Narratives are currently in beta

Key Takeaways

- Strategic Fit-for-Growth initiatives and proprietary innovations are boosting financial performance and expanding net margins despite lower production volumes.

- Breakthrough contracts with Chinese OEMs like Leapmotor and Xiaomi Mi Auto significantly grow market presence and drive exponential revenue growth.

- Gentherm faces revenue and profitability challenges due to automotive production declines, start-up costs, and slower EV technology adoption, with risks in key international markets.

Catalysts

About Gentherm- Designs, develops, manufactures, and sells thermal management and pneumatic comfort technologies in the United States and internationally.

- Gentherm secured $1.8 billion in new automotive business awards year-to-date, with a win rate exceeding 80%. This positions the company for continued strong revenue growth as they expect annual awards of over $2 billion for the second consecutive year.

- Fit-for-Growth initiatives are driving improved financial performance, evident from adjusted EBITDA margin expansion of nearly 100 basis points year-to-date, even amidst lower production volumes. This suggests potential for increasing net margins.

- Significant progress in proprietary innovations, including the first launch of ClimateSense on a vehicle and securing production awards for Pulse A and ComfortScale solutions, indicates future revenue growth opportunities as these innovations gain market adoption.

- Record quarterly revenue was achieved for lumbar and massage comfort solutions, with a 46% increase, showing strong customer demand which is expected to drive continued long-term revenue growth.

- Awarding of breakthrough contracts with new Chinese OEMs, such as Leapmotor and Xiaomi Mi Auto, expands Gentherm's market reach in China, a key emerging market, which could enhance revenue growth exponentially due to increased vehicle content adoption.

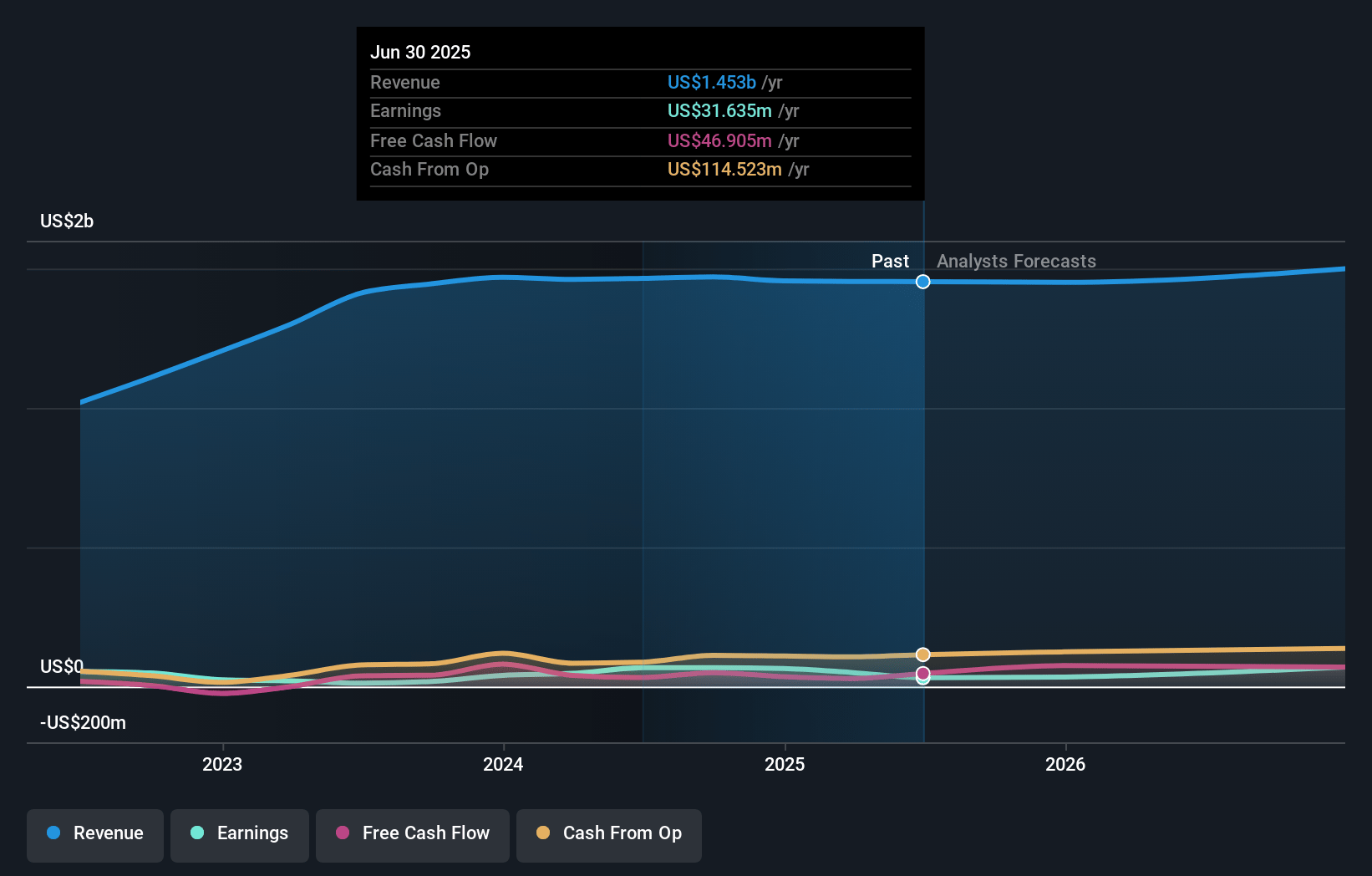

Gentherm Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gentherm's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 7.8% in 3 years time.

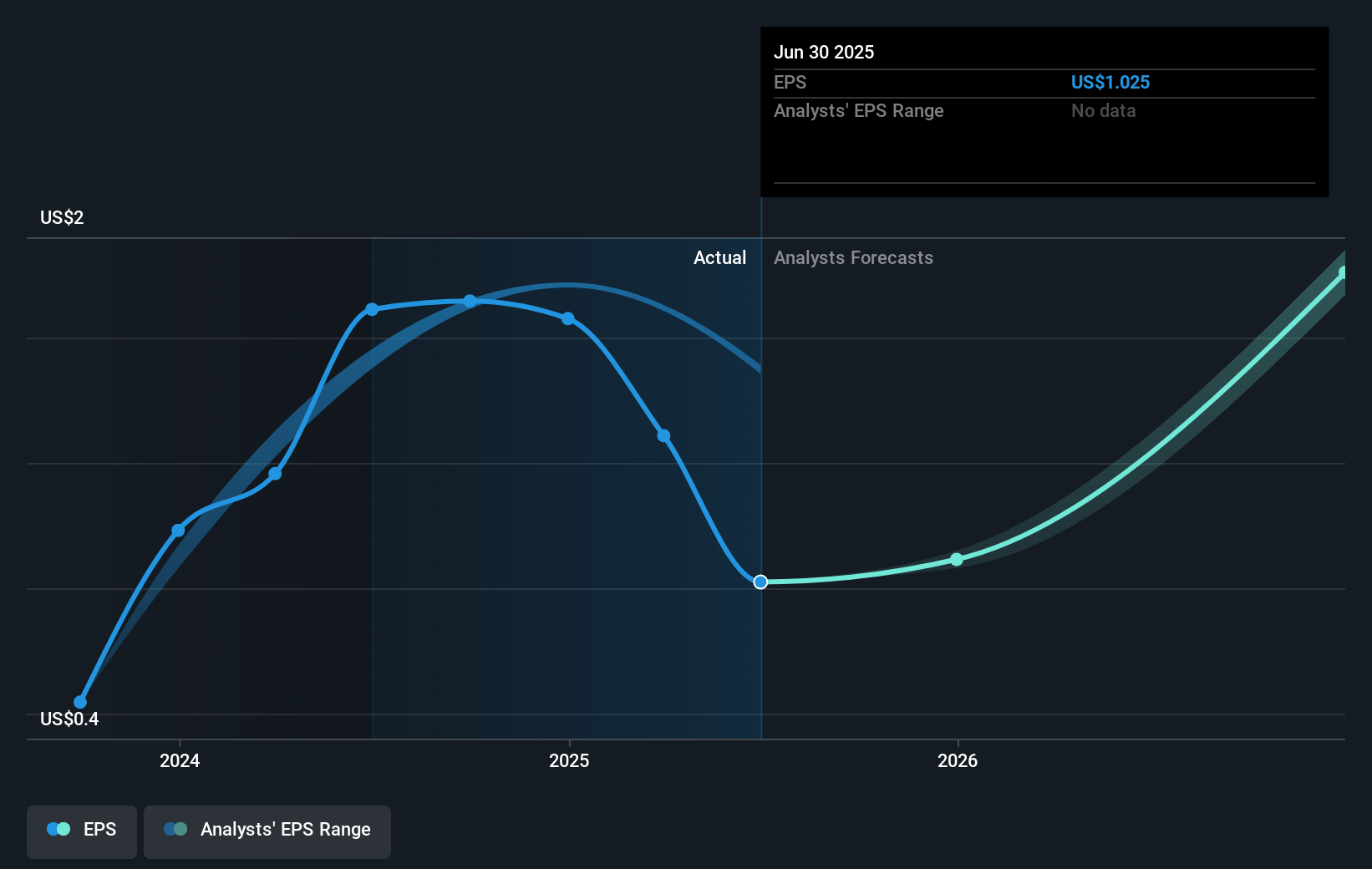

- Analysts expect earnings to reach $132.8 million (and earnings per share of $4.11) by about November 2027, up from $67.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2027 earnings, down from 20.0x today. This future PE is lower than the current PE for the US Auto Components industry at 20.0x.

- Analysts expect the number of shares outstanding to grow by 1.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Gentherm Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Gentherm's reliance on automotive production could impact revenue, as there's a noted decline in light vehicle production forecasted for the coming year.

- The start-up costs from opening new plants in Mexico and Morocco are cited as near-term headwinds, affecting profitability and potentially impacting net margins.

- The significant decreases in production by key partners like Stellantis and certain European OEMs could lead to further revenue challenges.

- Slower than expected adoption or deferrals of EV technologies in relevant markets pose a risk to future earnings growth projections.

- Challenges in the Chinese and Korean markets, especially from significant production declines, could threaten revenue and overall financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $61.0 for Gentherm based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $68.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.7 billion, earnings will come to $132.8 million, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of $43.8, the analyst's price target of $61.0 is 28.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives