Last Update01 May 25Fair value Decreased 6.24%

AnalystConsensusTarget has decreased revenue growth from 8.1% to 4.8%, decreased profit margin from 2.8% to 1.6% and increased future PE multiple from 16.2x to 27.3x.

Read more...Key Takeaways

- Expansion into automotive, micro LED, and sustainable display technologies positions AUO for revenue growth, higher margins, and reduced earnings volatility.

- Vertical integration, distributed manufacturing, and joint ventures drive operational flexibility, cost control, and diversification into high-value markets.

- Trade tensions, technological shifts, competitive price pressures, sluggish next-gen adoption, and rising regulatory costs all threaten AUO's margins, profitability, and core product relevance.

Catalysts

About AUO- Researches, develops, produces, and sells thin film transistor liquid crystal displays (TFT-LCDs) and other flat panel displays for various applications.

- Momentum in AUO’s Mobility Solutions (automotive displays and smart cockpit integrations)—strengthened by new design wins, the BHTC acquisition, and geographic diversification of production—positions the company to capture share in the fast-growing electric/autonomous vehicle market, supporting long-term revenue growth and margin expansion due to higher ASP and greater resilience to cyclical downturns.

- Significant progress in micro LED commercialization, including large-format TV, wearable, and automotive cockpit applications, combined with cost-reduction breakthroughs and new mass production capacities, sets the stage for AUO to benefit from increased demand for advanced, energy-efficient display technologies, which should uplift ASPs and support steady EPS expansion.

- The global shift toward energy efficiency and display sustainability (across segments like retail, smart building, and industrial automation) is catalyzing demand for AUO’s value-added and low-power display solutions (e.g., micro LED, e-paper), driving higher-margin specialty applications that stabilize earnings and improve net profit margins over time.

- AUO’s focus on vertical integration, asset-light strategies, and distributed manufacturing (e.g., capacity in Mexico, India, Germany, Bulgaria) enhances cost control, flexibility, and responsiveness to trade/tariff risks, which enables operational margin improvement and safeguards future EBITDA in an uncertain regulatory environment.

- Joint ventures (such as with E Ink for large-size e-paper modules) and expansion into high-value verticals (healthcare, smart retail) support revenue diversification and position AUO to leverage IoT and digital transformation trends, contributing to sustained top-line growth and reducing historical volatility linked to commoditized display sales.

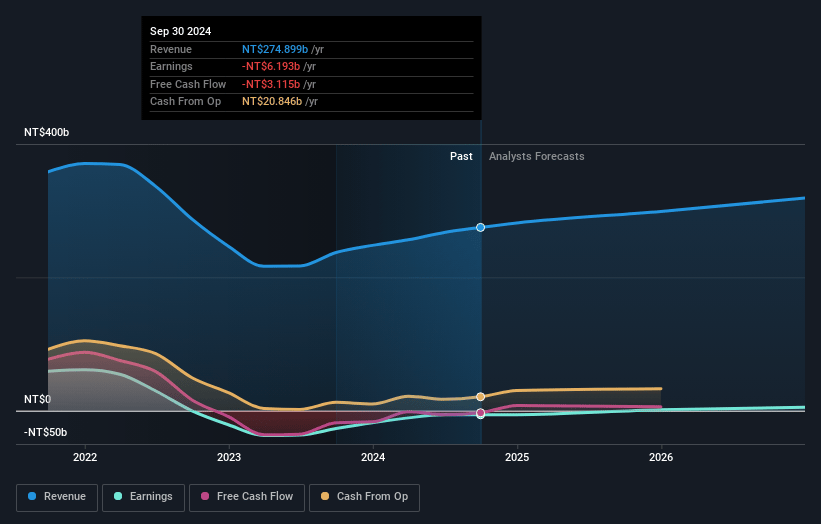

AUO Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AUO's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.3% today to 1.6% in 3 years time.

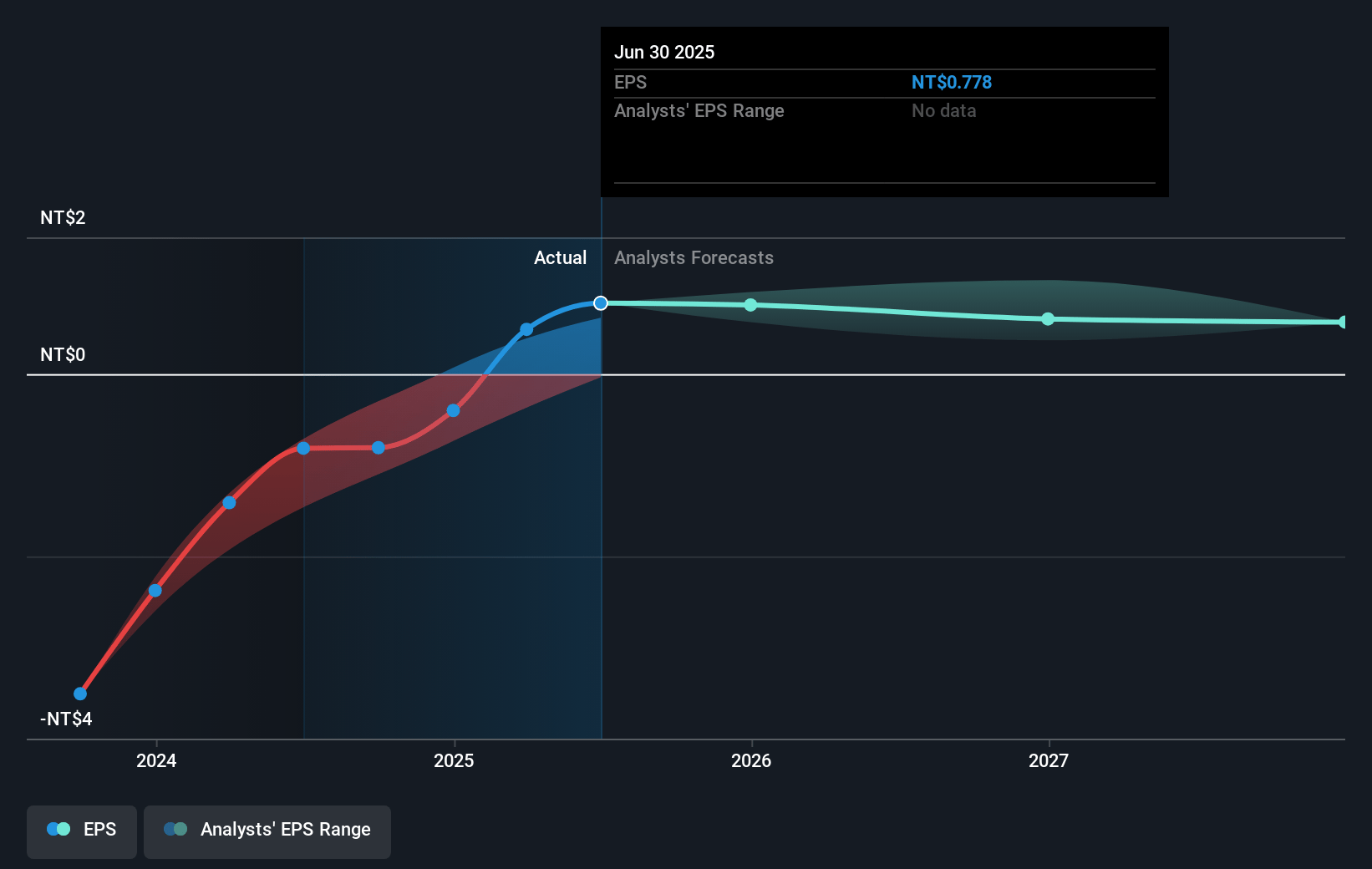

- Analysts expect earnings to reach NT$5.4 billion (and earnings per share of NT$0.7) by about May 2028, up from NT$3.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.3x on those 2028 earnings, down from 27.4x today. This future PE is greater than the current PE for the US Electronic industry at 19.6x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.91%, as per the Simply Wall St company report.

AUO Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent global tariff uncertainties and escalating trade friction—especially between China and the U.S.—may depress end-market consumption, lead to inconsistent demand, and create operational complexity, potentially reducing AUO’s revenues and net margins through indirect impacts on global economic growth and unpredictable consumer behavior.

- AUO's ongoing exposure to capital-intensive LCD and traditional display assets risks margin compression if industry supply exceeds demand or if further price wars among Asian panel makers (BOE, CSOT, Samsung) persist, resulting in chronic oversupply, lower ASPs, and reduced profitability.

- Delayed adoption and high production costs of next-generation display technologies such as Micro LED—despite technical showcases, management acknowledges cost breakthroughs and mass adoption are not imminent, so failure to achieve cost competitiveness and grow revenue from these segments could suppress long-term EPS and stifle planned margin expansion.

- Secular trends toward smaller, mobile-first devices and continued innovation in OLED and alternative display tech threaten demand and pricing power for large-format TFT-LCD panels—AUO’s historical core—which may result in top-line revenue erosion if product mix transition to high-value segments is slower than anticipated.

- Regulatory and ESG requirements, as well as increased scrutiny of manufacturing carbon footprints, could elevate long-term operational expenditures and capital needs for compliance, challenging AUO’s efforts to manage OpEx, maintain sufficient cash flow, and ultimately defend net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$14.757 for AUO based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$17.0, and the most bearish reporting a price target of just NT$13.6.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$337.5 billion, earnings will come to NT$5.4 billion, and it would be trading on a PE ratio of 27.3x, assuming you use a discount rate of 9.9%.

- Given the current share price of NT$13.65, the analyst price target of NT$14.76 is 7.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.