Last Update 27 Nov 25

Fair value Increased 0.53%2379: Net Profit Margin Improvement And Lower Discount Rate Will Drive Upside

Analysts have slightly raised their price target for Realtek Semiconductor from $596.19 to $599.35, citing modest improvements in revenue growth and profit margin expectations.

Valuation Changes

- Fair Value has increased slightly from NT$596.19 to NT$599.35.

- Discount Rate has decreased modestly from 9.16% to 9.05%.

- Revenue Growth expectations have improved slightly, rising from 10.83% to 10.90%.

- Net Profit Margin has edged up from 13.48% to 13.51%.

- Future P/E has remained virtually unchanged, moving from 17.59x to 17.60x.

Key Takeaways

- Strategic inventory management and diversification into high-growth sectors are driving revenue growth and operational resilience, boosting earnings stability.

- Focus on AI-enabled technologies and emerging innovations like smart glasses is poised to enhance market penetration and increase revenue.

- Geopolitical tensions and tariffs threaten Realtek's supply chain, demand, revenue growth, and margins, with competition and macroeconomic uncertainties exacerbating financial risks.

Catalysts

About Realtek Semiconductor- Engages in the research, development, production, and sale of various integrated circuits and related application software in Taiwan, Asia, and internationally.

- Realtek is capitalizing on strategic inventory build-ups, driven by customers preparing for market uncertainties, potentially resulting in boosted revenue growth as these inventories are utilized.

- Management expects continued demand in consumer electronics, networking, and automotive sectors, which are anticipated to enhance gross margins through product mix optimization with high-margin products like IoT devices and automotive Ethernet.

- The diversification of supply chain partnerships and market expansion efforts, particularly into high-growth areas like automotive and enterprise networks, are likely to drive sustainable revenue streams and improve operational resilience, positively impacting earnings stability.

- Realtek's strategic focus on AI-enabled and high-speed technology developments, including Wi-Fi 7 and advanced automotive Ethernet, presents potential catalysts for innovative product offerings, likely leading to increased revenue and higher net margins over time.

- Collaborations and advancements in emerging technologies such as smart glasses, humanoid robotics, and system-on-panel ESL indicate broader market penetration opportunities, potentially contributing to diversified and future revenue growth.

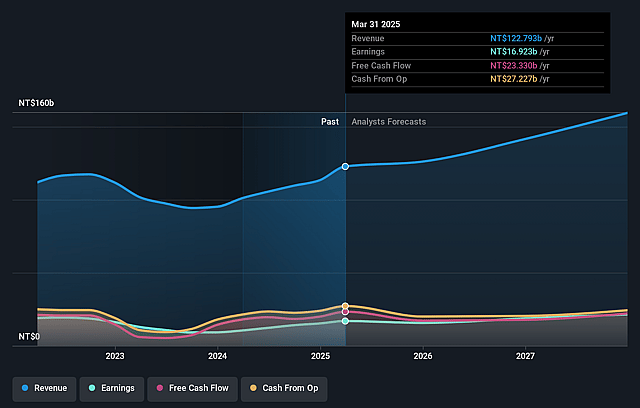

Realtek Semiconductor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Realtek Semiconductor's revenue will grow by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.3% today to 13.4% in 3 years time.

- Analysts expect earnings to reach NT$22.1 billion (and earnings per share of NT$42.21) by about September 2028, up from NT$16.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting NT$25.7 billion in earnings, and the most bearish expecting NT$18.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.2x on those 2028 earnings, up from 16.9x today. This future PE is lower than the current PE for the TW Semiconductor industry at 31.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.86%, as per the Simply Wall St company report.

Realtek Semiconductor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical tensions and tariff uncertainties, particularly between the U.S. and China, may adversely impact Realtek's supply chain and market demand, affecting revenue growth and margins.

- Strategic customer order adjustments and potential pull-forward effects due to tariffs could lead to temporary demand distortions, affecting future revenue sustainability.

- Macroeconomic uncertainties and potential tariff impacts may dampen consumer and end-market demand, posing risks to revenue and net margins.

- Increased costs from tariffs or reshoring efforts could challenge Realtek’s ability to maintain high gross margins, especially if lower-margin products become more prevalent in a weakened macroeconomic environment.

- Heightened competition and potential oversupply issues in both domestic and international markets, driven by national self-sufficiency policies, could lead to irrational price competition, impacting Realtek’s revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$611.0 for Realtek Semiconductor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$650.0, and the most bearish reporting a price target of just NT$535.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$165.5 billion, earnings will come to NT$22.1 billion, and it would be trading on a PE ratio of 18.2x, assuming you use a discount rate of 8.9%.

- Given the current share price of NT$542.0, the analyst price target of NT$611.0 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.