Catalysts

About ASE Technology Holding

ASE Technology Holding provides advanced semiconductor packaging, testing and system integration solutions for high performance computing, AI and data center applications.

What are the underlying business or industry changes driving this perspective?

- The explosive build out of AI data center compute, with hyperscaler CapEx hitting new highs, could normalize if AI model efficiency gains reduce accelerator demand intensity, which may pressure ASE's advanced packaging revenue trajectory after an initial surge.

- Escalating package complexity in large AI modules, including very large interposers and 16 HBM configurations, increases technical risk and yield volatility. This raises the possibility of cost overruns that compress gross margins in leading edge packaging.

- Dependence on a narrow set of high end AI platforms and a small number of foundry and GPU partners for FOCoS, FOCoS Bridge and full process services leaves ASE exposed to product road map shifts, qualification delays or insourcing. These factors could undercut expected earnings growth.

- Slow ecosystem readiness and equipment availability for panel level packaging, despite ASE’s technological progress, may delay broad migration from wafers to panels. This could limit the scale benefits and cost efficiencies needed to sustain margin expansion.

- Large investments in emerging power delivery and silicon photonics solutions for high voltage, high density data centers could outpace near term adoption. This may create a long payback period and depress returns on capital and free cash flow if volumes ramp more slowly than assumed.

Assumptions

This narrative explores a more pessimistic perspective on ASE Technology Holding compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

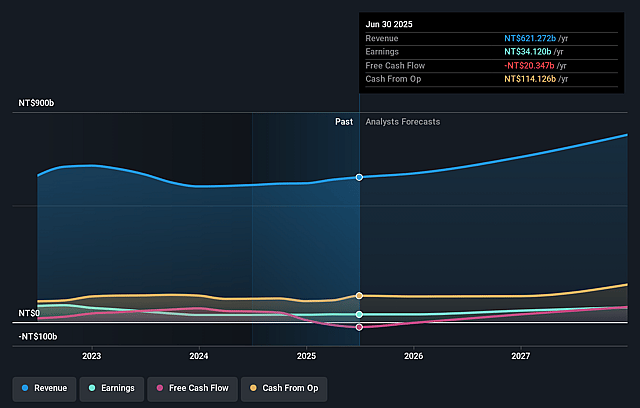

- The bearish analysts are assuming ASE Technology Holding's revenue will grow by 7.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.6% today to 8.9% in 3 years time.

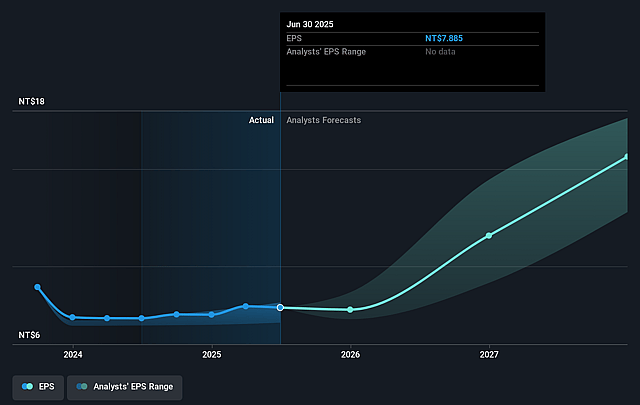

- The bearish analysts expect earnings to reach NT$70.0 billion (and earnings per share of NT$15.82) by about December 2028, up from NT$35.3 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as NT$107.4 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, down from 30.1x today. This future PE is lower than the current PE for the US Semiconductor industry at 29.5x.

- The bearish analysts expect the number of shares outstanding to grow by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.35%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The explosive and sustained growth in AI and data center spending, with hyperscaler CapEx hitting record highs and expected to continue, could support structurally higher demand for ASE's advanced packaging and power solutions. This could drive stronger revenue than assumed, supporting the share price through the cycle and lifting earnings.

- ASE's positioning in high value add advanced packaging for large AI modules, including FOCoS and FOCoS Bridge with increasing content per device, means revenue per unit can grow even when volumes are modest. This may underpin long term revenue growth and expand net margins.

- The company is investing in panel level packaging, powerSiP, high voltage direct current infrastructure and silicon photonics, all of which target long duration AI infrastructure trends. These initiatives could open additional high margin revenue streams and improve long run earnings resilience.

- Management expects leading edge advanced packaging and testing to be margin accretive to the group, with improving utilization and easing FX headwinds. This could drive a structural uplift in gross margin and operating margin and therefore support higher earnings than a bearish view implies.

- ASE's role as a key partner to foundries and hyperscaler ecosystems, combined with growing exposure to wafer probe and final test, may allow it to capture a larger share of AI semiconductor value over time. This could support diversified revenue growth and a more durable earnings base.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for ASE Technology Holding is NT$168.74, which represents up to two standard deviations below the consensus price target of NT$249.69. This valuation is based on what can be assumed as the expectations of ASE Technology Holding's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$330.0, and the most bearish reporting a price target of just NT$160.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be NT$782.0 billion, earnings will come to NT$70.0 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 10.3%.

- Given the current share price of NT$243.5, the analyst price target of NT$168.74 is 44.3% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ASE Technology Holding?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.