Narratives are currently in beta

Key Takeaways

- Strategic expansion in ADAS and key relationships aims to boost revenue through design wins and deeper customer engagement.

- Emphasis on advanced AI products and operational efficiency could enhance future profitability and market demand.

- Challenges in the Chinese market, including reduced shipments and competitive pressures, pose risks to revenue and profitability, necessitating effective mitigation strategies.

Catalysts

About Mobileye Global- Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

- Mobileye is focusing on securing its long-term ADAS (Advanced Driver Assistance Systems) position with core customers. It aims to expand into new customer relationships, potentially driving higher future revenue through design wins and deeper customer engagement.

- The deployment of EyeQ5-based SuperVision in China is expected to serve as a proof point, enhancing global customer relations and acting as a foundation for advanced product growth, supporting revenue and profitability.

- EyeQ6 products are being developed with cutting-edge AI to improve their performance. Successful integration and design wins with advanced products like SuperVision and Chauffeur could enhance future revenue and margins.

- The regulatory environment is expected to require more sophisticated ADAS systems, which might increase demand for Mobileye's advanced technology, potentially raising revenue through higher ASP (Average Selling Price) systems.

- Operational efficiency efforts, like discontinuing in-house LiDAR development, are expected to manage operating expenses. This creates potential for improved net margins and earnings as revenue grows in the coming years.

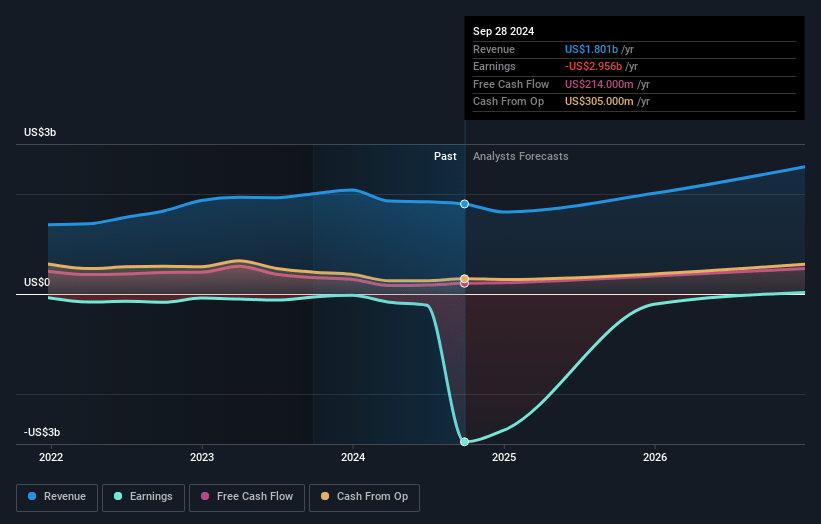

Mobileye Global Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mobileye Global's revenue will grow by 19.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -164.1% today to 4.5% in 3 years time.

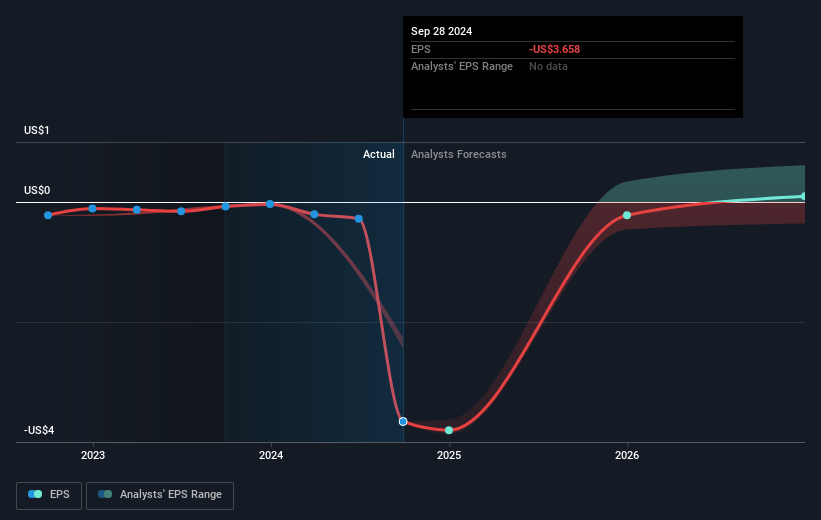

- Analysts expect earnings to reach $137.4 million (and earnings per share of $0.44) by about November 2027, up from $-3.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $448.5 million in earnings, and the most bearish expecting $-298 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 54.9x on those 2027 earnings, up from -4.7x today. This future PE is greater than the current PE for the US Auto Components industry at 20.0x.

- Analysts expect the number of shares outstanding to decline by 27.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.1%, as per the Simply Wall St company report.

Mobileye Global Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant revenue decline was experienced in Q3 2024, largely due to a 9% reduction in IQ volumes, including a substantial 50% drop in shipments to domestic China OEMs, which may continue to impact revenue unless successfully mitigated.

- Despite progress with advanced product designs, unforeseen headwinds have affected market expectations for 2024 and 2025, suggesting potential risks to future revenue and operating leverage if challenges persist.

- The complex and competitive environment in China presents risks, as the push for local technology development could limit business growth or lead to further revenue reduction from China-based customers.

- The profitability has been impacted by increased operating expenses driven by higher headcount and development costs, which could pressure net margins if revenue growth does not offset these expenses.

- The uncertainty surrounding SuperVision volumes, compounded by volatility in the Chinese market, adds risk to revenue forecasts and may hinder anticipated growth if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.21 for Mobileye Global based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.1 billion, earnings will come to $137.4 million, and it would be trading on a PE ratio of 54.9x, assuming you use a discount rate of 8.1%.

- Given the current share price of $17.31, the analyst's price target of $19.21 is 9.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives