Key Takeaways

- Major clean energy expansion and long-term contracts underpin stable growth, improved margins, and reduced earnings volatility.

- Strategic shift into solar and storage enhances revenue diversity and strengthens long-term earnings resilience.

- Heavy reliance on hydropower and limited market diversification expose CK Power to climate variability, regulatory shifts, higher financing costs, and increasing competitive and environmental risks.

Catalysts

About CK Power- Through its subsidiaries, generates and sells electricity and steam in Thailand and Lao People’s Democratic Republic.

- The company's major upcoming capacity expansion, especially the Luang Prabang project (1,460 MW, expected COD early 2030), will significantly increase electricity generation, positioning CK Power to capture rising demand from regional electrification and infrastructure buildout-directly benefiting long-term revenue growth and improved operating leverage.

- CK Power's focus on renewables (over 93% of portfolio) aligns it strongly with ongoing global policy shifts and investor preferences for low-carbon, ESG-compliant power producers, enabling continued access to capital and potentially lowering the company's future financing costs, thereby enhancing net margins and future earnings stability.

- The presence of long-term power purchase agreements (PPAs) (most contracts around 25+ years with Thailand's state utility) secures predictable and stable cash flows, supporting improved earnings quality and reducing earnings volatility, which can drive valuation re-rating over time.

- Ongoing deleveraging and refinancing activities (debt repayment, redemption of mature debentures, gradual reduction in project-level debt) are lowering consolidated finance costs, translating to higher net profit margins as seen recently in both core business and JVs-an ongoing trend expected to positively impact future earnings.

- The company's strategic move to diversify into new solar and battery storage projects and incremental solar expansions (several MW annually in the pipeline through 2029) leverages falling renewable technology costs, opening additional revenue streams and improving both growth prospects and overall earnings resilience over the long term.

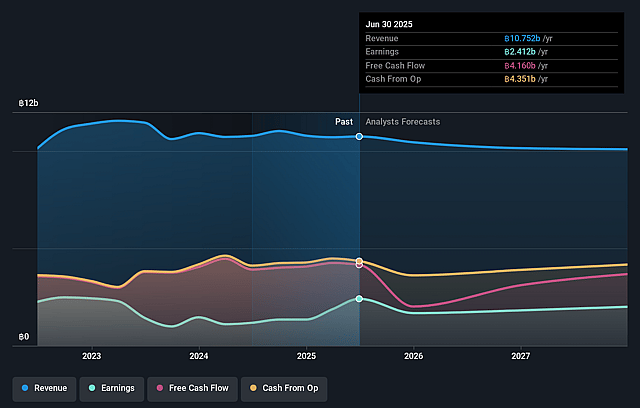

CK Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CK Power's revenue will decrease by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.4% today to 18.1% in 3 years time.

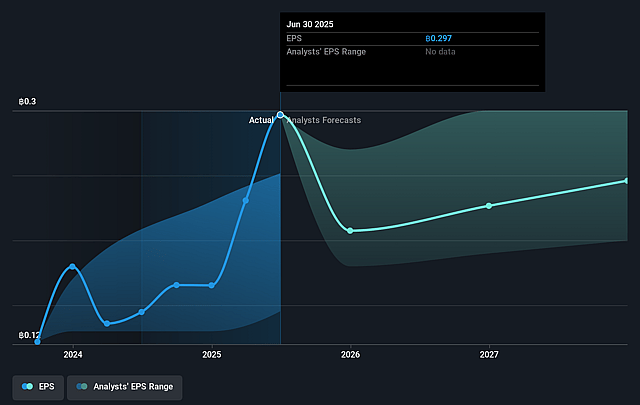

- Analysts expect earnings to reach THB 1.8 billion (and earnings per share of THB 0.25) by about September 2028, down from THB 2.4 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as THB2.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, up from 9.4x today. This future PE is greater than the current PE for the TH Renewable Energy industry at 10.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.0%, as per the Simply Wall St company report.

CK Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on large-scale hydropower for the majority of its generation leaves CK Power highly exposed to variable rainfall patterns and potential climate change-driven droughts, which could significantly reduce annual electricity output, impacting long-term revenue and net profit margins.

- The company's concentration in Thailand and Lao PDR markets increases vulnerability to regulatory shifts, policy risk, or regional geopolitical instability, which could hamper revenue streams or compress net margins if power purchase agreements are altered or tariffs adjusted.

- The planned expansion primarily into new hydropower (Luang Prabang) entails substantial CapEx and increased leverage in coming years; if construction overruns or project delays occur, or if interest rates rise, financing costs could climb, impacting future earnings and net margins.

- Expiry of subsidized tariffs (adder) on solar assets and slower pace of asset diversification compared to peers risks losing competitiveness in renewables, potentially lowering returns as solar and wind technology costs continue to decline and market incentives prioritize next-generation solutions.

- Growing regional and global scrutiny of large hydropower's social and environmental impact may result in stricter licensing, public opposition, or operational setbacks-potentially causing project delays or cancellations and reducing visibility into CK Power's future revenue pipeline.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of THB3.847 for CK Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of THB5.0, and the most bearish reporting a price target of just THB3.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be THB9.9 billion, earnings will come to THB1.8 billion, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 12.0%.

- Given the current share price of THB2.8, the analyst price target of THB3.85 is 27.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.