Last Update 13 Nov 25

Fair value Increased 1.48%S63: Dividend Proposals And Contract Wins Will Support Steady Performance

Analysts have raised their price target for Singapore Technologies Engineering from $8.70 to $8.83, citing modest improvements in projected revenue growth and profit margins as reasons for the adjustment.

What's in the News

- A special dividend of 5.0 cents per share has been proposed for the year 2025 (Key Developments).

- A final dividend increase to 6.0 cents per share has been proposed for fiscal year 2025 (Key Developments).

- The company secured $4.9 billion in new contracts during Q3 2025, bringing the total to $14 billion in contract wins for the first nine months of 2025 (Key Developments).

- Major contract wins cover the Commercial Aerospace, Defence & Public Security, and Urban Solutions & Satcom sectors, reflecting growing global demand and customer confidence (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from SGD 8.70 to SGD 8.83.

- Discount Rate has fallen modestly from 7.00% to 6.78%.

- Revenue Growth expectations have increased marginally from 8.95% to 8.99%.

- Net Profit Margin forecast has edged up from 8.15% to 8.19%.

- Future P/E ratio has moved slightly higher from 27.23x to 27.30x.

Key Takeaways

- Strong order book and strategic investments enhance revenue visibility, operational capabilities, and margins, supporting long-term growth.

- Defense segment growth driven by geopolitical tensions and international expansions boost revenue and competitiveness.

- Geopolitical tensions boost defense revenue, while supply chain issues and U.S. tariffs challenge aerospace, and Satcom transformation poses risks to profitability and dividends.

Catalysts

About Singapore Technologies Engineering- Operates as a technology, defence, and engineering company worldwide.

- The company has a robust order book of $28.5 billion, providing significant revenue visibility with $8.8 billion expected for delivery in 2025, suggesting strong future revenue prospects.

- Strategic investments in new airframe MRO capacities and other facilities are expected to enhance operational capabilities and efficiency, which could lead to improved margins and earnings.

- The company’s focus on cost management and productivity enhancements has resulted in the lowest operation expenses as a percentage of revenue in recent years, potentially boosting net margins.

- The Defense and Public Security segment is experiencing robust growth partly due to heightened geopolitical tensions, which is expected to continue contributing significantly to revenue and EBIT.

- The company’s ongoing expansion into international markets, such as 155 mm ammunition export to Europe and partnerships in Kazakhstan, is likely to support revenue growth and improve global market competitiveness.

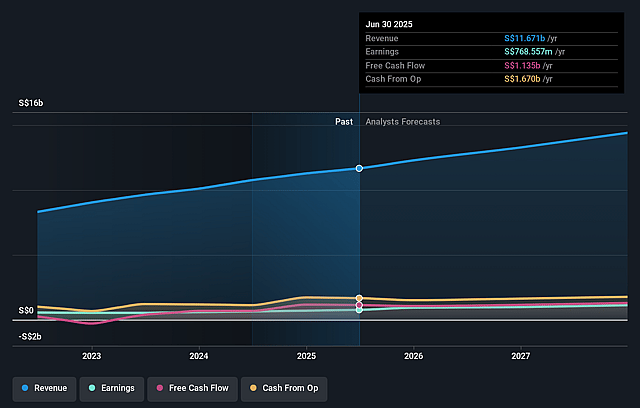

Singapore Technologies Engineering Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Singapore Technologies Engineering's revenue will grow by 8.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.6% today to 8.1% in 3 years time.

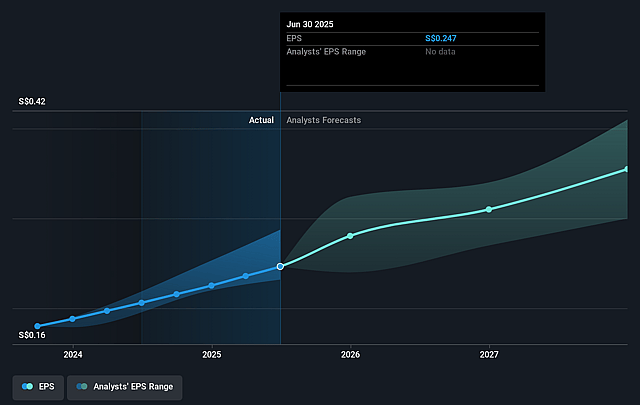

- Analysts expect earnings to reach SGD 1.2 billion (and earnings per share of SGD 0.41) by about September 2028, up from SGD 768.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SGD1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2028 earnings, down from 32.0x today. This future PE is lower than the current PE for the SG Aerospace & Defense industry at 30.4x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.0%, as per the Simply Wall St company report.

Singapore Technologies Engineering Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The success of ST Engineering's defense segment is partly due to geopolitical tensions and conflicts, which are unpredictable and could stabilize or shift, potentially impacting future revenue and net margins from defense contracts.

- The group's significant reliance on the commercial aerospace segment, with 39% of revenue coming from this area, could be affected by ongoing supply chain issues, such as shortages of aircraft feedstock for PTF work, impacting revenue growth and net margins.

- The transformation of the Satcom business, while showing early signs of recovery, is not yet complete, posing a risk to consistent revenue contributions and overall profitability if recovery efforts are insufficient or delayed.

- The potential impact of U.S. tariffs on ST Engineering's commercial aerospace operations could increase costs or disrupt operations, affecting net profit margins negatively if not mitigated through strategic measures.

- Future dividend payouts are dependent on consistent profit growth and efficient capital management. If growth targets are not met or if there are large, unforeseen expenditures, dividend payments could be affected, reducing returns for shareholders.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SGD8.704 for Singapore Technologies Engineering based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SGD10.5, and the most bearish reporting a price target of just SGD7.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SGD15.1 billion, earnings will come to SGD1.2 billion, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 7.0%.

- Given the current share price of SGD7.88, the analyst price target of SGD8.7 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.