Key Takeaways

- Leveraging unique technology and strategic acquisitions, Parade is positioned for growth in high-speed connectivity and advanced display solutions across multiple end markets.

- Expanding major OEM partnerships and command of premium pricing set the stage for sustained revenue growth, diversified earnings, and structural margin expansion.

- Heavy reliance on a concentrated customer base, rising supply chain risks, and intense price competition threaten Parade's long-term revenue growth, margins, and innovation capacity.

Catalysts

About Parade Technologies- Operates as a fabless semiconductor company in South Korea, China, Taiwan, Japan, and internationally.

- Analyst consensus sees the Spectra7 acquisition as a means to enter high-growth data center markets, but the deal's potential is understated-leveraging Spectra7's unique silicon germanium technology and Parade's substantial sales force could radically expand Parade's share in ultra-high-speed active cable segments, enabling revenue and gross margin growth well beyond near-term expectations.

- Analysts broadly agree that ramping high-speed and USB4 product lines will support earnings, but this view misses Parade's accelerating dominance in end-to-end connectivity solutions for AI PCs, automotive, and servers, positioning the company as an essential supplier whose comprehensive portfolio can command premium pricing and drive structural margin expansion.

- Parade's deepening partnerships with Tier 1 OEMs like Apple and rapidly increasing design wins in AI-powered content creation PCs and edge devices position the company to benefit disproportionately as global AI and edge computing adoption drives sustained, compounding revenue growth and earnings stability over the next several years.

- With a robust pipeline of next-generation display technologies-including integrated in-cell timing solutions and TED-Parade is set to capitalize on industry migration to advanced displays in automotive, industrial, and consumer electronics, boosting long-term gross margin as competition in commodity segments becomes less relevant.

- The company's demonstrated ability to commercialize high-speed, low-power ASICs at advanced nodes, coupled with its industry-leading IP portfolio and proven mass production capabilities, could unlock new high-value customer engagements and lucrative non-recurring engineering revenue, further diversifying Parade's earnings streams and supporting a higher long-term valuation multiple.

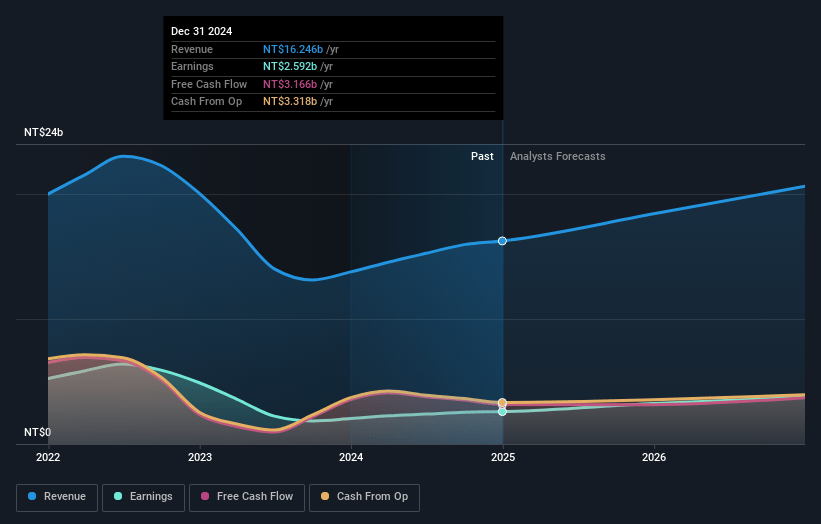

Parade Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Parade Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Parade Technologies's revenue will grow by 17.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.2% today to 17.8% in 3 years time.

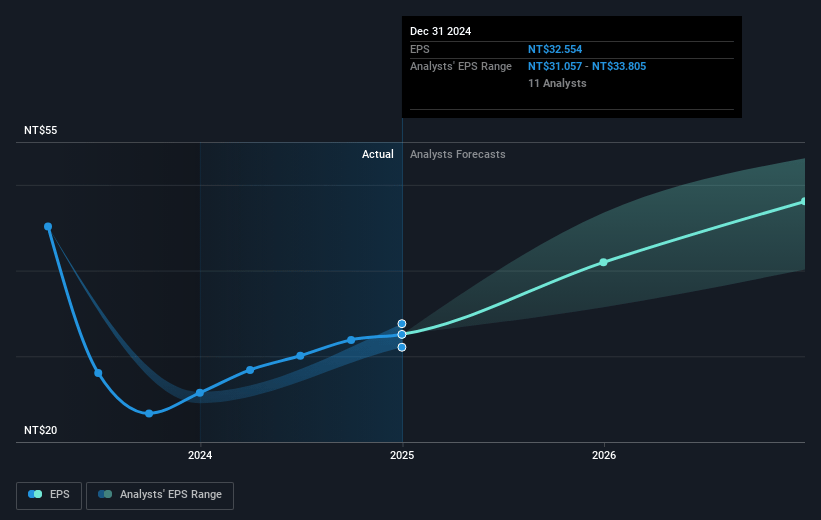

- The bullish analysts expect earnings to reach NT$4.8 billion (and earnings per share of NT$63.35) by about July 2028, up from NT$2.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, down from 17.5x today. This future PE is lower than the current PE for the TW Semiconductor industry at 24.8x.

- Analysts expect the number of shares outstanding to decline by 3.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Parade Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating regionalization of supply chains and emerging de-globalization trends, as reflected in the increasing need for Parade to support customer migrations to locations such as Mexico, could increase operational costs and undermine its ability to expand its global customer base, potentially reducing both revenue growth and net margins over the long term.

- Rising geopolitical tensions-particularly between Taiwan, China, and the United States-introduce ongoing risks of supply chain disruptions, tariffs, and regulatory uncertainty, as acknowledged throughout management's cautious outlook on tariffs and customer behavior, which could negatively affect revenue predictability and financial stability.

- Parade's business is highly exposed to a few large customers in the PC and display interface market, and its leadership repeatedly noted their fortunes are tightly linked to the overall health and cyclical patterns of these industries; this continued concentration poses long-term revenue volatility if key customers shift suppliers, insource, or face their own market declines.

- Sustained price competition and the commoditization of display interface IC products, illustrated by the ongoing discussion around aggressive pricing from rivals such as Texas Instruments and low-margin Chinese suppliers, may erode Parade's gross margins and weaken earnings, especially in lower-end segments.

- Increased complexity and escalating costs of next-generation semiconductor R&D and manufacturing, highlighted by the substantial capital requirements (for example, multi-million dollar mask costs for advanced ASIC projects) and Parade's limited diversification beyond its core interface solutions, could restrict innovation pace, leave the company vulnerable to rapid technology shifts, and constrain long-term revenue and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Parade Technologies is NT$866.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Parade Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$866.0, and the most bearish reporting a price target of just NT$440.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NT$26.8 billion, earnings will come to NT$4.8 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 7.6%.

- Given the current share price of NT$604.0, the bullish analyst price target of NT$866.0 is 30.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.