Key Takeaways

- Global production uncertainties, especially in China, and conservative forecasts challenge revenue growth and market penetration.

- In-house customer development and SuperVision-related revenue dependency could limit gross margin improvements and impact profitability.

- Over-reliance on the unpredictable Chinese market and potential in-house solutions pose significant risks to Mobileye's revenue and earnings growth projections.

Catalysts

About Mobileye Global- Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

- Concerns around global production volumes, particularly in China, and potential deterioration despite current stabilization could negatively impact revenue expectations.

- Conservative assumptions about new launches and the timing of new design wins reflect management's caution against reliance on optimistic customer forecasts, impacting future revenue projections.

- Potential in-house development by customers like Zika could displace Mobileye’s technology, putting pressure on future revenue for specific models and impacting market penetration.

- Dependence on SuperVision-related revenues, which have lower margins, suggests gross margin improvements might be limited despite projected volumes, affecting overall profitability and net margins.

- Considerations around macroeconomic conditions and their impact on OEM production decisions could lead to further reductions in EyeQ shipments, affecting Mobileye's earnings consistency and growth expectations.

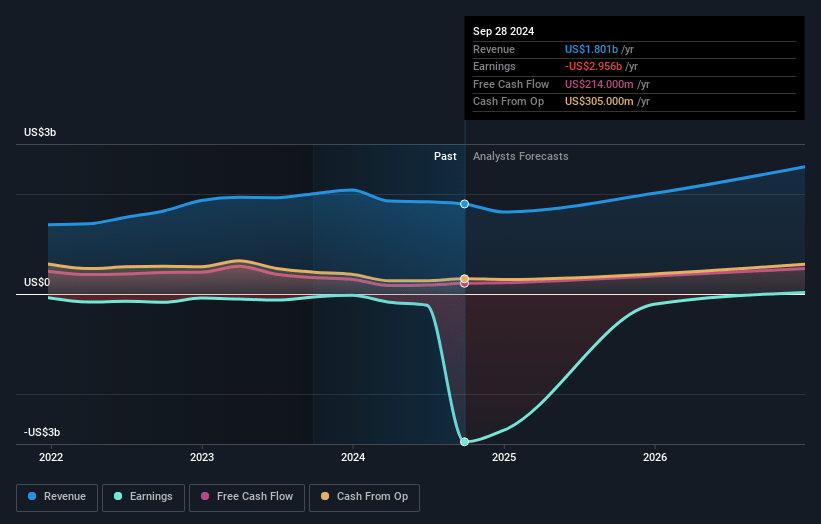

Mobileye Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Mobileye Global compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Mobileye Global's revenue will grow by 5.2% annually over the next 3 years.

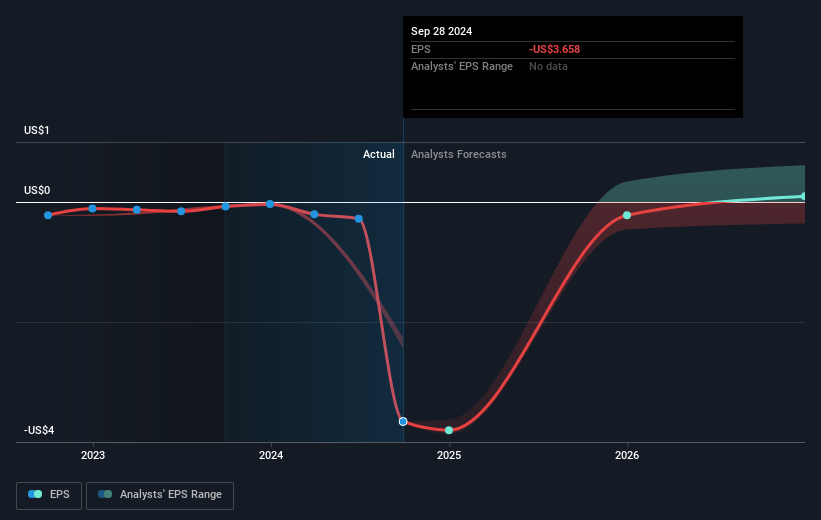

- The bearish analysts are not forecasting that Mobileye Global will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Mobileye Global's profit margin will increase from -186.8% to the average US Auto Components industry of 4.9% in 3 years.

- If Mobileye Global's profit margin were to converge on the industry average, you could expect earnings to reach $94.8 million (and earnings per share of $0.11) by about April 2028, up from $-3.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 155.5x on those 2028 earnings, up from -3.2x today. This future PE is greater than the current PE for the US Auto Components industry at 12.1x.

- Analysts expect the number of shares outstanding to grow by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.88%, as per the Simply Wall St company report.

Mobileye Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The forecast assumptions for Mobileye's Chinese customer volumes involve significant uncertainty, with a potential deterioration in demand due to low visibility, which could negatively affect its revenues and earnings.

- Mobileye's conservative guidance for 2025, despite customer indications of higher volumes, suggests caution due to risks such as over-reliance on a volatile Chinese market, potentially impacting its revenue growth.

- The risk of customers choosing in-house solutions, particularly for the ZEEKR 009 model, though not currently planned, represents a threat to Mobileye's revenue from that segment if realized.

- The ongoing inventory digestion issues and conservative assumptions regarding new launches may cause lower-than-expected revenue growth, impacting Mobileye's overall financial performance in terms of earnings.

- A lack of clarity on the exact timing of announcements for new product design wins introduces uncertainty, potentially affecting revenue realization and growth projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Mobileye Global is $13.82, which represents one standard deviation below the consensus price target of $19.02. This valuation is based on what can be assumed as the expectations of Mobileye Global's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $94.8 million, and it would be trading on a PE ratio of 155.5x, assuming you use a discount rate of 8.9%.

- Given the current share price of $12.3, the bearish analyst price target of $13.82 is 11.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NasdaqGS:MBLY. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.