts toward lower-value vehicle segments in China and volatile launch activity elsewhere expose Autoliv to unfavorable content-per-vehicle trends, which can cap revenue expansion despite growth in unit sales and reduce operating profitability.

- Reliance on continued recovery of tariff and cost inflation from customers lags in realization and is subject to ongoing negotiation-a process that may not always be successful-risking sustained net margin dilution and compressing cash flows, especially if new regulatory, macroeconomic, or supply chain disruptions emerge.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $126.077 for Autoliv based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $106.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.8 billion, earnings will come to $895.6 million, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of $113.88, the analyst price target of $126.08 is 9.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.