Key Takeaways

- Historic margin expansion is likely, driven by improved costs, efficiency, premiumization, and innovation in both beer and non-alcoholic segments.

- Rapid ASEAN growth, regulatory easing, and digital transformation should boost revenue diversification, market share, and long-term earnings resilience.

- Weaker economic conditions, mounting competition, margin pressures, high leverage, and shifting consumer preferences threaten Thai Beverage's earnings, financial flexibility, and long-term demand for core products.

Catalysts

About Thai Beverage- Produces and distributes alcoholic and non-alcoholic beverages, and food products in Thailand, Vietnam, Malaysia, Myanmar, Singapore, and internationally.

- While analyst consensus expects improved raw material costs and operational efficiency to support profitability in the beer business, the steep, multi-quarter declines in malt and packaging costs already locked in by Thai Beverage could drive beer net margins to historic highs over the next 12-18 months, materially exceeding current expectations for earnings recovery.

- Analysts broadly agree that the integration of Fraser and Neave will deliver incremental revenue and synergy, but the accelerated execution of Thai Beverage's dairy and non-alcoholic expansion-particularly the AgriValley project ramping up quicker than anticipated and new premium product launches-could deliver a step-change in non-alcoholic revenue growth, enhancing overall group revenue and earnings diversification.

- The ongoing structural shift toward premiumization and innovative product launches in both spirits and beer, reinforced by recent successful rollouts of high-margin products like single malt whisky and ready-to-drink Sato, positions Thai Beverage to outpace peers on revenue per case and net margin expansion, even in challenging consumer environments.

- South East Asia's rapid urbanization and growing middle class, coupled with regulatory liberalization and ASEAN economic integration, is set to create a sustained multi-year tailwind for both volume and premium product growth, providing outsized opportunities for Thai Beverage to expand market share and boost revenue as barriers to cross-border trade fall.

- The group's persistent investment in digital transformation, advanced supply chain automation, and route-to-market upgrades is likely to drive a significant step-up in free cash flow generation, cost leadership, and operational leverage, directly supporting stronger long-run earnings growth and margin resilience than the market currently appreciates.

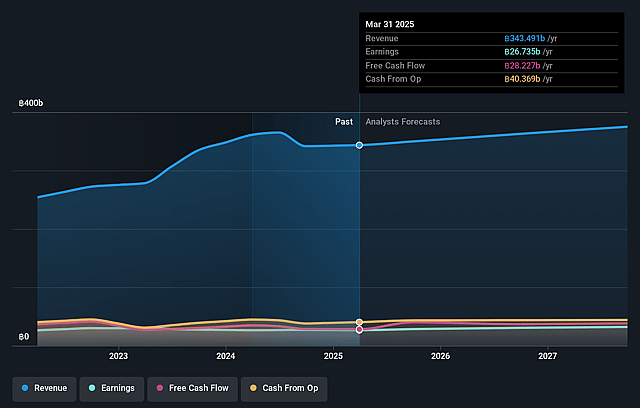

Thai Beverage Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Thai Beverage compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Thai Beverage's revenue will grow by 10.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.8% today to 9.8% in 3 years time.

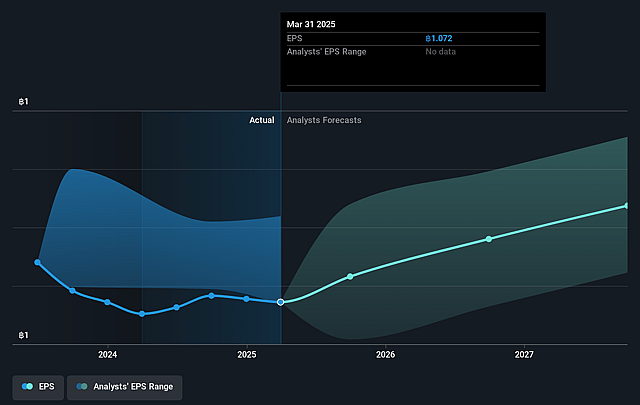

- The bullish analysts expect earnings to reach THB 45.7 billion (and earnings per share of THB 1.41) by about September 2028, up from THB 26.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, up from 10.8x today. This future PE is greater than the current PE for the SG Beverage industry at 10.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

Thai Beverage Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining consumer sentiment and weaker economic growth in Thailand and Vietnam are leading to slower growth or even declines in sales volumes for core categories like spirits, suggesting future pressure on overall revenues and earnings.

- Intensifying competition, particularly in Vietnam (with Sabeco losing beer market share to rivals such as Heineken), risks margin compression and muted top-line growth for Thai Beverage in its primary international market.

- Margin pressures are evident as higher raw material and input costs, increased marketing and brand investment, and expiration of tax incentives have led to shrinking segment net profits despite modest revenue growth, indicating possible continued downside for net margins and profitability.

- High leverage and a rising net debt-to-EBITDA ratio, driven by large-scale investments and ongoing expansion plans, may constrain the company's ability to invest for growth and limit future net income and financial flexibility.

- Structural demographic and secular shifts, such as rising health consciousness, anti-alcohol sentiment, and changing consumption trends toward low

- and no-alcohol alternatives, threaten long-term demand for Thai Beverage's traditional product portfolio and could erode revenues over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Thai Beverage is THB0.75, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Thai Beverage's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of THB0.75, and the most bearish reporting a price target of just THB0.46.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be THB465.7 billion, earnings will come to THB45.7 billion, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of THB0.46, the bullish analyst price target of THB0.75 is 38.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.