Key Takeaways

- Heavy dependence on high-spending international patients faces threats from reduced treatment intensity, evolving regulations, and stronger healthcare systems in source countries.

- Intensifying competition, capacity constraints, and digital healthcare alternatives may impede profitability and future revenue growth if Bumrungrad cannot further differentiate itself.

- Overdependence on international patients and regulatory risks threaten revenue stability, while regional healthcare improvements and weak tourist arrivals could further shrink market and margin prospects.

Catalysts

About Bumrungrad Hospital- Owns and operates hospitals in Thailand and internationally.

- Although patient volumes in core Middle Eastern markets like Qatar and UAE showed resilience in admissions and outpatient visits, sustained revenue growth is threatened by a material decline in average length of stay and lower treatment intensity. As a result, top-line revenue and net margins could remain pressured if this pattern persists or accelerates, particularly given the heavy reliance on higher-spending international patients.

- While Bumrungrad continues to benefit from Thailand's position as a medical tourism hub, the hospital's international patient base is increasingly vulnerable to regulatory changes, ongoing local infrastructure enhancements in source countries, and economic shocks. Strengthening healthcare capabilities across the GCC and Southeast Asia may significantly reduce outbound patient flows and diminish Bumrungrad's long-term revenue potential.

- Despite ongoing investment in advanced medical technology and prestigious global partnerships, capacity constraints at the flagship facility and a cost structure built to deliver high-end care could curtail profitability improvements. If revenue intensity and physical expansion lag, operating leverage may not materialize, restricting net earnings growth over time.

- While the expansion of Asia's middle class should expand the addressable market for private premium healthcare, rising competition from emerging medical tourism destinations and digital-first players introduces a risk of market share erosion, especially if Bumrungrad cannot sufficiently differentiate or flex its pricing power, potentially impacting future revenue and margin growth.

- Even as digital health initiatives and telemedicine platforms open broader regional opportunities, the risk remains that cross-border digital health could substitute for some traditional hospital visits, especially among younger, tech-savvy patients, gradually limiting volume growth and constraining incremental earnings upside over the long run.

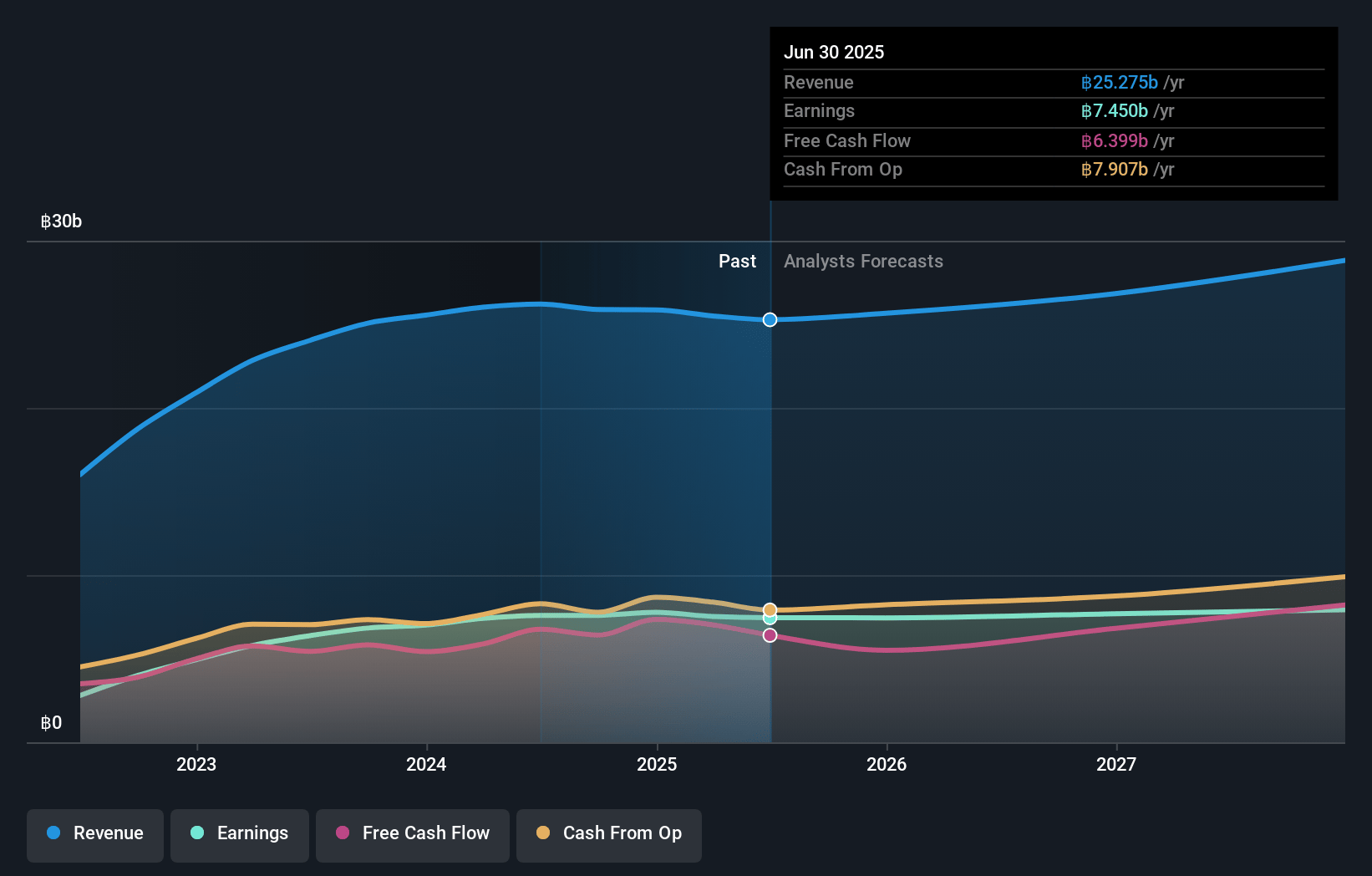

Bumrungrad Hospital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bumrungrad Hospital compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bumrungrad Hospital's revenue will grow by 2.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 29.5% today to 21.5% in 3 years time.

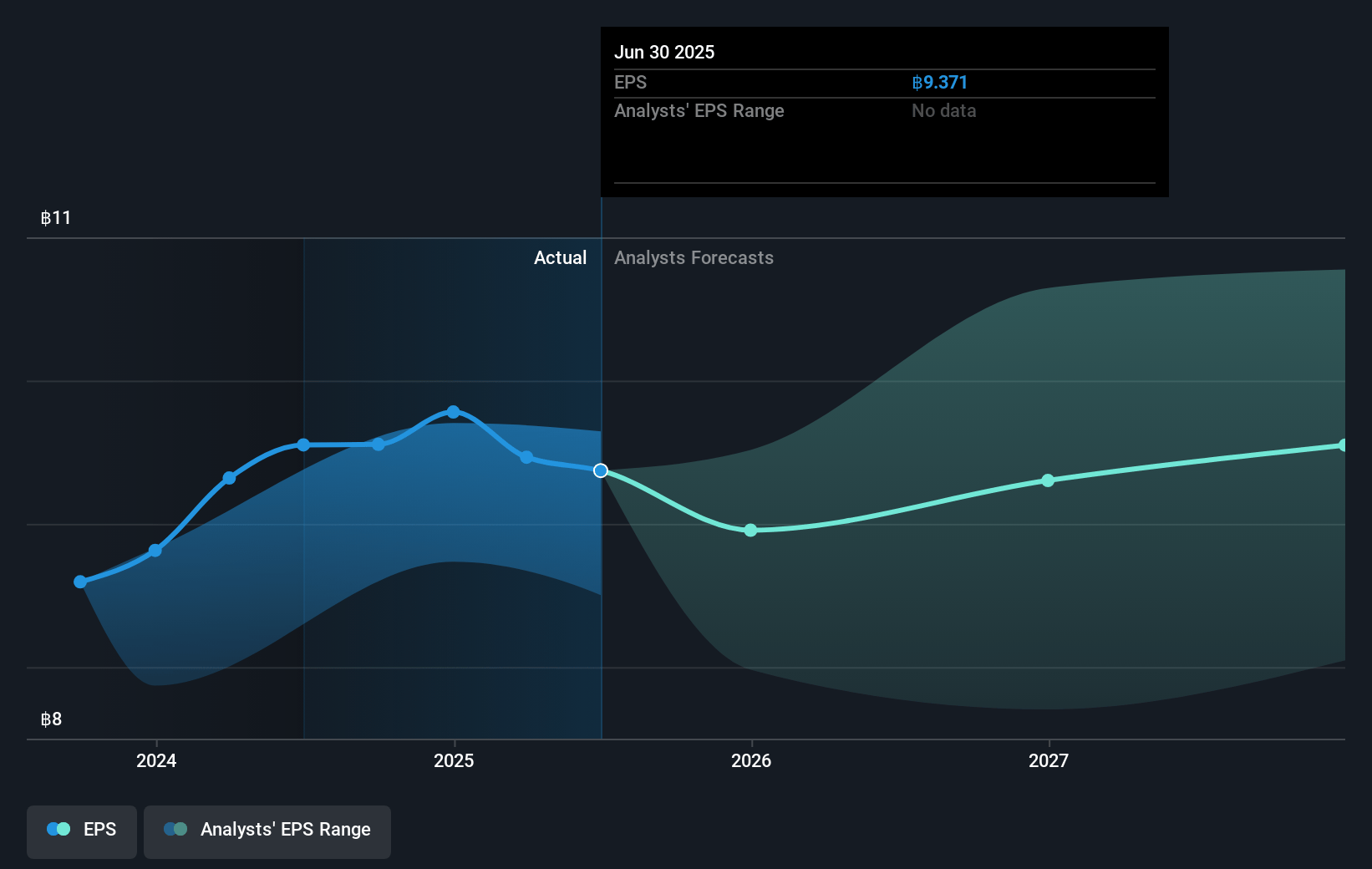

- The bearish analysts expect earnings to reach THB 5.9 billion (and earnings per share of THB 6.75) by about June 2028, down from THB 7.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.0x on those 2028 earnings, up from 14.2x today. This future PE is greater than the current PE for the TH Healthcare industry at 15.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.31%, as per the Simply Wall St company report.

Bumrungrad Hospital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on Middle Eastern patients-who comprised over half the company's revenue in previous quarters-poses a significant risk, as shown by the 30 percent quarterly revenue drop from this region due to shorter patient stays and reduced revenue intensity, which could drive further revenue volatility if outbound medical travel continues to decline.

- Improvements in healthcare infrastructure in the Middle East, such as the report that Kuwait is now treating almost all its own patients domestically, threaten Bumrungrad's international patient pipeline and may result in a long-term shrinking of its addressable market, ultimately depressing both revenue and earnings.

- Thailand's ongoing decrease in tourist arrivals from core source markets such as Mainland China-driven by safety concerns and negative travel incidents-has already led to an eleven percent drop in Chinese patient revenue, and prolonged weakness here would erode top-line growth and limit future earnings expansion.

- Despite cost controls, net profit margin and EBITDA margin shrank by almost thirteen percent in the latest quarter, suggesting that fixed cost pressures and heavy investment in new technologies could keep margins under stress if revenue growth does not recover, ultimately reducing profitability and earnings quality.

- Disruptions to inbound medical travel from regulatory changes, such as complicated visa and payment processes affecting Bangladeshi travelers, highlight the risk that policy shifts and rising barriers for foreign patients may continue to limit international patient volumes and lead to inconsistent or declining revenue performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bumrungrad Hospital is THB150.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bumrungrad Hospital's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of THB330.0, and the most bearish reporting a price target of just THB150.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be THB27.4 billion, earnings will come to THB5.9 billion, and it would be trading on a PE ratio of 25.0x, assuming you use a discount rate of 7.3%.

- Given the current share price of THB134.5, the bearish analyst price target of THB150.0 is 10.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.