Key Takeaways

- Investment in zero-emission technologies and Chinese market expansion positions Garrett Motion for revenue growth and margin improvement.

- Strong cost management and cash generation support shareholder value through strategic share repurchases and dividends.

- Challenges like declining vehicle sales, currency volatility, intense competition, and geopolitical uncertainties threaten Garrett Motion's revenues, margins, and financial stability.

Catalysts

About Garrett Motion- Designs, manufactures, and sells turbocharging, air and fluid compression, and high-speed electric motor technologies for original equipment manufacturers and distributors in the United States, Europe, Asia, and internationally.

- Garrett Motion's continued investment in differentiated technologies, particularly in zero-emission applications such as electric powertrain solutions, is expected to bolster future revenue growth and margin expansion by catering to advanced vehicle platforms.

- The initiation of new business wins in the Chinese market, particularly with emerging local manufacturers, and the diversification into products like plug-in hybrids and range extenders, suggest potential revenue growth opportunities as these partnerships mature.

- The company's robust cost management strategies, including fixed cost productivity actions and agile variable cost structures, are expected to maintain or improve net margins even in a challenging industry environment.

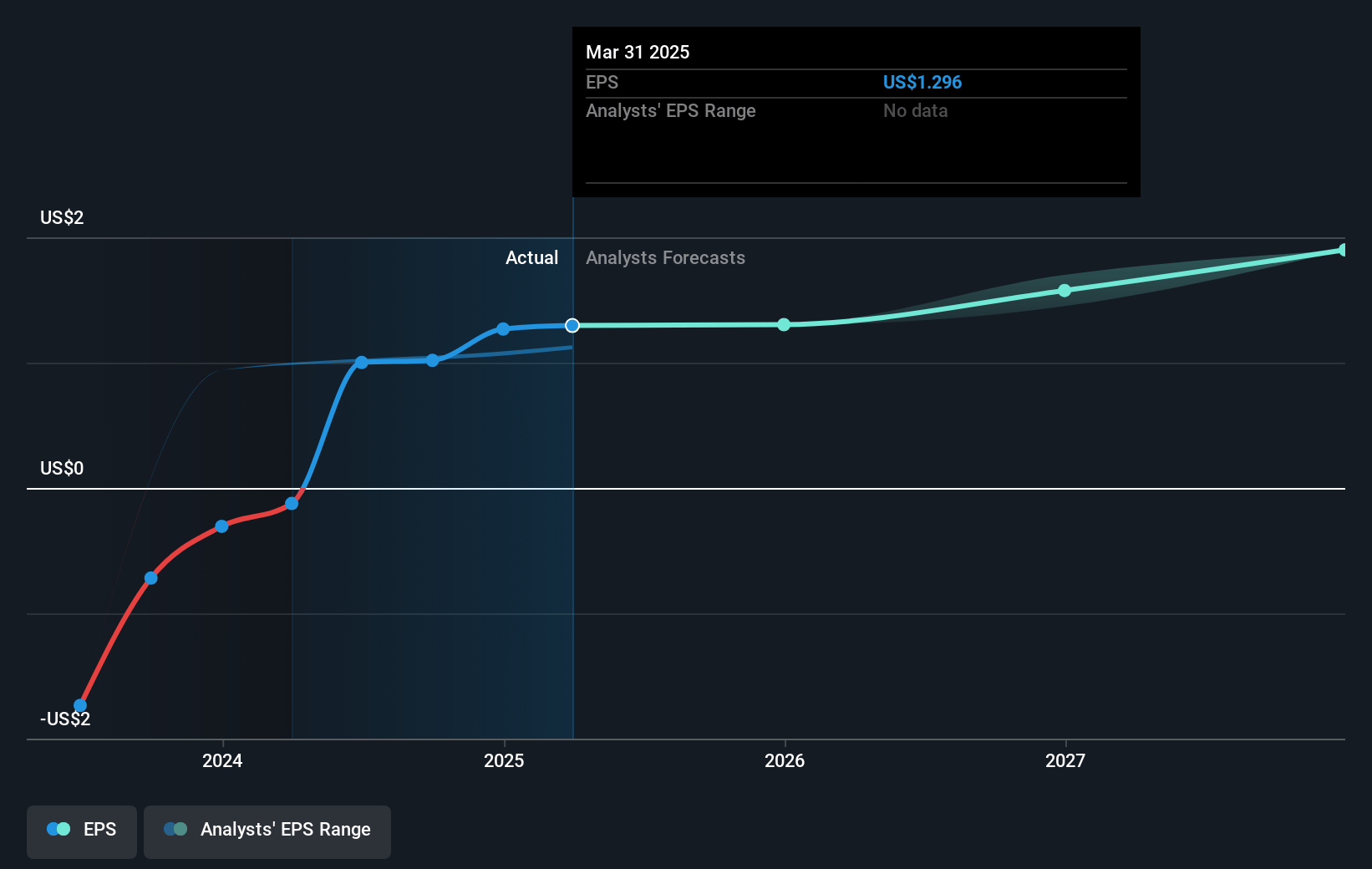

- Garrett Motion plans to leverage its strong cash generation capability to return value to shareholders through significant share repurchases and dividends. This capital allocation strategy is intended to enhance earnings per share (EPS) and shareholder value over time.

- The expansion into new geographic and product markets, including commercial vehicles and industrial applications, and the anticipated ramp-up of new programs suggest future top-line growth potential despite current market challenges.

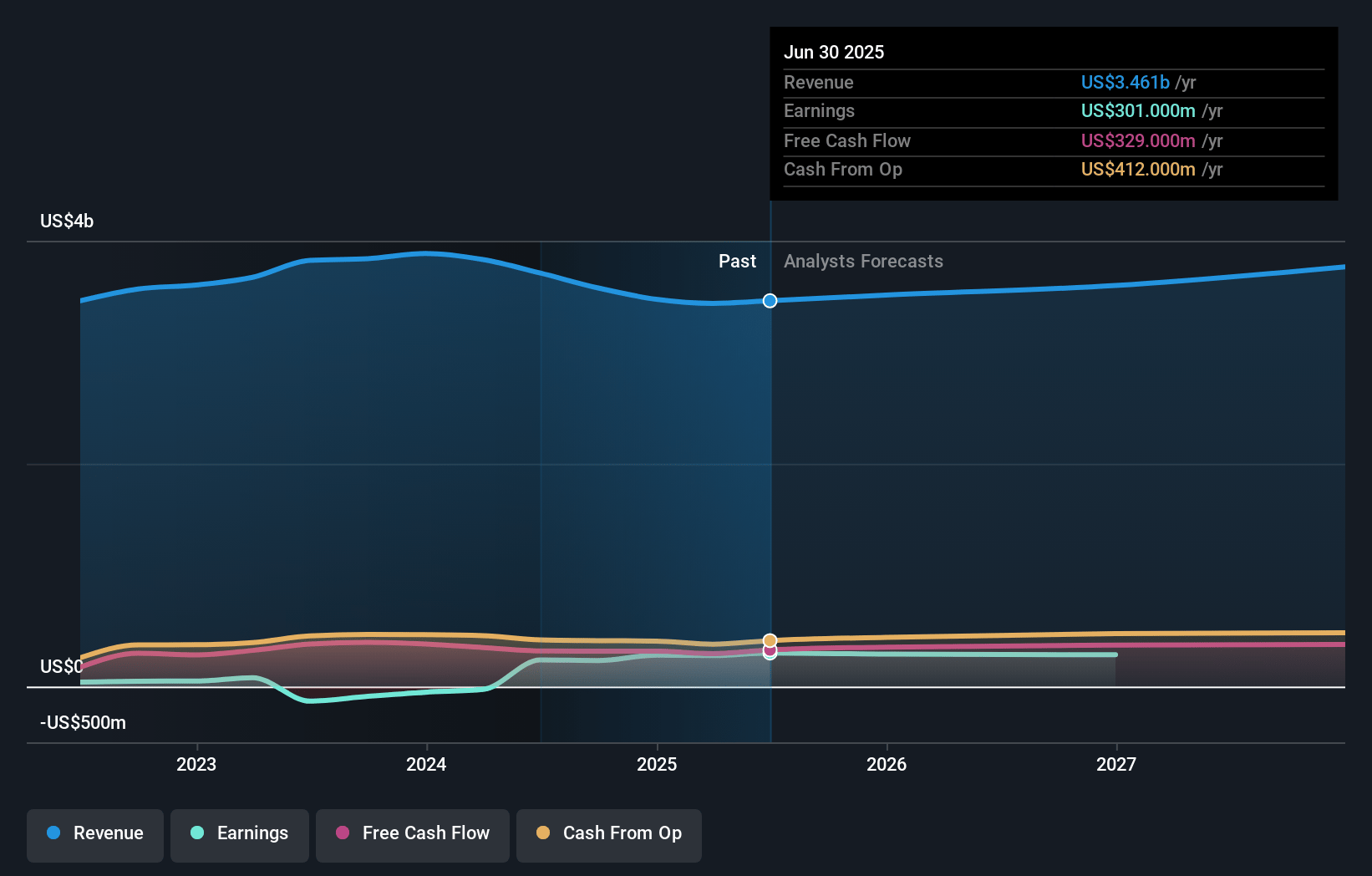

Garrett Motion Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Garrett Motion's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.1% today to 8.7% in 3 years time.

- Analysts expect earnings to reach $328.8 million (and earnings per share of $1.69) by about April 2028, up from $282.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2028 earnings, up from 6.6x today. This future PE is lower than the current PE for the US Auto Components industry at 13.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.75%, as per the Simply Wall St company report.

Garrett Motion Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is experiencing softness in vehicle sales in key markets such as Europe and China, which could negatively impact revenues if the trend continues without sufficient offset from other regions or market segments.

- Declines in the production of gasoline and diesel vehicles, particularly in Europe, may also lead to reduced future revenues if not compensated by increases in other product segments.

- Foreign exchange volatility, especially the strengthening of the U.S. dollar against the euro, has negatively affected financial results and could continue to impact net margins if such trends persist or worsen.

- Significant competition from both traditional automotive players and new entrants, particularly in China, may compress margins due to price pressures and the need for extensive R&D investments to remain competitive.

- Uncertain macroeconomic and geopolitical conditions introduce risks that are difficult to predict, potentially disrupting operations and creating financial uncertainties affecting earnings in future quarters.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.0 for Garrett Motion based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.8 billion, earnings will come to $328.8 million, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 8.8%.

- Given the current share price of $9.01, the analyst price target of $12.0 is 24.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.