Key Takeaways

- Focus on low-carbon operations and green energy investments strengthens regulatory positioning and reduces costs, enhancing net margins.

- Strategic market expansion and innovation in energy storage drive revenue growth, benefiting from rising global demand for sustainable solutions.

- Heavy reliance on traditional cement poses risks amid carbon challenges, while geopolitical, market, and safety issues threaten growth in green and diversified ventures.

Catalysts

About TCC Group Holdings- Engages in the production and sale of cement and ready-mix concrete in Taiwan.

- TCC Group Holdings is focusing on reducing carbon emissions and transforming into a low-carbon operation, which gives it competitive advantages in the increasingly stringent regulatory environment around carbon emissions. This could improve net margins over time by reducing costs associated with carbon taxes and improving operational efficiencies.

- The company's strategic investments in green energy solutions, such as renewable energy, energy storage, and EV charging infrastructure, are expected to drive future revenue growth as global demand for sustainable energy sources continues to rise.

- Expansion into new geographical markets and diversification of its revenue base, particularly in Europe with the import of low-carbon cement products from Africa, positions TCC to capitalize on increasing demand for greener construction materials, potentially boosting revenue and profitability in the European market.

- TCC has been recognized as a leader in energy storage and has introduced innovations like EnergyArk, offering significant growth opportunities in sectors with rising energy demands, such as AI-driven data centers. This advancement is expected to contribute to increased earnings as the technology addresses critical safety concerns in energy storage.

- The adoption and implementation of advanced technologies, such as self-driving electric mining vehicles and high-efficiency energy-saving shipping technology, are likely to enhance operational efficiencies and reduce costs, positively impacting the company's net margins and earnings.

TCC Group Holdings Future Earnings and Revenue Growth

Assumptions

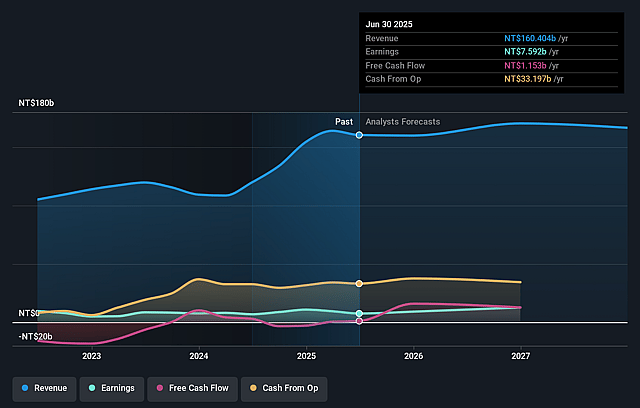

How have these above catalysts been quantified?- Analysts are assuming TCC Group Holdings's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.7% today to 11.7% in 3 years time.

- Analysts expect earnings to reach NT$20.0 billion (and earnings per share of NT$1.67) by about September 2028, up from NT$7.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, down from 22.2x today. This future PE is greater than the current PE for the TW Basic Materials industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 5.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.7%, as per the Simply Wall St company report.

TCC Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- TCC Group Holdings relies heavily on its traditional cement business for stable cash flows, which, despite transformation efforts, remains carbon-intensive and presents ongoing challenges in fully reducing emissions. This could impact their net margins and earnings if carbon regulation costs increase or competition with greener alternatives intensifies.

- Plans to transport semi-finished cement products from Africa to Europe could face geopolitical risks or logistical challenges, potentially affecting revenue growth in European markets.

- The financial success of TCC's emerging green technology ventures is uncertain, and these ventures currently fall within the BCG matrix's question mark and star designations. This introduces high variability in future revenue and earnings.

- TCC's geographical diversification, while broad, results in exposure to varied market and economic conditions across regions such as Mainland China and Turkey, which could affect revenue stability and cash flow.

- Persistent safety concerns with energy storage systems, despite innovative solutions like EnergyArk, could stall market acceptance or increase liability risks, impacting earnings from new energy ventures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of NT$32.0 for TCC Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NT$36.0, and the most bearish reporting a price target of just NT$20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be NT$170.7 billion, earnings will come to NT$20.0 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 8.7%.

- Given the current share price of NT$22.35, the analyst price target of NT$32.0 is 30.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.