Key Takeaways

- Strategic partnerships and advanced tech development position eMemory for future revenue growth and enhanced market position through licensing and royalties.

- Expanding AI and IoT applications promise increased demand for eMemory's security and repair technologies, boosting profit margins and earnings long-term.

- Declines in key revenue streams and reliance on strategic partnerships pose risks to eMemory's growth and market share amidst uncertain economic conditions.

Catalysts

About eMemory Technology- Researches, develops, manufactures, and sells embedded flash memory products in Taiwan and internationally.

- Successful completion of the first 3 nanometer customer licensing project with a global leader in CPU IP suggests future growth in revenue and earnings as this partnership strengthens eMemory's position in the market.

- Collaboration with Siemens on advanced SRAM repair technology for AI applications is anticipated to drive significant royalty revenue increase as high-density SRAM becomes essential in AI accelerators, impacting future earnings positively.

- Advanced technology development to 2 nanometers and ongoing chip design integration at 3 nanometers highlight eMemory's potential to capture new markets with cutting-edge technology, contributing to future revenue growth.

- Significant year-over-year growth in MTP technology, driven by applications in DDR5 and e-Paper displays, positions the company for increased licensing and royalty revenue, boosting future net margins and earnings.

- Partnership with Arm on security IPs and ongoing developments in hardware security PUF-based solutions expected to increase licensing fees and royalties as demand for secure AI and IoT applications grows, enhancing revenue and profit margins in the future.

eMemory Technology Future Earnings and Revenue Growth

Assumptions

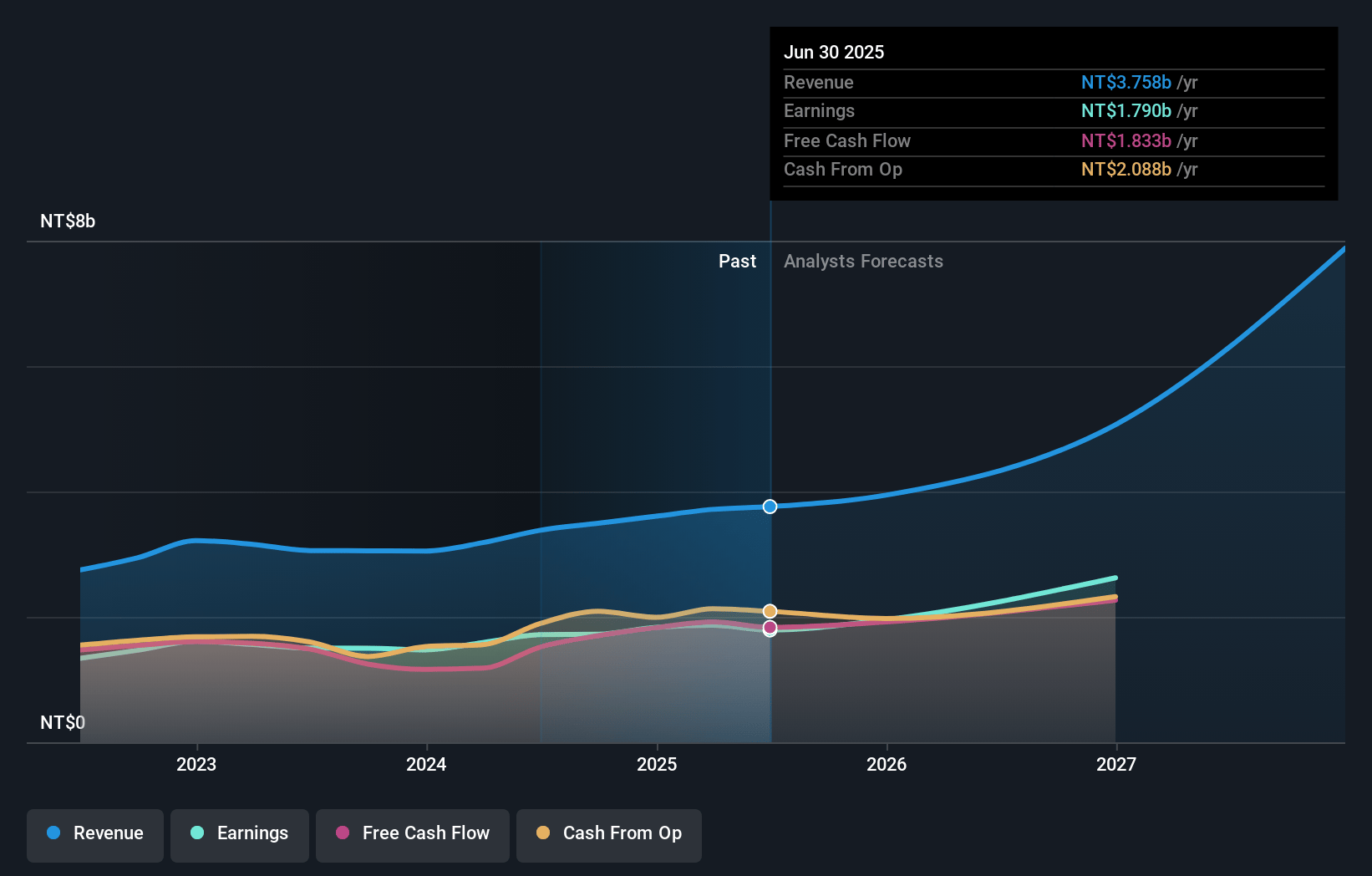

How have these above catalysts been quantified?- Analysts are assuming eMemory Technology's revenue will grow by 35.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 49.3% today to 46.0% in 3 years time.

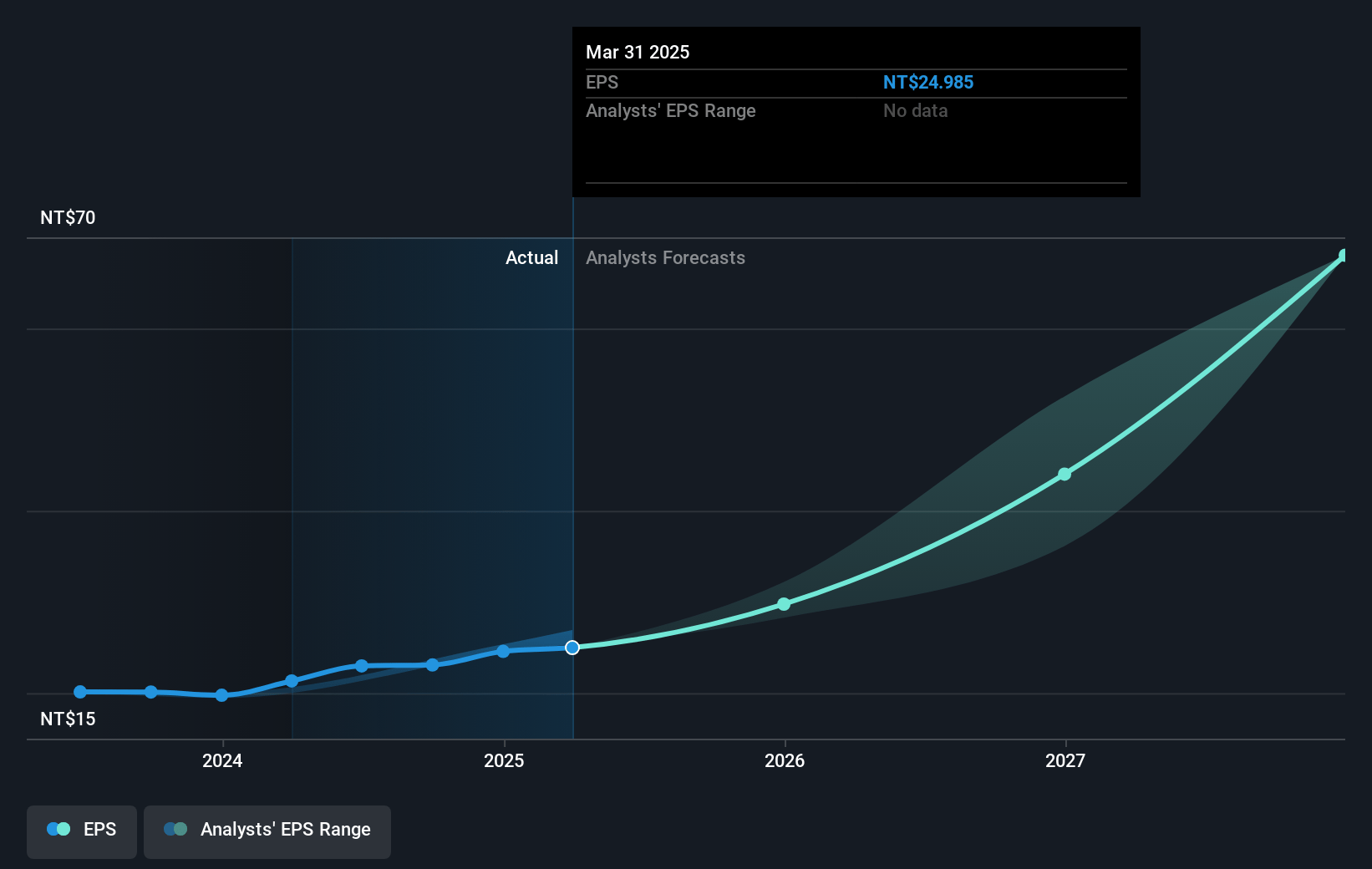

- Analysts expect earnings to reach NT$4.0 billion (and earnings per share of NT$82.85) by about January 2028, up from NT$1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 61.3x on those 2028 earnings, down from 146.4x today. This future PE is greater than the current PE for the TW Semiconductor industry at 29.1x.

- Analysts expect the number of shares outstanding to decline by 13.83% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

eMemory Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in PUF-based Security IP licensing and royalties, which decreased by 39% year-over-year, poses a potential risk to revenue growth if this trend does not reverse.

- The net income saw a significant sequential decrease of 12.9%, which could impact investor confidence and future earnings if not addressed.

- NeoFuse licensing revenue experienced a sequential decline of 10.1% and a year-over-year decline of 9.7%, which may affect revenue growth and market share if demand for this technology continues to wane.

- The reliance on collaboration with major partners, like Siemens and Arm, could pose a risk if any of these partnerships do not deliver the expected outcomes, impacting earnings and future growth prospects.

- Economic fluctuations and market conditions affecting ASIC companies in Taiwan raise concerns; if these conditions worsen, they could potentially impact eMemory’s revenue and net margins despite their unique business model.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$4180.0 for eMemory Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$4760.0, and the most bearish reporting a price target of just NT$3850.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$8.6 billion, earnings will come to NT$4.0 billion, and it would be trading on a PE ratio of 61.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of NT$3380.0, the analyst's price target of NT$4180.0 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives