Key Takeaways

- Escalating security standards and AI proliferation are driving widespread adoption of eMemory's IP, ensuring recurring revenue growth and deeper integration across global chipmakers.

- eMemory's differentiated technology is becoming indispensable amid new regulations and advanced chip demands, supporting resilient margins and strong market positioning against commoditization.

- Rising geopolitical and industry pressures, shifting technology trends, and increased competition threaten eMemory's growth prospects, pricing power, and long-term royalty sustainability.

Catalysts

About eMemory Technology- Researches, develops, manufactures, and sells embedded flash memory products in Taiwan and internationally.

- While analyst consensus anticipates steady demand from edge AI and edge computing, broader adoption of eMemory's OTP, MTP and security IPs may accelerate dramatically as regulations and cybersecurity threats force "always-on" security across virtually all connected devices, supporting a multi-year step-change in addressable market and royalty-driven revenue growth.

- The consensus view sees post-quantum cryptography (PQC) adoption as a gradual opportunity, but in reality, new global standards (adopted by NIST in 2024) could drive much faster and industry-wide adoption of PUF-based security IPs, establishing eMemory's technology as a core requirement for all modern chips and potentially multiplying high-margin licensing income.

- Robust global expansion of foundry capacity-across advanced and mature process nodes, especially in the US, Europe and Japan amid localization-means an increasing number of design wins and entrenched "stickiness" for eMemory IP, resulting in structurally higher recurring royalties, improved earnings visibility and more resilient topline growth.

- The proliferation of IoT, autonomous systems, and "smart everything" in industrial automation and vehicles accelerates the need for high-reliability embedded NVM and hardware root-of-trust, positioning eMemory as an indispensable partner for both established and emerging chipmakers and fueling margin expansion via high-value, defensible IP.

- Advanced memory requirements for AI, HPC and next-gen SoC designs create secular tailwinds for eMemory's differentiated analog and security IP, which are less vulnerable to standardization and EDA commoditization, increasing both average selling prices and long-term net margins as the ecosystem increasingly defaults to eMemory's solutions.

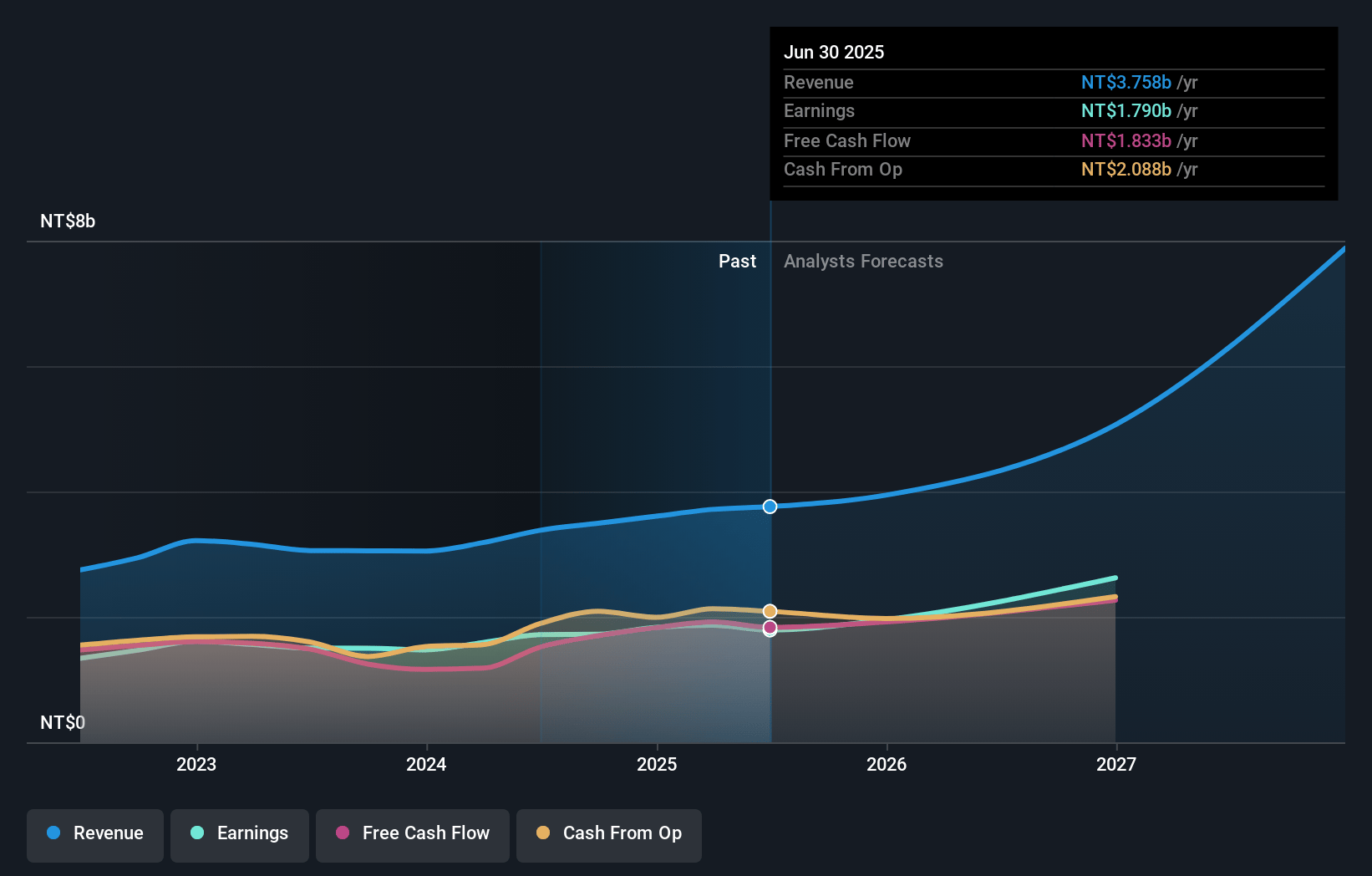

eMemory Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on eMemory Technology compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming eMemory Technology's revenue will grow by 37.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 50.2% today to 48.1% in 3 years time.

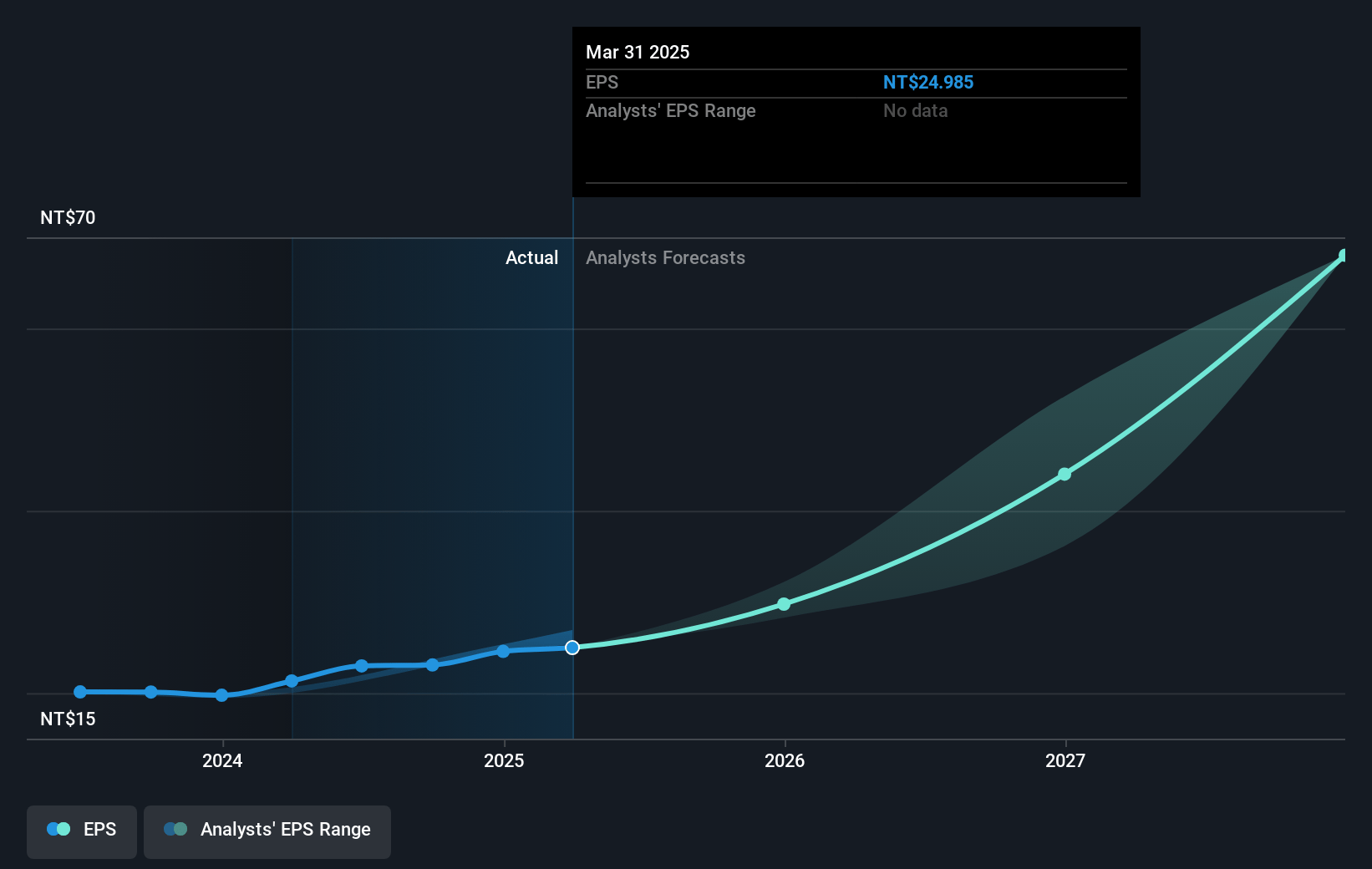

- The bullish analysts expect earnings to reach NT$4.7 billion (and earnings per share of NT$78.36) by about July 2028, up from NT$1.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 80.8x on those 2028 earnings, down from 95.9x today. This future PE is greater than the current PE for the TW Semiconductor industry at 24.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.75%, as per the Simply Wall St company report.

eMemory Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising geopolitical tensions and expanding trade barriers, especially between the US and China, could disrupt eMemory Technology's global expansion plans and create barriers to cross-border customer acquisition, leading to slower revenue growth and elevated customer churn risk.

- Industry consolidation among semiconductor firms and foundries may increase buyer bargaining power, forcing eMemory to accept less favorable licensing terms and reducing royalty and licensing fee margins over the long run, thereby lowering net margins.

- The shift toward alternative memory technologies such as MRAM and RRAM, as discussed in the Q&A, could render eMemory's current OTP/NeoFuse platforms less relevant; this technological change may erode the long-term sustainability of existing revenue streams.

- eMemory's high dependence on mature process nodes for royalty revenue exposes it to risk from oversupply and price pressure, especially as Chinese foundries continue to expand capacity; this trend could compress average royalty per chip and reduce overall revenue if advanced node ramp fails to compensate.

- Increasing competition from both established and emerging players in embedded non-volatile memory and security IP, coupled with the commoditization of basic IP in mature nodes, could dilute eMemory's pricing power, slowing revenue growth and compressing future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for eMemory Technology is NT$3961.44, which represents two standard deviations above the consensus price target of NT$3274.17. This valuation is based on what can be assumed as the expectations of eMemory Technology's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$4000.0, and the most bearish reporting a price target of just NT$3000.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NT$9.7 billion, earnings will come to NT$4.7 billion, and it would be trading on a PE ratio of 80.8x, assuming you use a discount rate of 8.8%.

- Given the current share price of NT$2395.0, the bullish analyst price target of NT$3961.44 is 39.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.