Last Update01 May 25Fair value Decreased 20%

Key Takeaways

- Shifting focus to higher-margin products and expanding clean energy offerings could significantly enhance profitability and drive robust revenue growth.

- Expansion into government and fleet sectors, plus new dealer partnerships, aims to boost both consumer and business sales.

- Worksport faces profitability challenges and execution risks in scaling up and launching new products amidst external uncertainties and financial structural issues impacting investor confidence.

Catalysts

About Worksport- Through its subsidiary, designs and distributes truck tonneau covers in Canada and the United States.

- Worksport's strategic shift towards higher-margin branded products and reduction of lower-margin offerings is expected to improve gross margins significantly, thereby enhancing profitability and potentially increasing net margins by the end of 2025.

- The launch of the high-end AL4 tonneau cover and the development of new products like the HD3 are anticipated to expand the product lineup, drive sales growth, and contribute to increased revenue.

- The upcoming launch of the SOLIS solar tonneau cover and COR mobile power system could open new revenue streams and leverage Worksport's clean energy efforts, potentially increasing earnings through premium pricing and larger market opportunities.

- The expansion into government and fleet sectors, and the onboarding of new dealers and distributors, are likely to enhance the company's market presence and boost both business-to-consumer and business-to-business sales, supporting robust revenue growth.

- Worksport aims to achieve cash flow positivity by late 2025 or early 2026 through continued revenue growth, margin improvements, and lean operational management, ultimately contributing to improved EBITDA.

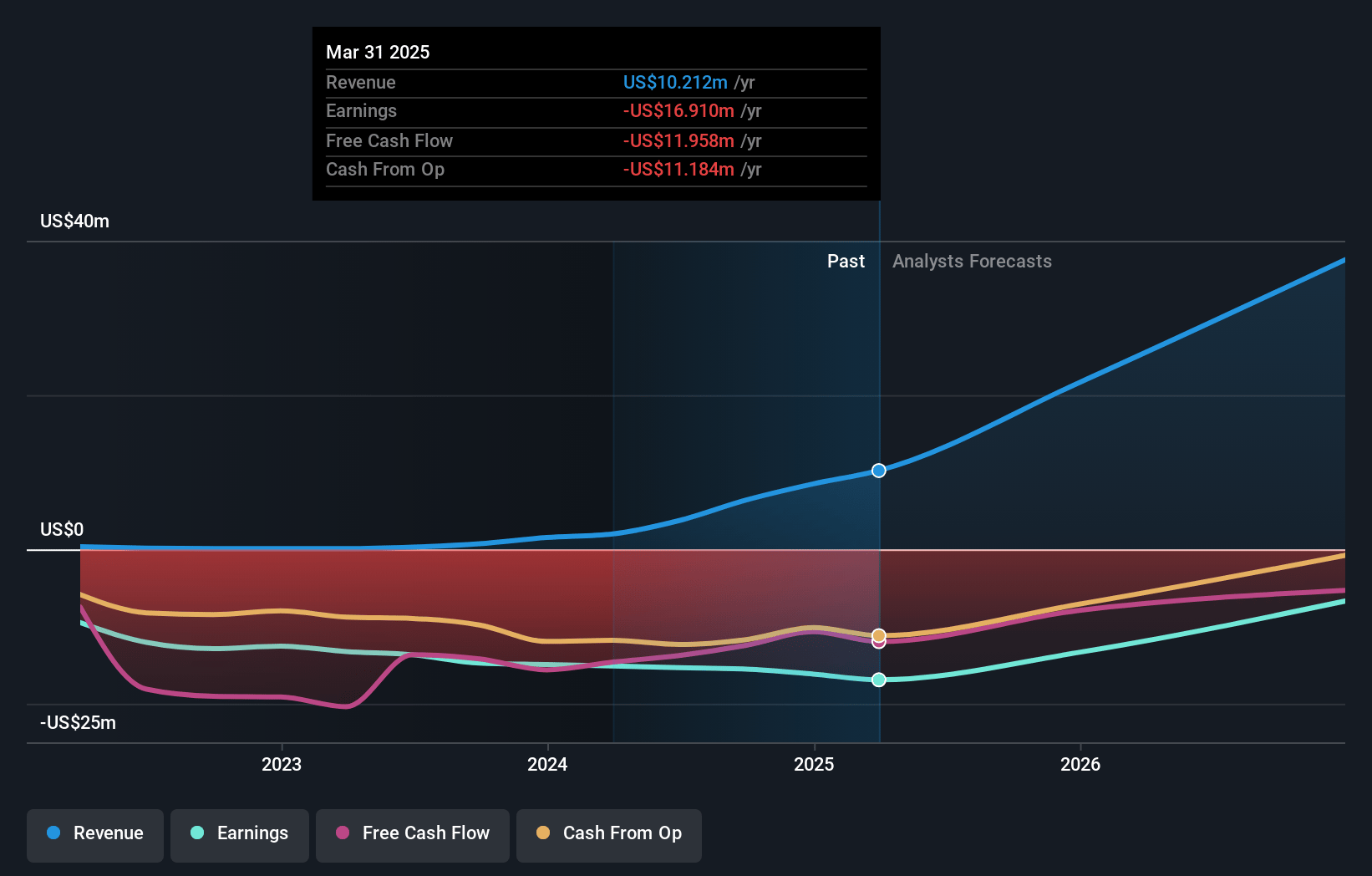

Worksport Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Worksport's revenue will grow by 100.5% annually over the next 3 years.

- Analysts are not forecasting that Worksport will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Worksport's profit margin will increase from -190.5% to the average US Auto Components industry of 4.5% in 3 years.

- If Worksport's profit margin were to converge on the industry average, you could expect earnings to reach $3.1 million (and earnings per share of $0.77) by about May 2028, up from $-16.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from -0.6x today. This future PE is greater than the current PE for the US Auto Components industry at 14.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

Worksport Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Worksport's operating loss increased in 2024 due to scaling up their business and product development, suggesting continued challenges in achieving net profitability, impacting net margins and earnings.

- Heavy reliance on high-risk growth projections, including needing to significantly increase sales and effectively launch new products like SOLIS and COR to reach revenue targets, introduces execution risk that could impact overall revenue.

- The ambitious revenue guidance and expected margin improvements hinge on successfully expanding dealer networks and e-commerce channels, which carry uncertainties and market competition risks, potentially affecting revenue and gross margins.

- Economic uncertainties, geopolitical issues, and supply chain challenges related to crucial components for SOLIS and COR from regions like Asia present external risk factors that could disrupt production timelines and increase costs, impacting net profits.

- The decision to use protected capital strategies, like a 1-for-10 reverse stock split to comply with NASDAQ listing requirements, underscores financial structural challenges that could strain liquidity and investor confidence, affecting share value and potentially leading to further dilution.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.0 for Worksport based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.5, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $68.4 million, earnings will come to $3.1 million, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 8.0%.

- Given the current share price of $3.01, the analyst price target of $11.0 is 72.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.