Key Takeaways

- Robust AI demand and strategic fab expansions in multiple regions drive strong revenue growth and competitive positioning for TSMC.

- Geographic diversification reduces geopolitical risks, supports stable revenue, and long-term growth, while maintaining operational efficiencies boosts future net margins.

- Geopolitical risks, increased production costs, and market volatility threaten TSMC's profitability, earnings predictability, and financial stability amidst aggressive expansion and investment plans.

Catalysts

About Taiwan Semiconductor Manufacturing- Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

- The robust AI-related demand and plans to double CoWoS capacity in 2025 are forward-looking catalysts indicating strong revenue growth, particularly from AI accelerators like GPU, ASIC, and HPM controllers.

- TSMC's significant expansion in Arizona, with expected additional investment of USD 100 billion and plans for several advanced fabs, suggests a strategic positioning to cater to the strong AI demand in the U.S., aiming to support revenue and maintain competitive advantage.

- The accelerated ramp-up of 2-nanometer technology and its planned deployment in the U.S. reflect a long-term growth opportunity driven by demand for advanced semiconductor nodes, potentially boosting revenue and maintaining premium pricing power.

- Investments in global manufacturing expansion, including new fabs in Japan and Germany, aim to diversify geographic capabilities and reduce geopolitical risks, potentially supporting stable revenue streams and long-term growth.

- TSMC's commitment to maintaining a long-term gross margin of 53% or higher, despite overseas fab dilution, indicates confidence in its operational efficiencies and pricing strategy, impacting net margins positively in the long run.

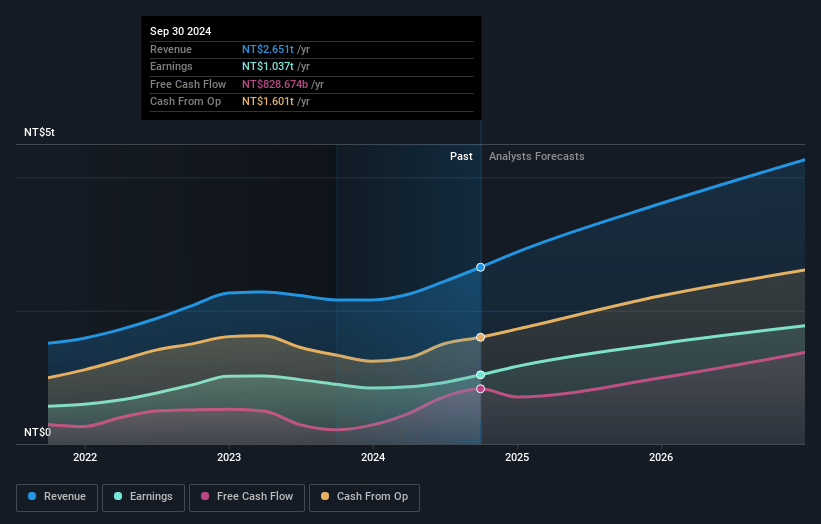

Taiwan Semiconductor Manufacturing Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Taiwan Semiconductor Manufacturing's revenue will grow by 17.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 41.7% today to 41.5% in 3 years time.

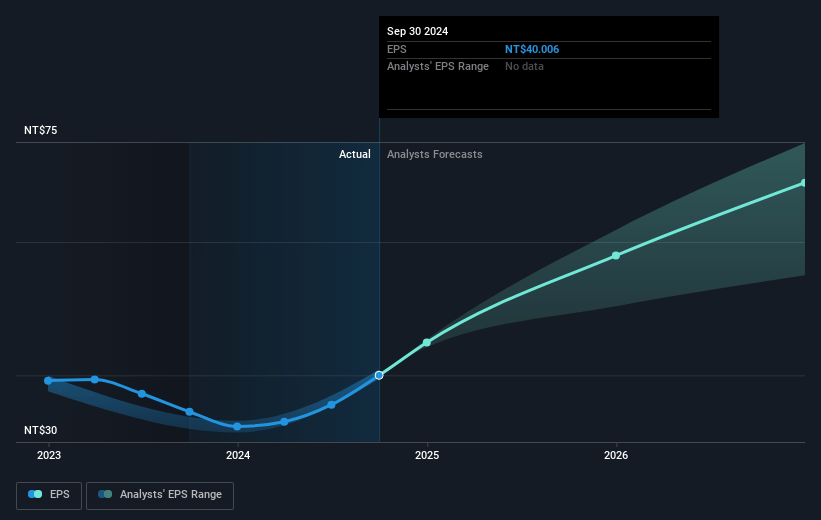

- Analysts expect earnings to reach NT$2113.9 billion (and earnings per share of NT$81.88) by about May 2028, up from NT$1309.3 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as NT$2472.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.7x on those 2028 earnings, down from 19.8x today. This future PE is lower than the current PE for the US Semiconductor industry at 25.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

Taiwan Semiconductor Manufacturing Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increase in production costs due to global manufacturing expansions, particularly the new fabs in Arizona and other overseas locations, is expected to cause margin dilution, impacting TSMC’s profitability and net margins.

- TSMC’s aggressive capital expenditure plans, with a 2025 capex budget between USD 38 billion and USD 42 billion, could pressure free cash flow if return on these investments does not meet expectations, potentially affecting overall earnings.

- Seasonality and weak demand in the smartphone and IoT sectors led to a sequential revenue decline, highlighting TSMC’s exposure to market volatility, which can impact revenue stability and overall financial performance.

- The geopolitical risks, including potential tariffs, and changes in customer behavior could affect demand and revenue forecasting accuracy, escalating uncertainties around revenue predictability and financial outcomes.

- Inventory levels increased as part of ramping up new overseas fabs, which could lead to asset utilization inefficiencies if demand forecasts do not materialize as expected, impacting operational margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$1248.213 for Taiwan Semiconductor Manufacturing based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$1700.0, and the most bearish reporting a price target of just NT$950.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$5096.0 billion, earnings will come to NT$2113.9 billion, and it would be trading on a PE ratio of 19.7x, assuming you use a discount rate of 8.8%.

- Given the current share price of NT$999.0, the analyst price target of NT$1248.21 is 20.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.