Key Takeaways

- Strategic acquisitions and diversification in complementary markets position Patrick Industries for expanded earnings potential and improved revenue growth.

- Improved liquidity through debt refinancing enhances net margins and earnings potential by reducing financial expenses.

- Market volatility and strategic reliance on cyclical sectors could pressure revenue and margins, while tariffs and operational costs pose additional risks to profitability.

Catalysts

About Patrick Industries- Manufactures and distributes component products and materials for the recreational vehicle, marine, powersports, manufactured housing, and industrial markets in the United States, Mexico, China, and Canada.

- Patrick Industries has strategically diversified through acquisitions in complementary and adjacent markets, such as Powersports, RV, marine, and housing, which is likely to expand the company's earnings potential and cash generation capabilities. This diversification is expected to positively impact revenue growth.

- The company's investment in innovative product development, along with the alignment of its organizational structure to drive customer service excellence, positions it well for organic growth of 2% to 3% annually. This is expected to improve revenue performance by strengthening Patrick Industries' customer relationships and expanding its market share.

- Significant market share gains and the strategic acquisition of companies like Sportech and RecPro suggest that Patrick Industries is positioned to benefit from a recovery in its core markets, including outdoor enthusiast markets. This recovery is anticipated to bolster revenue and earnings as field inventories normalize and consumer demand increases.

- Optimizing their financial foundation through debt refinancing has improved liquidity, reduced the cost of fixed-rate debt, and extended maturity profiles, which collectively enhance the company’s net margins and earnings potential by lowering financial expenses.

- Lean dealer inventories and expectations of pent-up consumer demand release in the RV and marine market could lead to increased demand in 2025, supporting revenue growth and profitability as dealers replenish their inventories.

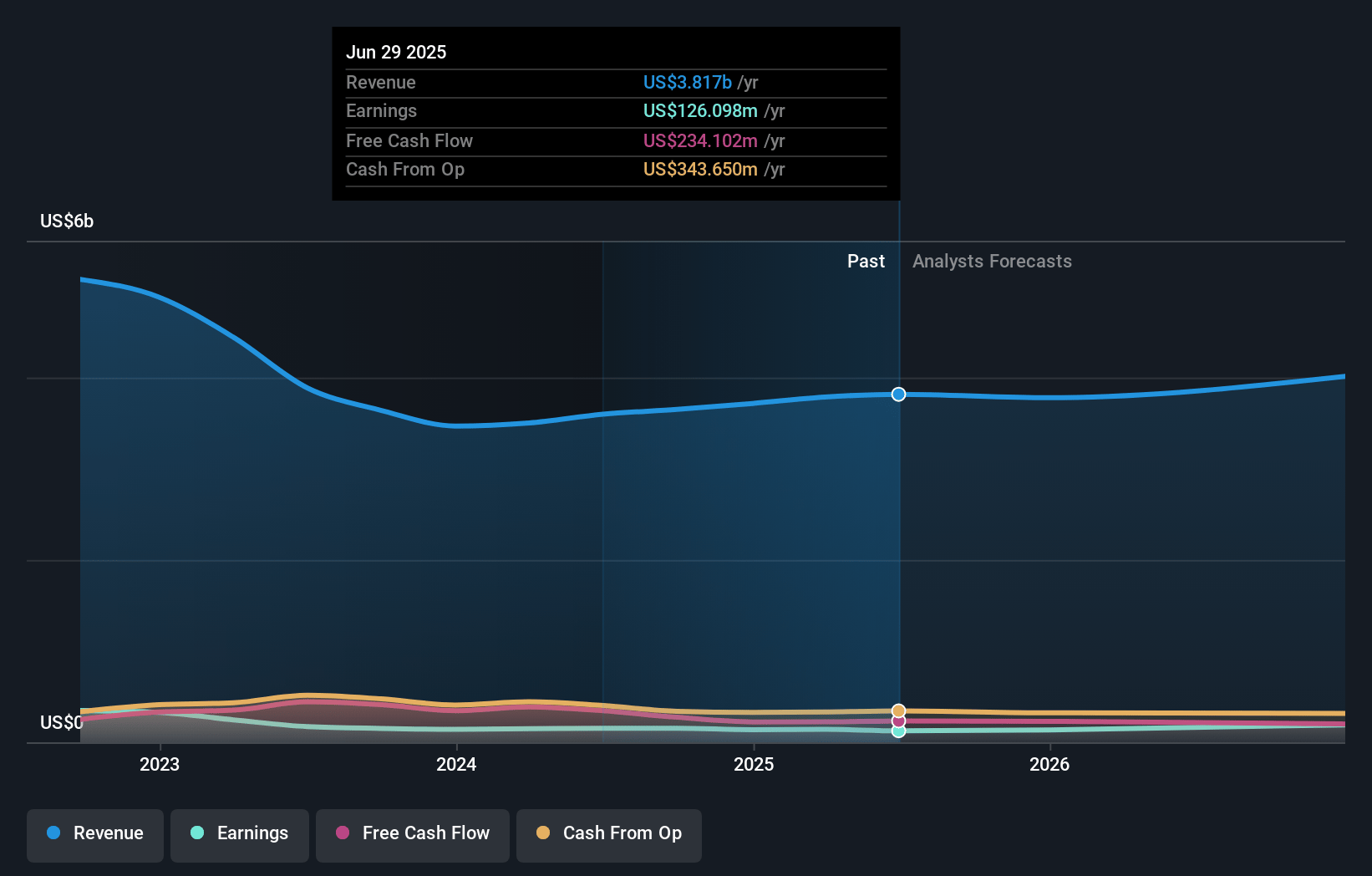

Patrick Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Patrick Industries's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.7% today to 6.0% in 3 years time.

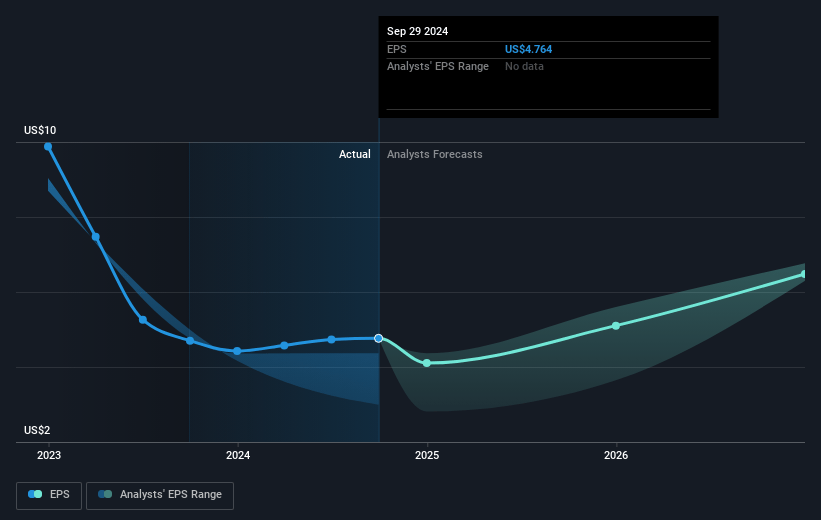

- Analysts expect earnings to reach $267.7 million (and earnings per share of $7.51) by about April 2028, up from $138.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, down from 19.3x today. This future PE is greater than the current PE for the US Auto Components industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

Patrick Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Market and macroeconomic volatility, as well as a mix shift towards smaller, more affordable units, may affect revenue growth and net margins.

- Declines in the marine market and focus on reducing field inventory levels could suppress earnings potential.

- The strategic plan relies heavily on organic growth in potentially cyclical markets such as RV, marine, and housing, which could impact future revenues if these markets do not recover as anticipated.

- Increased operating expenses due to acquisitions and maintenance of cost structures could pressure net margins if anticipated demand uptick does not materialize.

- Exposure to tariffs, particularly from China, Mexico, and Canada, presents a potential risk to gross margins and overall profitability if alternative sourcing or cost-mitigation strategies fail to counterbalance tariff impacts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $102.0 for Patrick Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.4 billion, earnings will come to $267.7 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 8.1%.

- Given the current share price of $79.71, the analyst price target of $102.0 is 21.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.