Narratives are currently in beta

Key Takeaways

- New business wins with Chinese OEMs and automation efforts are enhancing margins and driving growth in Asia Pacific.

- Restructuring and balance actions in EMEA and Americas aim to increase profit margins and earnings by 2026.

- Restructuring efforts and cost-cutting measures face challenges from cyclical headwinds, impacting revenue, margins, and cash flow, with uncertainty in European and Chinese markets.

Catalysts

About Adient- Engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks.

- Adient continues to win new business with China domestic OEMs, which is expected to underpin solid growth in the Asia Pacific region. This growth is accretive to overall company margins, positively impacting future revenue and margins.

- Efforts in automation and the use of AI, such as AI welding inspection tools and automated assembly processes, are anticipated to drive significant cost savings and improve margins by reducing labor costs and enhancing operational efficiencies.

- Restructuring actions in the EMEA region, including rightsizing engineering and SG&A expenses, are expected to deliver annual net savings benefits by the end of 2027, helping to improve net margins.

- Balance in/balance out actions in the Americas and EMEA, including the roll-off of underperforming programs and introduction of more profitable new business, are expected to provide margin tailwinds, aiding earnings growth by fiscal year 2026.

- Growing business with local OEMs in China and leveraging these relationships as they localize into other regions, including EMEA, are anticipated to drive future revenue growth and provide a competitive advantage in terms of market share expansion.

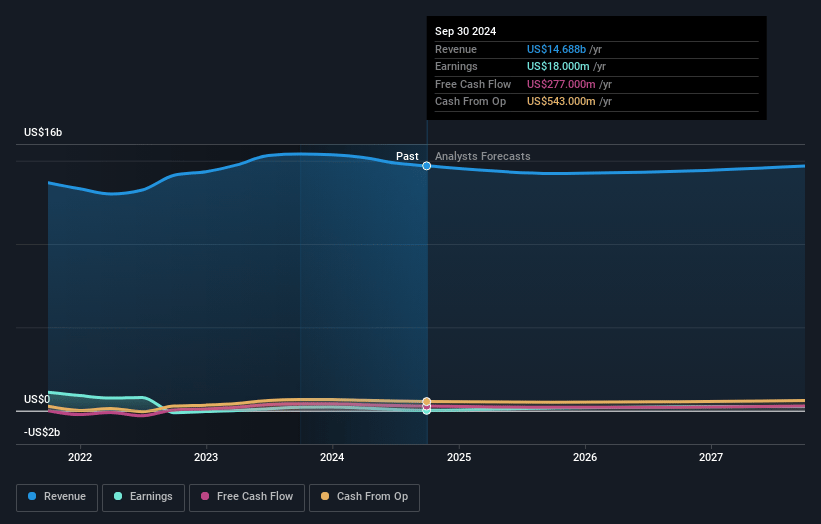

Adient Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Adient's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.1% today to 1.9% in 3 years time.

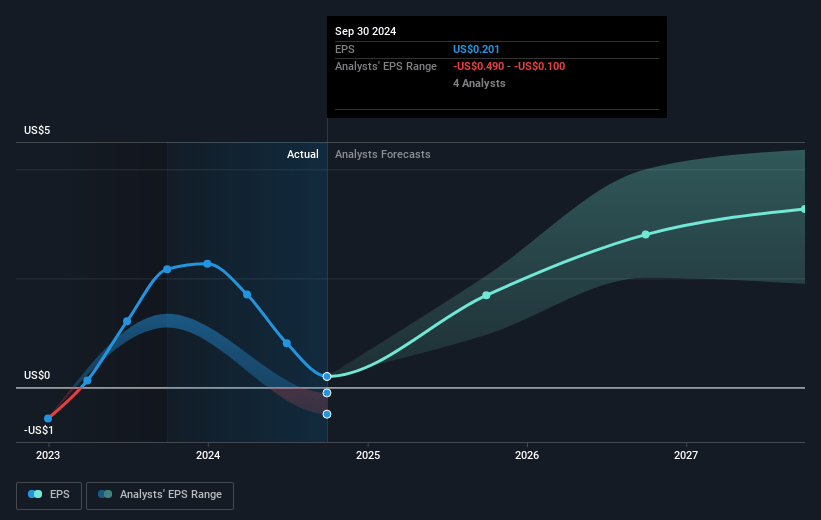

- Analysts expect earnings to reach $284.1 million (and earnings per share of $3.67) by about November 2027, up from $18.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $446 million in earnings, and the most bearish expecting $155.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2027 earnings, down from 89.4x today. This future PE is lower than the current PE for the US Auto Components industry at 19.0x.

- Analysts expect the number of shares outstanding to decline by 3.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Adient Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing restructuring efforts and cost-cutting measures in the EMEA region reflect intensifying cyclical and secular headwinds, which may continue to impact Adient's revenue and net margins negatively until at least FY '26.

- Expected 5% contraction in European light vehicle production and reduced total addressable market for seating systems could lead to lower industry volumes, posing a threat to Adient's future earnings.

- The company's heavy reliance on new business wins from domestic Chinese OEMs, which represent competition from imports and lower exports, introduces uncertainty that may affect revenue stability.

- Potential underperformance in EMEA due to volume and mix headwinds that are expected only to be partially offset by restructuring and efficiency actions, could impact profitability.

- Cash restructuring costs are anticipated to increase significantly in fiscal year 2025, potentially straining free cash flow and affecting its ability to return capital to shareholders or invest in future growth opportunities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.8 for Adient based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $68.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $14.9 billion, earnings will come to $284.1 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 12.3%.

- Given the current share price of $18.95, the analyst's price target of $29.8 is 36.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives