Key Takeaways

- Positioning as a regional data hub and leveraging advanced infrastructure may drive revenue growth and margin outperformance beyond current market expectations.

- Integration of digital services and strong demographic tailwinds foster durable, high-margin growth, while renewable energy investments provide cost and earnings stability.

- Mounting competitive, regulatory, currency, and technological pressures threaten revenue growth, margins, and profitability, challenging Turkcell's ability to sustain expansion and defend core earnings.

Catalysts

About Turkcell Iletisim Hizmetleri- Provides converged telecommunication and technology services in Turkey, Belarus, Turkish Republic of Northern Cyprus, and the Netherlands.

- Analyst consensus expects strong growth from data center and cloud revenues, but this may significantly understate Turkcell's potential as management is positioning the company as the regional data hub for hyperscalers-given regulatory requirements to localize data, rapid growth in Turkish cloud markets, and the upcoming AI-driven digital transformation, revenues from this division could substantially exceed current expectations and drive top-line outperformance.

- While analysts broadly see the 5G rollout as a growth catalyst, their focus on 2026 launch and ARPU uplift may be conservative; Turkcell's leadership in advanced fiber and virtualized core infrastructure enables earlier monetization of enterprise 5G and IoT services, potentially accelerating revenue growth and improving blended margins ahead of the industry curve.

- The young, digitally-native and rapidly growing Turkish population is driving sustained demand for mobile, data, entertainment, and digital services, enabling structurally higher ARPU, persistent subscriber growth, and long-term revenue durability that is likely being underappreciated at current valuation levels.

- Turkcell's integration of its techfin/payments platform (Paycell), digital content apps, and smart mobility offerings (including embedded solutions for EVs like TOGG) is creating a unique digital ecosystem that captures high-margin, recurring revenue streams and cross-platform synergies, with the ability to expand user engagement and lift net margin over time.

- The company's aggressive investments in renewable energy-targeting coverage of 20 percent of annual energy needs and scaling further-are set to structurally reduce operating costs and shield earnings from inflationary energy price shocks, sustainably enhancing net margins and free cash flow for reinvestment or shareholder returns.

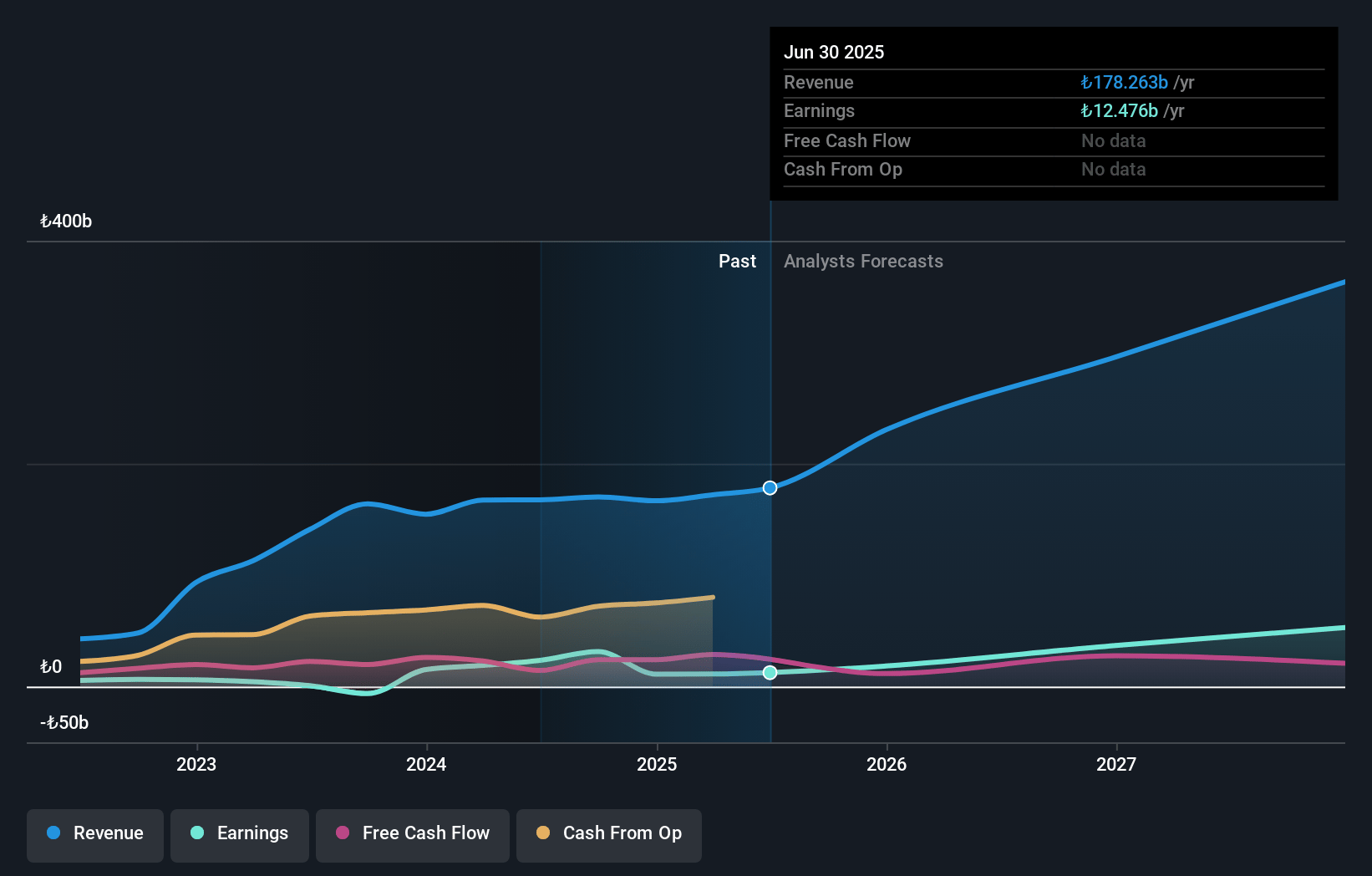

Turkcell Iletisim Hizmetleri Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Turkcell Iletisim Hizmetleri compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Turkcell Iletisim Hizmetleri's revenue will grow by 33.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.6% today to 22.8% in 3 years time.

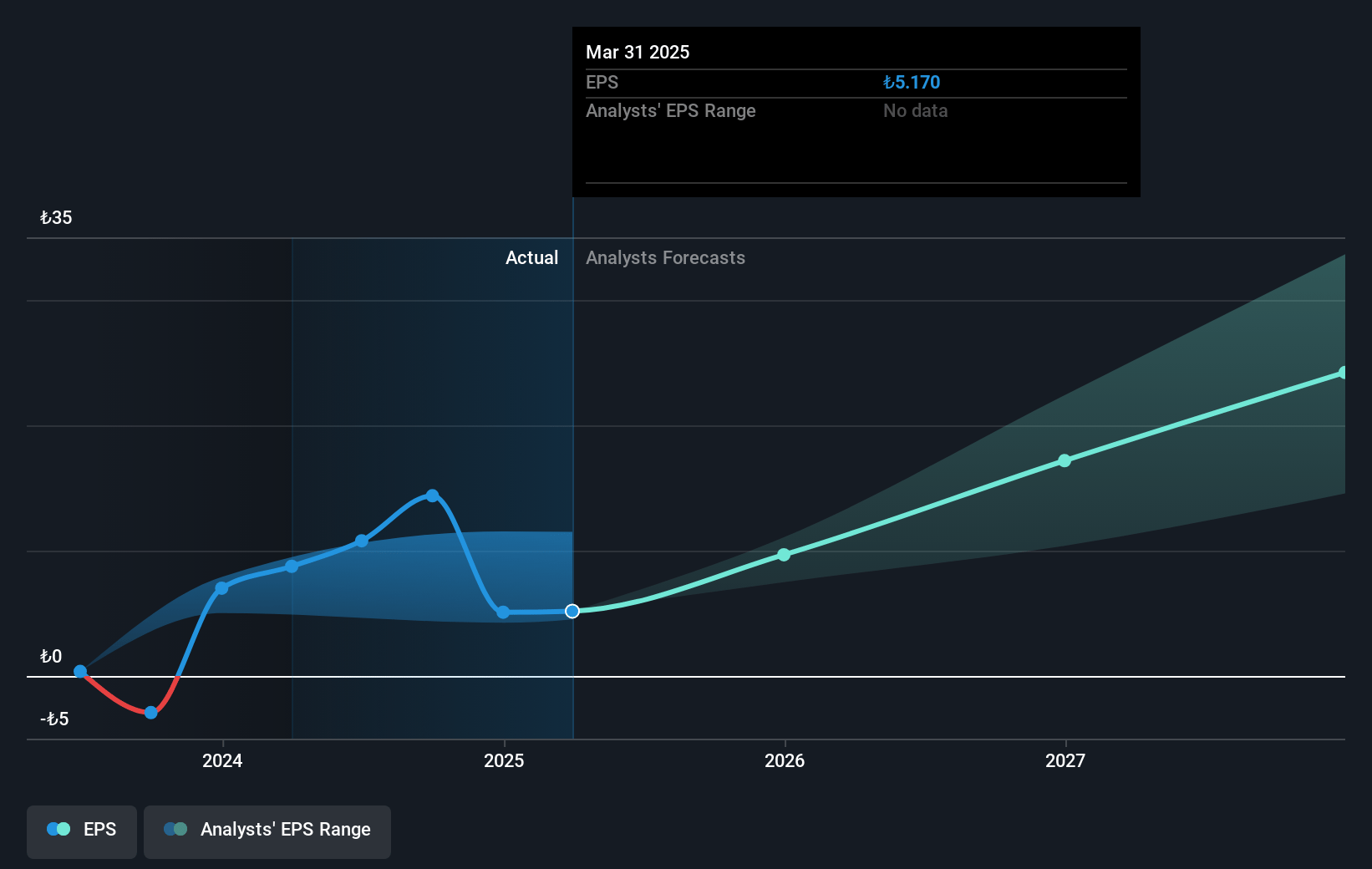

- The bullish analysts expect earnings to reach TRY 94.0 billion (and earnings per share of TRY 43.13) by about July 2028, up from TRY 11.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, down from 17.8x today. This future PE is lower than the current PE for the US Wireless Telecom industry at 17.8x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 27.57%, as per the Simply Wall St company report.

Turkcell Iletisim Hizmetleri Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Turkcell's future revenue growth is constrained by the slowing population growth and high market saturation in Turkey, which limits the number of new mobile and broadband subscribers and could make sustaining top-line expansion increasingly challenging over the long term.

- Competitive pressure in Turkey's mobile and fiber segments is intensifying, with lower postpaid net additions, rising churn, and aggressive pricing campaigns by rivals, all of which could compress ARPU and erode margins, negatively impacting net earnings.

- Exposure to foreign currency-denominated debt and persistent Turkish Lira depreciation present ongoing risks, as a significant FX mismatch-even with partial hedging-can raise interest payments and reduce net income, especially if macroeconomic volatility continues.

- Regulatory and geopolitical uncertainty, including potential changes in spectrum pricing, data localization requirements, and government intervention, could escalate capital expenditures and compliance costs, undermining profitability and stifling innovation, which would weaken future net margins.

- The global shift toward OTT platforms and the rise of low-cost MVNOs threaten to cannibalize traditional telecom services, putting long-term downward pressure on core service revenue streams and potentially resulting in stagnant or declining ARPU and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Turkcell Iletisim Hizmetleri is TRY193.39, which represents two standard deviations above the consensus price target of TRY147.27. This valuation is based on what can be assumed as the expectations of Turkcell Iletisim Hizmetleri's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of TRY206.0, and the most bearish reporting a price target of just TRY110.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be TRY411.6 billion, earnings will come to TRY94.0 billion, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 27.6%.

- Given the current share price of TRY92.4, the bullish analyst price target of TRY193.39 is 52.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.