Last Update01 May 25Fair value Decreased 0.29%

Key Takeaways

- Strategic acquisitions and greenfield projects are enhancing margins and strengthening long-term earnings through attractive valuations and robust returns.

- Strong liquidity and favorable market conditions position Orrön Energy for significant revenue and earnings growth amid recovering electricity prices.

- Continued low energy prices, production disruptions, legal challenges, and project approval delays pose significant risks to Orrön Energy's revenue and growth prospects.

Catalysts

About Orrön Energy- Operates as an independent renewable energy company in the Nordics, the United Kingdom, Germany, and France.

- Orrön Energy is focusing on organic growth through a significant greenfield project pipeline, including plans for monetization within the next 6 to 12 months, which is expected to greatly enhance revenue and earnings potential.

- Current acquisitions of operating assets in the Nordics are being made at attractive valuations, resulting in double-digit rates of return, anticipated to improve net margins and strengthen long-term earnings.

- The development of large-scale projects in the U.K. and Germany provides opportunities for future revenue growth as these projects progress towards permitting and eventual sales.

- The company maintains a strong liquidity position with a total available liquidity of €116 million, providing flexibility to capitalize on future growth opportunities without financial constraints, thereby supporting both revenue growth and earnings stability.

- Future market conditions indicate a recovery in electricity prices, with Q1 pricing already showing strong indications, likely to positively impact revenue and EBITDA through improved pricing and higher production volumes in the forthcoming quarters.

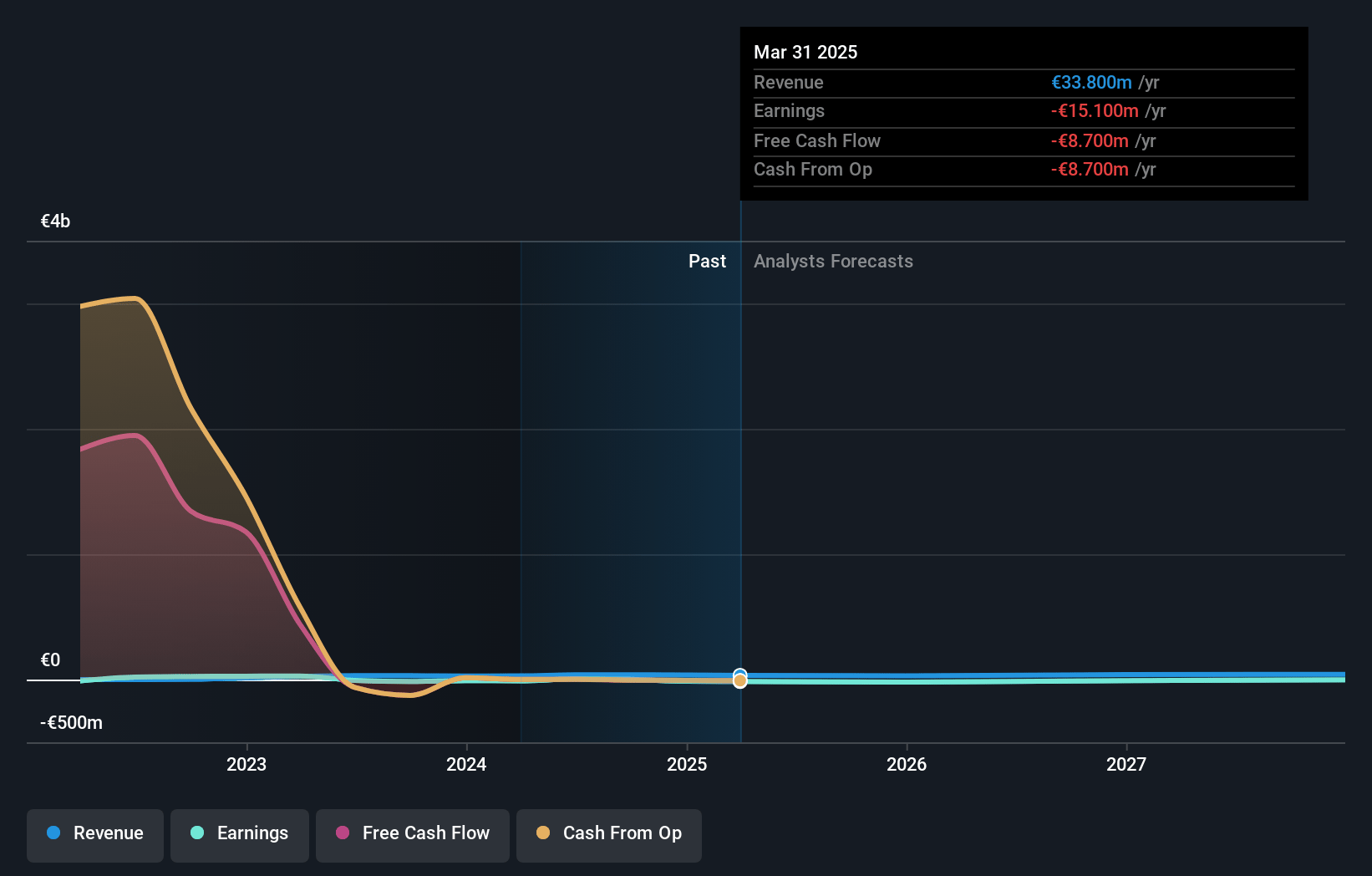

Orrön Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Orrön Energy's revenue will grow by 4.3% annually over the next 3 years.

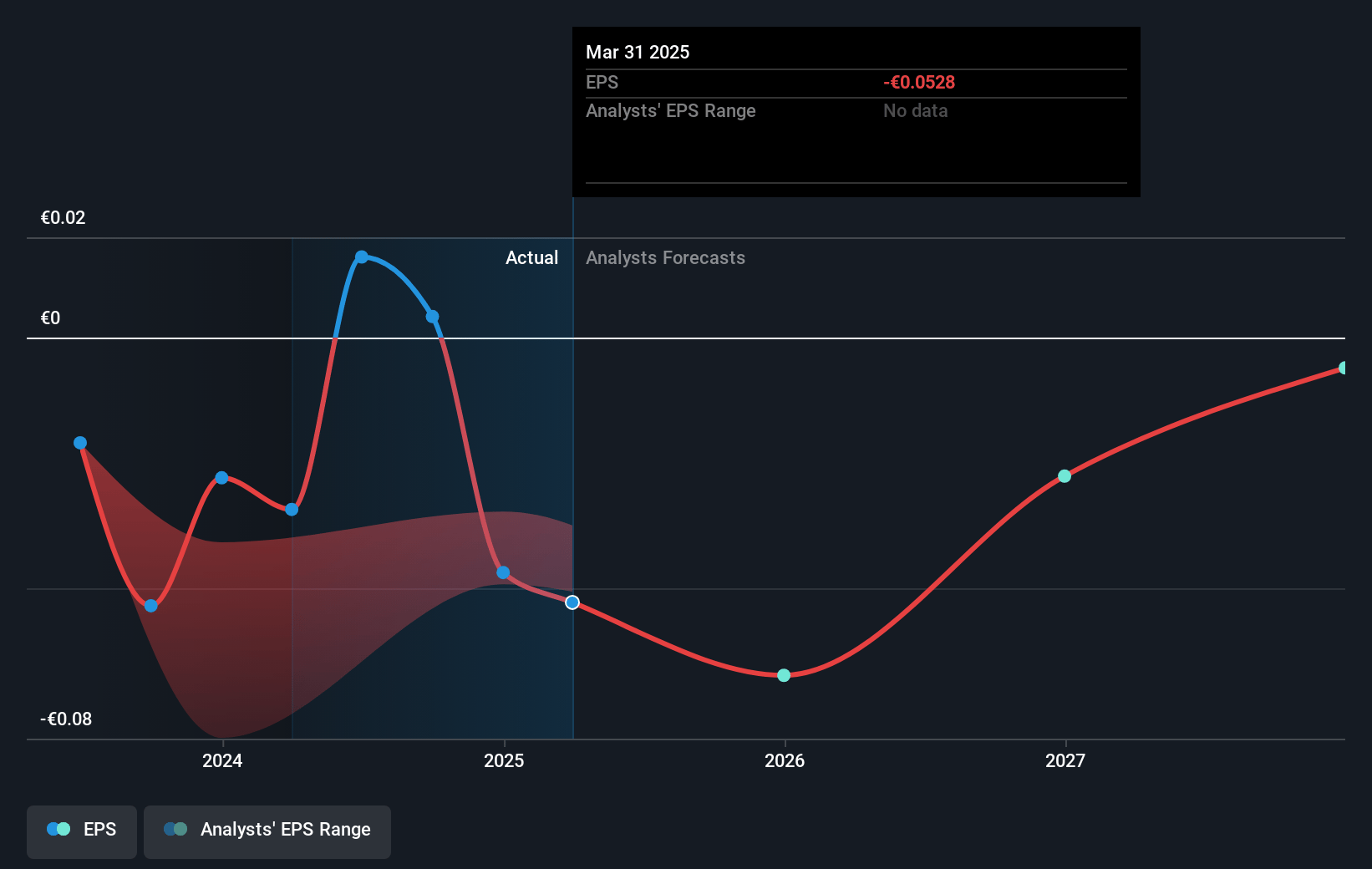

- Analysts are not forecasting that Orrön Energy will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Orrön Energy's profit margin will increase from -36.5% to the average GB Renewable Energy industry of 28.6% in 3 years.

- If Orrön Energy's profit margin were to converge on the industry average, you could expect earnings to reach €11.9 million (and earnings per share of €0.04) by about May 2028, up from €-13.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, up from -9.4x today. This future PE is greater than the current PE for the GB Renewable Energy industry at 8.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.6%, as per the Simply Wall St company report.

Orrön Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent low energy prices in the Nordics, especially during Q3 when prices were as low as €20 per megawatt hour, could continue to impact Orrön Energy's revenues negatively if such conditions persist or worsen.

- Weather conditions and voluntary curtailments have already resulted in a 10% drop in expected annual production, demonstrating vulnerability to factors that could continue to affect power generation and consequently lower revenues and profits.

- The ongoing Sudan legal case and associated costs add significant financial burden until its expected conclusion in early 2026, impacting net margins if operating costs and legal expenses are not effectively managed.

- Challenges in the approval process for new onshore wind projects in Sweden, combined with halted offshore developments, may limit future earnings growth opportunities and impact the pace of project pipeline monetization.

- The potential need for price hedging discussions and the risks of unfavorable interest rate changes could affect cost management strategies and ultimately impact Orrön Energy's net earnings if energy prices remain unpredictable.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK7.494 for Orrön Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK10.11, and the most bearish reporting a price target of just SEK4.88.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €41.6 million, earnings will come to €11.9 million, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 5.6%.

- Given the current share price of SEK4.83, the analyst price target of SEK7.49 is 35.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.