Last Update04 Aug 25Fair value Decreased 15%

Bora Pharmaceuticals’ consensus price target has been notably reduced, likely reflecting a slight decline in its future P/E ratio while profit margins remain stable, resulting in a revised fair value of NT$813.95.

What's in the News

- Completed share buyback of 36,000 shares (0.26%) for TWD 23.71 million.

- Approved amendment of the article of incorporation at AGM.

- Upcoming board meeting to approve 2025 Q1 consolidated financial statements.

Valuation Changes

Summary of Valuation Changes for Bora Pharmaceuticals

- The Consensus Analyst Price Target has significantly fallen from NT$1002 to NT$813.95.

- The Future P/E for Bora Pharmaceuticals has fallen slightly from 22.55x to 21.96x.

- The Net Profit Margin for Bora Pharmaceuticals remained effectively unchanged, at 15.88%.

Key Takeaways

- Operational recovery and strategic expansion in higher-value pharmaceuticals and CDMO capacity position Bora for stronger margins and recurring, long-term revenue growth.

- Enhanced client base, project wins, and operational efficiencies increase visibility, stability, and sustained profitability for future earnings.

- Heavy dependence on key assets, clients, and expansion initiatives heightens operational, competitive, and regulatory risks that could compress margins and destabilize earnings.

Catalysts

About Bora Pharmaceuticals- Engages in contract development, manufacture, and sale of pharmaceuticals in Europe, the United States, Taiwan, and internationally.

- Recent non-operational expenses and production delays have temporarily depressed margins and earnings, but these are now resolved, with management guiding for higher gross margins and improved operational leverage in the second half of 2025 as capacity constraints at key sites normalize, positively impacting net margins and earnings growth.

- Bora is aggressively expanding CDMO capacity and capabilities, particularly in the US and sterile injectables, to capture sustained demand driven by the aging population, rising chronic disease prevalence, and increased pharma outsourcing-secular trends likely to drive robust, recurring revenue growth and expanded margins.

- The company's ongoing shift from low-margin generics to high-value, specialty and branded pharmaceuticals, along with complex generics and DEE-focused assets, positions Bora to benefit from long-term increases in healthcare access and pharmaceutical consumption, especially in specialty care, fueling higher revenue growth and profitability.

- Strong client additions, a significant increase in project wins (including major top-20 pharma clients), growing CDMO order backlog, and strategic partnerships provide enhanced visibility and stability for forward revenues and earnings.

- Operational efficiencies through digitalization, automation, and supply chain optimization (including natural currency hedging and geographic diversification), coupled with a disciplined capital allocation strategy for capacity expansion, set Bora up for sustained improvement in operating margins and long-term earnings power.

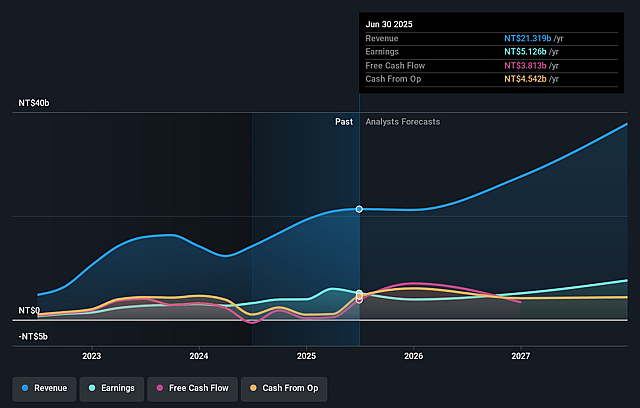

Bora Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bora Pharmaceuticals's revenue will grow by 22.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.0% today to 17.8% in 3 years time.

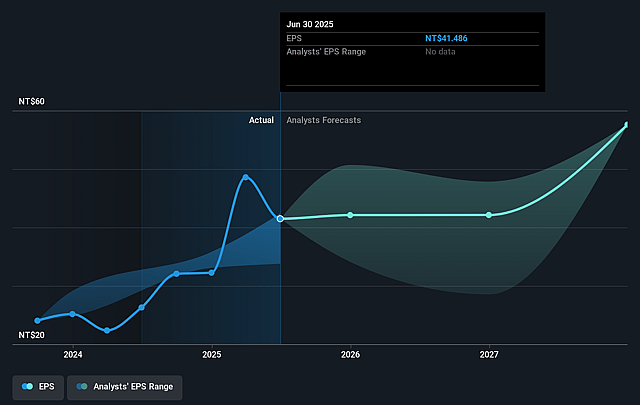

- Analysts expect earnings to reach NT$6.9 billion (and earnings per share of NT$57.56) by about August 2028, up from NT$5.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, up from 19.2x today. This future PE is greater than the current PE for the TW Pharmaceuticals industry at 18.5x.

- Analysts expect the number of shares outstanding to grow by 2.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.17%, as per the Simply Wall St company report.

Bora Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a limited number of high-value assets and anchor customers at certain facilities (e.g., Mississauga and Canadian dermatology site) introduces concentration risk; a loss or reduction in business from these clients could sharply impact revenue growth and earnings stability.

- The shift away from low-margin generics and reliance on specialty, branded, or complex assets exposes Bora to rising generic competition, potential product obsolescence, and limited diversification, which could compress long-term net margins if growth in specialty products is not sustained.

- Ongoing and significant CapEx investments in facility upgrades and expansions (such as Maple Grove, Maryland, and Camden) carry execution and integration risks; operational missteps, delays, or failure to realize anticipated synergies may negatively affect EBIT margins and return on invested capital.

- Demand tailwinds for U.S.-based manufacturing could weaken if U.S. drug tariffs are reduced or global regulatory and political pressures shift; a reversal of current onshoring trends or loss of pricing power from tariff-related strategies would directly threaten revenue and profitability projections.

- Increasing regulatory scrutiny, compliance obligations (especially around ESG, environmental standards, and new product categories like biologics), and macroeconomic headwinds (tariffs, FX volatility) may raise operating costs and reduce the company's global competitiveness, impacting long-term margins and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$847.458 for Bora Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$987.0, and the most bearish reporting a price target of just NT$725.13.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$38.9 billion, earnings will come to NT$6.9 billion, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 5.2%.

- Given the current share price of NT$792.0, the analyst price target of NT$847.46 is 6.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.