Key Takeaways

- Growth driven by focus on Ethernet and high-end products, expanding opportunities in AI and high-performance markets to support revenue and margin improvements.

- Strategic automotive and connectivity expansions poised to enhance revenue, leveraging inventory management for operational efficiency.

- Intense price competition and sluggish high-tech adoption may impede Realtek's profitability, market share, and revenue growth amidst geopolitical and seasonal challenges.

Catalysts

About Realtek Semiconductor- Engages in the research, development, production, and sale of various integrated circuits and related application software in Taiwan, Asia, and internationally.

- Realtek's growth in Ethernet products is expected to continue into 2025, driven by the upgrade to 2.5 gig Ethernet across various applications like PCs and telecommunications projects. This should support revenue growth and potentially enhance gross margins due to the focus on higher-end products.

- The strategic focus on mid

- to high-end products, along with new projects in AI and high-performance computing, aims to mitigate price competition and improve overall gross margin in the long term. This shift is expected to enhance earnings by catering to markets with higher average selling prices.

- Realtek is expanding its automotive product offerings, with automotive Ethernet showing robust growth potential. As more vehicles adopt advanced Ethernet solutions, Realtek anticipates higher sales from this segment, which should contribute significantly to revenue growth in the coming years.

- Realtek is leveraging its expertise in connectivity technologies to tap into the AI and high-performance server markets. This includes expanding product offerings in Wi-Fi, audio codecs, and other connectivity solutions, which are expected to drive revenue growth as demand for interconnected systems increases.

- The company's strategic inventory management and a focus on maintaining healthy inventory levels aim to provide flexibility in meeting sudden demand surges, reducing supply disruptions, and improving operational efficiency, which may positively impact net margins and profitability.

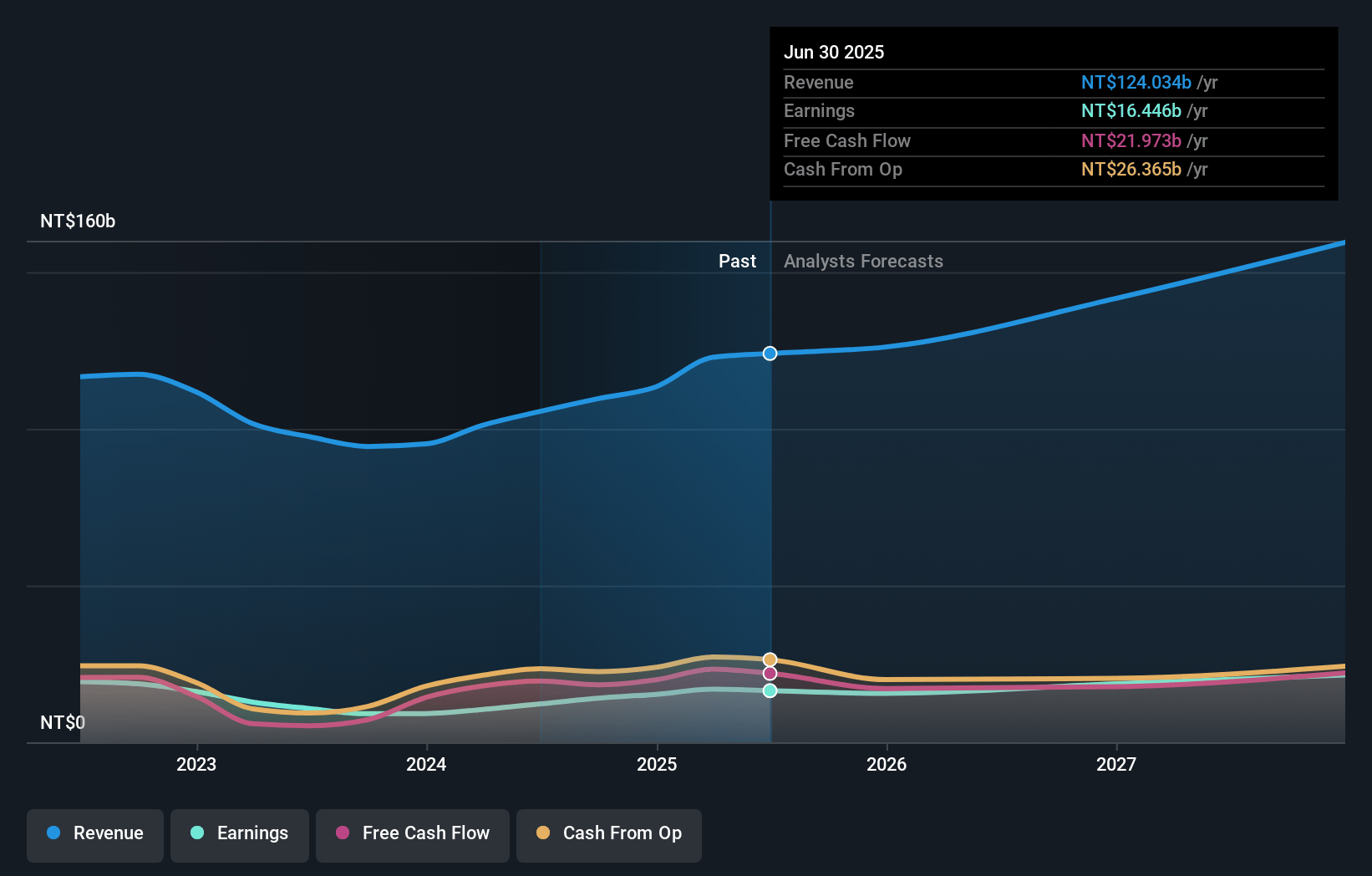

Realtek Semiconductor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Realtek Semiconductor's revenue will grow by 12.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.8% today to 13.8% in 3 years time.

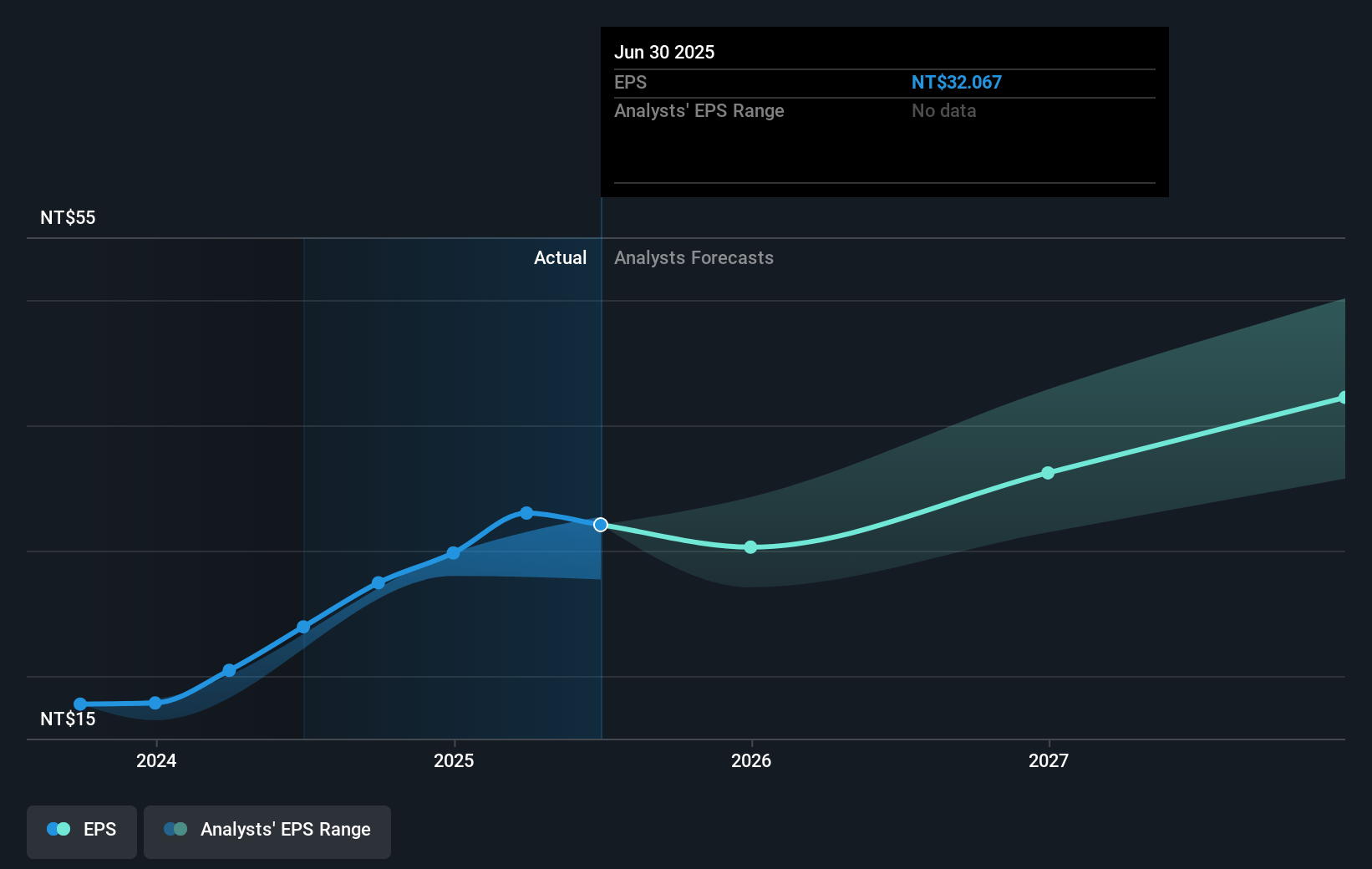

- Analysts expect earnings to reach NT$21.6 billion (and earnings per share of NT$40.71) by about January 2028, up from NT$14.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as NT$16.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, down from 19.8x today. This future PE is lower than the current PE for the TW Semiconductor industry at 29.1x.

- Analysts expect the number of shares outstanding to grow by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

Realtek Semiconductor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Realtek's gross margin is expected to be pressured in 2025 due to competition-induced price erosion and less significant impact from reverse inventory write-offs, affecting overall profitability.

- Seasonality and potential slowdowns, particularly in the consumer segment, could impact Realtek's revenue consistency and growth projections, especially in the latter parts of the year.

- Intense price competition from Chinese companies, especially for mature products with basic specifications, poses a risk to Realtek's sales margins and market share.

- Sluggish adoption rates for some high-technology products like Wi-Fi 7 due to cost considerations could limit future revenue and expansion in premium market segments.

- Fluctuating PC market expectations and geopolitical tensions affecting market access can create uncertainty in Realtek's revenue growth, especially in regions like China and emerging markets such as India.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$572.67 for Realtek Semiconductor based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$647.0, and the most bearish reporting a price target of just NT$425.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$156.3 billion, earnings will come to NT$21.6 billion, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of NT$542.0, the analyst's price target of NT$572.67 is 5.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives