Key Takeaways

- Expanding into Asia and enhancing manufacturing capacity should boost revenue and margins by aligning market growth with production capabilities.

- Transitioning to a dealership model and focusing on green mobility may optimize operations and support long-term profitability.

- Reliance on non-GAAP and forward-looking statements, alongside aggressive expansion, could impact transparency, execution, and financial stability amid uncertain macroeconomic conditions.

Catalysts

About VinFast Auto- Engages in the design and manufacture of electric vehicles (EV), e-scooters, and e-buses in Vietnam, Canada, and the United States.

- VinFast plans to expand internationally, focusing on Asia with new markets like Indonesia, the Philippines, and India, which are expected to significantly contribute to sales. This expansion should drive revenue growth as new markets are tapped.

- The introduction of new CKD plants in Asia in 2025 will improve manufacturing capacity and is expected to align market expansion with production capabilities, which could enhance margins and revenue.

- VinFast's shift to a dealership model in North America and Europe aims to optimize operations and expand market reach, potentially improving net margins by reducing costs associated with direct-to-consumer sales.

- The company's green mobility ecosystem, which includes shared mobility services and an expanding charging network, addresses EV adoption barriers and supports long-term revenue growth through increased market penetration.

- Continued product innovation and launching new vehicle platforms are intended to drive cost savings and platform commonalities, aiming to improve net margins and profitability in the long run.

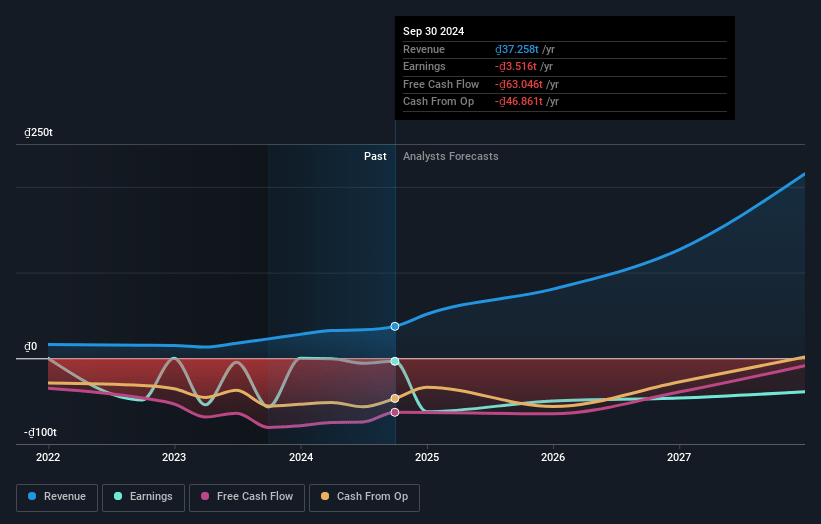

VinFast Auto Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming VinFast Auto's revenue will grow by 60.9% annually over the next 3 years.

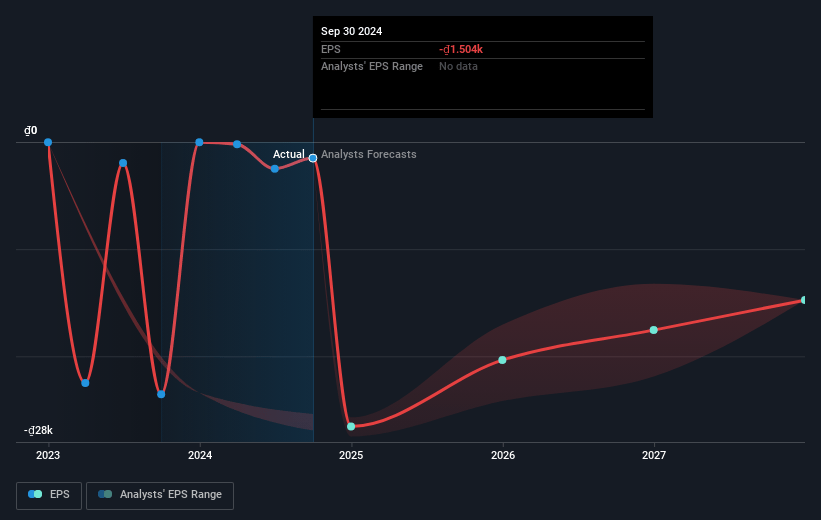

- Analysts are not forecasting that VinFast Auto will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate VinFast Auto's profit margin will increase from -175.5% to the average US Auto industry of 4.3% in 3 years.

- If VinFast Auto's profit margin were to converge on the industry average, you could expect earnings to reach ₫7829.2 billion (and earnings per share of ₫3344.39) by about May 2028, up from ₫-77265.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 77.2x on those 2028 earnings, up from -2.7x today. This future PE is greater than the current PE for the US Auto industry at 13.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 19.45%, as per the Simply Wall St company report.

VinFast Auto Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- VinFast's reliance on non-GAAP financials and the use of forward-looking statements in its communications may present regulatory and transparency risks, potentially impacting investor confidence and future earnings predictability.

- The aggressive international expansion and dealership model transition in markets like the U.S. and Europe could pose execution risks, affecting revenue streams if market penetration does not meet expectations.

- The discontinuation of the battery leasing program, despite its initial success in bridging cost differences between EVs and traditional vehicles, may lead to increased price sensitivity among consumers, affecting revenue growth.

- The expected substantial increase in CapEx and cash burn, alongside ongoing R&D expenses, can pressure financials and delay profitability, particularly if revenue growth does not scale as anticipated.

- Uncertain macroeconomic conditions, including potential U.S. tariffs, could negatively affect international sales volumes and margins, particularly if geopolitical tensions escalate or unexpected regulatory changes occur.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.833 for VinFast Auto based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₫183320.3 billion, earnings will come to ₫7829.2 billion, and it would be trading on a PE ratio of 77.2x, assuming you use a discount rate of 19.4%.

- Given the current share price of $3.38, the analyst price target of $5.83 is 42.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.