Last Update 11 Dec 25

Fair value Increased 0.12%J69U: Distribution Visibility Will Support Future Upside Despite Slight Margin Softness

Narrative Update

Analysts have nudged their price target on Frasers Centrepoint Trust slightly higher to approximately S 2.60. This reflects modestly improved long term revenue growth expectations and a marginally lower discount rate, partially offset by a slightly softer profit margin outlook.

What's in the News

- Announced a distribution of 5.963 Singapore cents per unit for 4 April 2025 to 30 September 2025, comprising taxable, tax exempt and capital components (company announcement)

- Unitholders on record with The Central Depository as at 5.00pm on 3 November 2025 will be entitled to the distribution (company announcement)

- Distribution is scheduled to be paid on 28 November 2025 to eligible unitholders (company announcement)

Valuation Changes

- The Fair Value Estimate has risen slightly from about SGD 2.60 to about SGD 2.60, reflecting a minor upward adjustment in intrinsic valuation.

- The Discount Rate has fallen marginally from about 6.94 percent to about 6.92 percent, indicating a slightly lower required return in the valuation model.

- The Revenue Growth Assumption has improved from approximately minus 0.40 percent to approximately minus 0.16 percent, pointing to a less negative long-term growth outlook.

- The Net Profit Margin Assumption has edged down from about 58.34 percent to about 57.92 percent, indicating a slightly more conservative profitability view.

- The Future P/E Multiple remains broadly unchanged, nudging up from about 30.22 times to about 30.24 times, suggesting a stable valuation multiple expectation.

Key Takeaways

- Strong demand for suburban retail space and favorable demographics support high occupancy, stable rental income, and consistent earnings growth.

- Focus on necessity-driven malls, active asset enhancements, and disciplined capital management provide income resilience and opportunities for future expansion.

- Heavy reliance on Singapore malls, rising costs, e-commerce disruption, and tenant health concerns threaten earnings stability and long-term income growth.

Catalysts

About Frasers Centrepoint Trust- Frasers Centrepoint Trust (“FCT”) is a leading developer-sponsored retail real estate investment trust (“REIT”) and the largest suburban retail mall owner by net lettable area in Singapore with assets under management of approximately $7.1 billion.

- The ongoing tight supply of prime suburban retail space in Singapore, combined with strong demand and limited new completions over the next 3 years, is expected to support high occupancy rates and positive rental reversions, driving future revenue and earnings growth.

- Favorable demographic trends-specifically rising population and urbanisation in Singapore-are boosting consistent shopper footfall and tenant sales, which should underpin the durability of FCT's rental income and support stable or improving net margins.

- FCT's focus on necessity-driven suburban malls, with high exposure to supermarkets and F&B tenants, ensures steady recurring revenue streams and lowers income volatility, providing resilience and visibility for future net property income and margins.

- Proactive asset enhancement initiatives (AEIs), including completed and upcoming projects like Tampines 1 and Hougang Mall, are creating tangible value through higher rental rates and returns on investment (7-8% yield on recent AEIs), which will likely translate into earnings and NAV per unit growth.

- Continued capital management discipline and moderate gearing (targeting below 40%) position FCT to seize accretive acquisition opportunities as smaller landlords exit, potentially expanding its asset base and boosting distributable income and DPU.

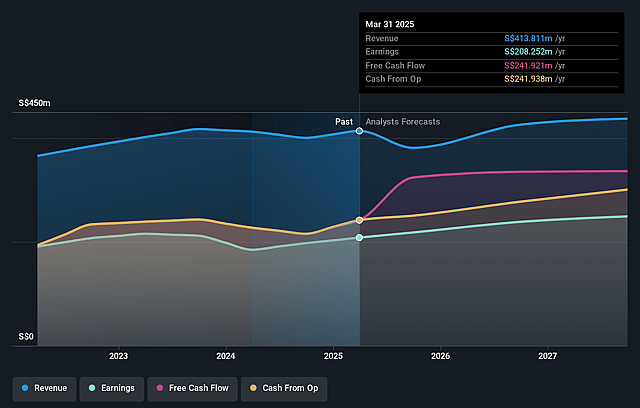

Frasers Centrepoint Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Frasers Centrepoint Trust's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 50.3% today to 55.3% in 3 years time.

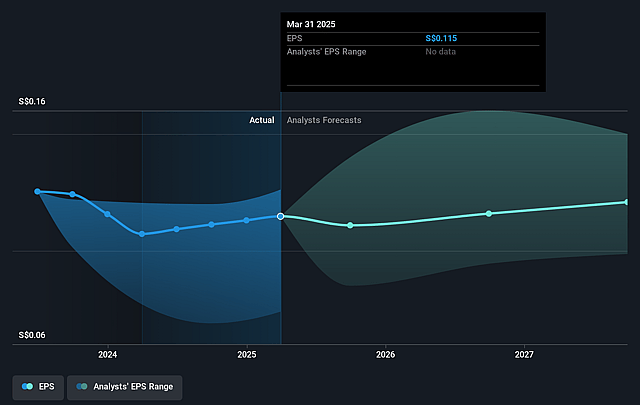

- Analysts expect earnings to reach SGD 253.7 million (and earnings per share of SGD 0.13) by about September 2028, up from SGD 208.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SGD317 million in earnings, and the most bearish expecting SGD221.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, up from 23.0x today. This future PE is greater than the current PE for the SG Retail REITs industry at 19.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.86%, as per the Simply Wall St company report.

Frasers Centrepoint Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- FCT's portfolio remains highly concentrated in Singapore's suburban retail malls, exposing the company to localised demographic shifts, competition, and economic shocks-posing a risk to long-term revenue stability and leading to potentially volatile earnings if Singapore retail fundamentals weaken.

- The ongoing structural shift toward e-commerce and online retail channels remains a significant secular trend, as evidenced by management's need to re-purpose cinema space and introduce new tenant concepts-indicating persistent risks to footfall, occupancy, and rental income growth over time.

- Asset enhancement initiatives (AEIs) and acquisitions require substantial capital expenditure and increase leverage (post-South Wing acquisition, gearing is at 40.4%); if execution is delayed, AEIs underperform, or market conditions turn, this could erode net margins and slow distributable income growth.

- Rising operating and maintenance costs-including those related to sustainability, technology upgrades, and inflation-could weigh on net property income and compress margins, especially if rental growth or cost pass-through lags sector-wide expense escalation.

- Retail tenant health, especially for categories like cinemas and SMEs facing arrears or structural decline, introduces risk of higher default rates and vacancy; if tenant churn persists or replacement tenants secure lower rents, revenue and net operating income will face long-term pressure.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SGD2.539 for Frasers Centrepoint Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SGD3.07, and the most bearish reporting a price target of just SGD2.15.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SGD459.0 million, earnings will come to SGD253.7 million, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 6.9%.

- Given the current share price of SGD2.36, the analyst price target of SGD2.54 is 7.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Frasers Centrepoint Trust?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.