Key Takeaways

- Broad deployment of next-generation wireless and optical technologies is driving revenue acceleration, gross margin expansion, and stronger long-term earnings stability.

- WIN's technological leadership and strategic pivot into diversified optical applications positions it to capture greater infrastructure spending and benefit from ongoing industry shifts.

- Weak demand, margin pressures, technological shifts, and geopolitical risks undermine WIN Semiconductors' profitability and threaten both near

- and long-term growth prospects.

Catalysts

About WIN Semiconductors- Researches, develops, manufactures, markets, and sells gallium arsenide (GaAs) wafers in Taiwan, Asia, the United States, and Europe.

- While analyst consensus expects Wi-Fi 7 adoption to boost revenue in the Wi-Fi PA segment, the company is already seeing momentum across both smartphone and router applications, indicating a much broader deployment that could lead to sharply accelerating revenue and a mid-term improvement in capacity utilization, with corresponding expansion in gross margins as economies of scale take effect.

- Analysts broadly agree that AI-driven infrastructure and optical communications will drive growth, but this likely underestimates the magnitude of demand coming from LEO satellite investments and cloud-to-edge data transfer; WIN's positioning in high-frequency, high-voltage solutions positions it to capture a disproportionate share of new infrastructure spending, bolstering both revenue and net margins over a multi-year horizon.

- Underappreciated is the accelerating shift to fabless business models and outsourcing among chip designers, a trend that is strengthening foundry utilization and fortifying WIN's customer stickiness, suggesting sustained improvements in long-term revenue stability and earnings visibility.

- The rapid global rollout of 5G and eventual 6G infrastructure will require next-generation RF and power devices, and WIN's technological leadership and ongoing investments in advanced process nodes place it at the forefront of this refresh cycle, likely supporting outsized top-line growth and margin expansion as higher-value products enter the mix.

- The company's pivot towards non-3D sensing optical applications, particularly in LiDAR and traditional optical communication, is driving a more diversified optical revenue base-which, combined with deepening R&D collaborations, could materially expand total addressable market and generate structurally higher net margins as optical becomes a larger share of business mix.

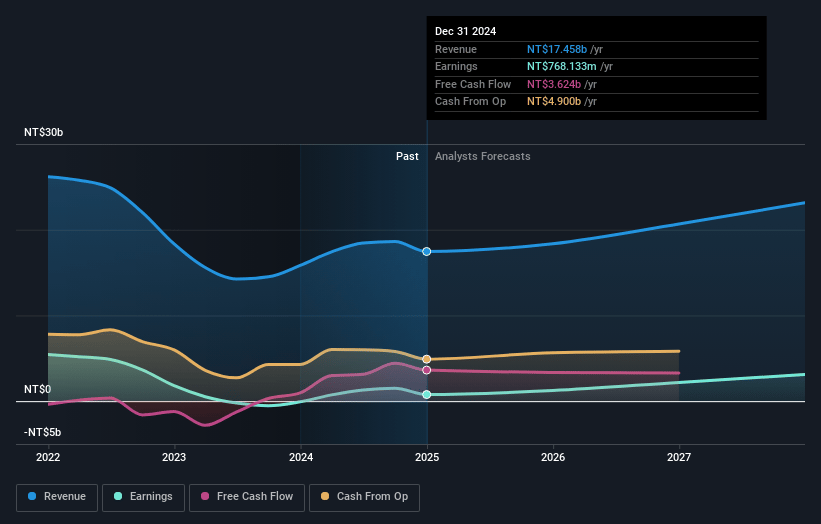

WIN Semiconductors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on WIN Semiconductors compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming WIN Semiconductors's revenue will grow by 14.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.3% today to 17.2% in 3 years time.

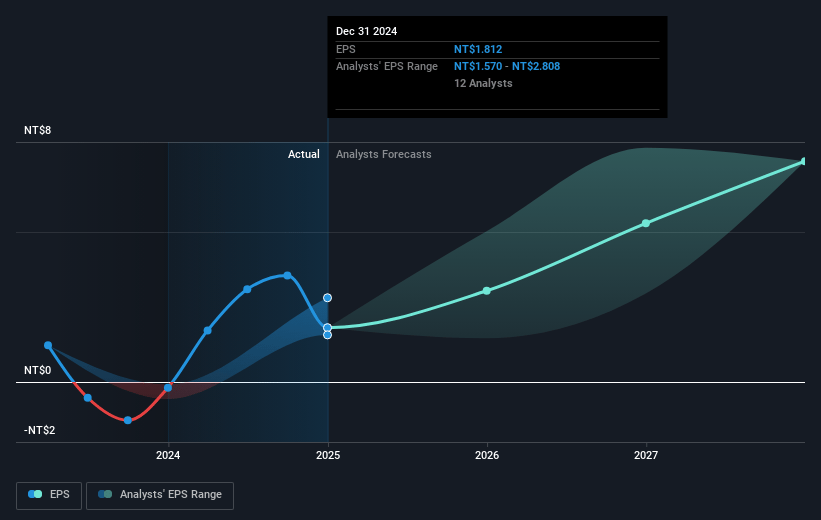

- The bullish analysts expect earnings to reach NT$4.3 billion (and earnings per share of NT$10.19) by about July 2028, up from NT$377.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 98.5x today. This future PE is lower than the current PE for the TW Semiconductor industry at 24.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.31%, as per the Simply Wall St company report.

WIN Semiconductors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural decline in consolidated revenue of approximately twenty percent year over year, combined with negative operating and net margins, indicates that WIN Semiconductors is struggling to maintain profitability amid end-market maturation and intensifying global competition, suggesting limited near-term earnings growth.

- Persistently low factory utilization at around thirty-five percent implies underused fixed assets and weak demand relative to capacity, which, if continued, will depress gross margins and reduce the company's ability to leverage operating expenses for future profitability.

- Heavier reliance on high-volume, low-margin segments such as cellular and Wi-Fi, particularly as these end-markets mature, exposes WIN to further margin compression and makes long-term revenue growth vulnerable to technology shifts or intensified price competition.

- The risk of long-term technological obsolescence is notable, as end-markets increasingly favor new technologies like silicon photonics or integrated system-on-chip solutions over traditional III-V compound semiconductors, which could steadily erode WIN's addressable market and eventually drive down both revenue and net profits.

- Geopolitical shifts and industry decoupling, particularly between the United States and China, coupled with the possibility of stricter tariffs and restricted equipment access, create significant long-term uncertainty for WIN's access to advanced manufacturing technologies and global end-customers, threatening both revenue sustainability and long-term investment returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for WIN Semiconductors is NT$127.94, which represents two standard deviations above the consensus price target of NT$96.19. This valuation is based on what can be assumed as the expectations of WIN Semiconductors's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$135.0, and the most bearish reporting a price target of just NT$70.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be NT$25.1 billion, earnings will come to NT$4.3 billion, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 11.3%.

- Given the current share price of NT$87.6, the bullish analyst price target of NT$127.94 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.