Narratives are currently in beta

Key Takeaways

- Sustained loan growth and increased AUM boost potential revenue through loan interest and wealth management income, enhancing overall earnings.

- Strategic digitalization and innovative products drive customer growth and deposit volumes, improving net interest margins and supporting earnings growth.

- Narrow net interest margins, struggling Hong Kong real estate exposure, and geopolitical risks could pressure earnings and asset quality, with strategic capital allocations impacting dividends.

Catalysts

About Oversea-Chinese Banking- Engages in the provision of financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

- Sustained loan growth and the expansion of the sustainable financing loan volume indicate future increases in revenue, as it supports growth in higher demand sectors, including technology and new energy, thereby boosting loan interest income.

- Increased Assets Under Management (AUM), driven by net new money inflows and improved market valuations, suggests future growth in wealth management fee income and trading income, hence positively impacting noninterest income and overall earnings.

- The bank’s strategic investment in digitalization initiatives and the launch of innovative products like OCBC MyOwn Account for teenagers are poised to drive future growth in customer base and deposit volumes, translating into higher revenue from digital banking services and lower funding costs, improving net interest margins.

- The implementation of global minimum corporate tax is expected to have minimal impact on OCBC due to its current effective tax rate being close to 15%. This stability allows continued reinvestment into growth areas without significant profit erosion, supporting future earnings growth.

- Potential strategic capital deployment for acquisitions, such as PT Bank Commonwealth, and efficiency in capital management reflect a forward-looking approach to growth through inorganic means, potentially raising shareholder returns, contributing to earnings growth.

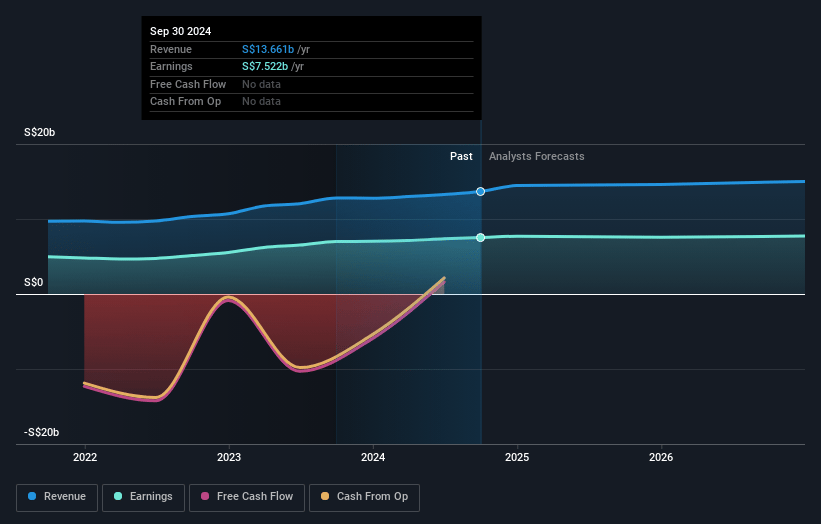

Oversea-Chinese Banking Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oversea-Chinese Banking's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 55.1% today to 51.6% in 3 years time.

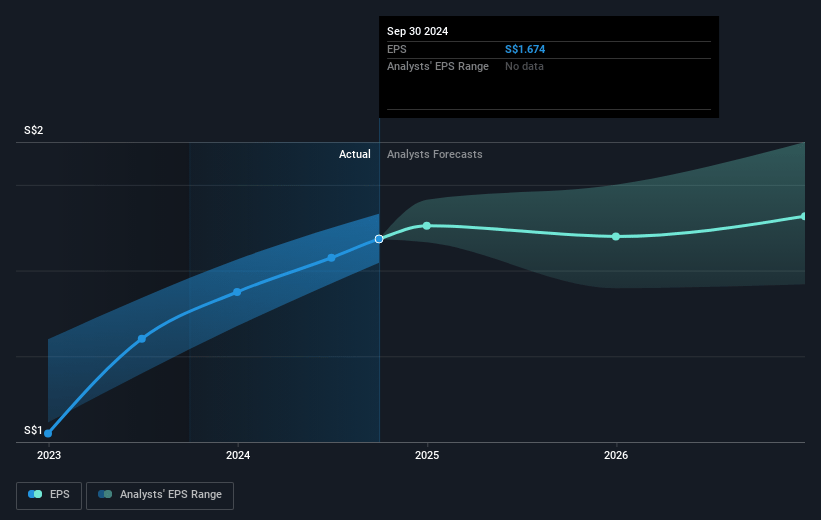

- Analysts expect earnings to reach SGD 7.9 billion (and earnings per share of SGD 1.75) by about January 2028, up from SGD 7.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SGD7.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the SG Banks industry at 10.6x.

- Analysts expect the number of shares outstanding to grow by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.95%, as per the Simply Wall St company report.

Oversea-Chinese Banking Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The narrow net interest margin (NIM) of 2.2% for 2024, largely due to declining interest rates and increasing funding costs, could pressure earnings if interest rates fall faster or more significantly than expected.

- The exposure to the weak Hong Kong real estate market and specific non-performing assets (NPAs) in the region could affect asset quality, leading to higher provisions and impacting net margins.

- A significant amount of capital is earmarked for potential acquisitions, strategic investments, and maintaining a minimum CET1 ratio, which might limit funds available for direct shareholder returns like share buybacks or increased dividends, potentially affecting investor sentiment and earnings per share.

- The potential impact of the global minimum corporate tax rate, starting January 2025, might increase OCBC's tax obligations, thereby reducing net profit margins, particularly in its operations in low-tax regions.

- An environment of geopolitical uncertainty, heightened by U.S. policy changes and ongoing international conflicts, could disrupt market conditions and economic stability in the ASEAN region, negatively impacting revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SGD17.82 for Oversea-Chinese Banking based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SGD20.8, and the most bearish reporting a price target of just SGD15.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SGD15.3 billion, earnings will come to SGD7.9 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 6.0%.

- Given the current share price of SGD17.04, the analyst's price target of SGD17.82 is 4.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives