Last Update06 Sep 25

With no change in analyst rationale, both the discount rate and future P/E for Central Retail Corporation were essentially flat, resulting in the consensus analyst price target holding steady at THB22.77.

Valuation Changes

Summary of Valuation Changes for Central Retail Corporation

- The Consensus Analyst Price Target remained effectively unchanged, at THB22.77.

- The Discount Rate for Central Retail Corporation remained effectively unchanged, moving only marginally from 13.94% to 13.90%.

- The Future P/E for Central Retail Corporation remained effectively unchanged, moving only marginally from 19.97x to 19.95x.

Key Takeaways

- Expansion in Vietnam through new malls and renovations aims to boost revenue and occupancy rates amid strong economic growth.

- Strategic focus on growth, operational efficiencies, and e-commerce integration could improve net margins and drive revenue.

- The new CEO's potential changes in strategy, reliance on tourism, and heavy investments in Vietnam introduce uncertainty and risks that could impact earnings and profitability.

Catalysts

About Central Retail Corporation- Operates as a multi-format retailing business in Thailand, Italy, Vietnam, and internationally.

- The introduction of a new CEO, Khun Ty-san, with a proven track record in strategic vision and operational excellence, could lead to improved strategic initiatives and operational efficiencies, potentially boosting earnings.

- Expansion in Vietnam, with plans to increase the company’s presence from 29 to 32 provinces by the end of 2024 and build five new malls amid strong economic growth, could significantly increase revenue.

- Renovations and rebranding of existing malls in Vietnam, such as Thang Long and Dong Nai, aim to enhance the company's retail offerings and could drive up revenue and improve occupancy rates.

- The company's focus on profitable market share growth in Vietnam, with significant improvements in EBITDA and EBIT, suggests an emphasis on cost control and efficiency that could improve net margins.

- Strong performance in omnichannel sales in Vietnam, with a 12% contribution and 23% growth in Q3 2024, poses an opportunity for revenue growth through increased e-commerce integration.

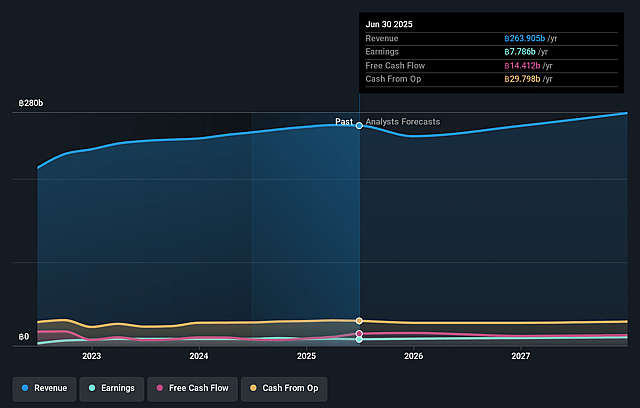

Central Retail Corporation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Central Retail Corporation's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.0% today to 3.7% in 3 years time.

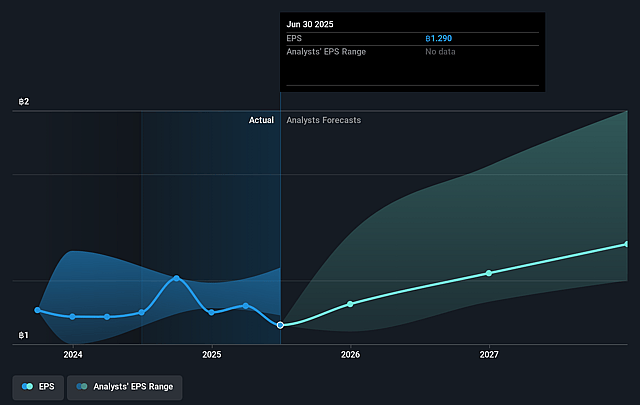

- Analysts expect earnings to reach THB 10.2 billion (and earnings per share of THB 1.68) by about September 2028, up from THB 7.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as THB13.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, up from 18.2x today. This future PE is greater than the current PE for the TH Multiline Retail industry at 18.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.94%, as per the Simply Wall St company report.

Central Retail Corporation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition in leadership, with a new CEO set to take over in May 2025, introduces potential uncertainty in strategic direction and execution which could affect CRC's operational efficiency and thereby impact earnings.

- While there is positive growth in Vietnam, the company's reliance on international visitors and tourism for expansion poses a risk if geopolitical or global economic factors suppress travel, potentially impacting revenue and net margins.

- The heavy investment in expanding and constructing malls in Vietnam, if consumer demand does not meet expectations, could lead to increased operational costs and affect the company's profitability and EBITDA.

- Despite reported profitability in certain formats, a loss in total modern trade market share due to mini-mart growth suggests competitive pressures that might erode profit margins and affect revenue stability.

- The company's significant investment in its omnichannel capabilities requires successful execution and market acceptance; failure to achieve desired sales growth could strain financial resources, affecting net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of THB22.772 for Central Retail Corporation based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of THB40.0, and the most bearish reporting a price target of just THB16.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be THB271.3 billion, earnings will come to THB10.2 billion, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 13.9%.

- Given the current share price of THB23.5, the analyst price target of THB22.77 is 3.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.