Last Update 13 Dec 25

MYCR: Expanding Asian Orders Will Support Steady Earnings And Balanced Prospects

Analysts have nudged their price target for Mycronic slightly higher to approximately SEK 219 per share, reflecting modestly increased discount rate and future P E assumptions, while maintaining a generally stable view on long term revenue growth and profitability.

What's in the News

- Mycronic secured a new Asian customer for its SLX semiconductor mask writer, an energy efficient system with an order value between USD 5 million and 7 million, with revenue recognized in the current quarter (company announcement).

- The company reaffirmed its 2025 sales guidance, maintaining the board’s view that net sales will reach approximately SEK 7.5 billion (corporate guidance).

- An existing Asian customer placed an additional SLX mask writer order worth USD 5 million to 7 million, scheduled for delivery in the second quarter of 2026 to support rising photomask demand (company announcement).

- Mycronic received a separate SLX mask writer order from an existing Asian customer valued at USD 3 million to 5 million, with net sales to be recognized in the current quarter (company announcement).

- An existing Asian customer ordered three high value display mask writers: one Prexision 8 Evo and two Prexision Lite 8 Evo systems, totaling an estimated USD 48 million to 52 million, with deliveries spread from the second quarter of 2026 to the first quarter of 2027 (company announcement).

Valuation Changes

- Fair Value Estimate: Unchanged at approximately SEK 219 per share, indicating a stable assessment of Mycronic’s intrinsic value.

- Discount Rate: Risen slightly from about 6.38 percent to 6.41 percent, implying a modestly higher required return on equity.

- Revenue Growth: Essentially unchanged at around 3.05 percent annually, reflecting a steady outlook for long term top line expansion.

- Net Profit Margin: Fallen slightly from roughly 21.87 percent to 21.69 percent, suggesting a marginally more conservative profitability assumption.

- Future P E: Risen slightly from about 26.6 times to 26.9 times, pointing to a modestly higher valuation multiple applied to expected earnings.

Key Takeaways

- Mycronic's acquisitions and new technology launches are bolstering revenue and market position, particularly in the Global Technologies and display industries.

- Strategic geographic expansion and increased R&D investments indicate potential for long-term revenue growth and market diversification.

- The combination of tariffs, demand weakness, and currency fluctuations is leading to declining revenues and earnings instability in Mycronic's High Flex division.

Catalysts

About Mycronic- Develops, manufactures, and sells production equipment for electronics industry in Sweden, rest of Europe, the United States, other Americas, China, South Korea, rest of Asia, and internationally.

- Mycronic's recent acquisitions, such as Hprobe and RoBAT, are expected to expand its offerings in the Global Technologies division with unique technologies for testing MRAM and PCBs, potentially leading to increased revenue and strengthened market position.

- The successful launch of the Prexision 8000 Evo, a high-end machine for mask writing in the display industry, confirms alignment with industry needs, and its reception may drive future order volumes, positively impacting revenue and earnings.

- Strong growth in the company's High Volume division, particularly in the Chinese domestic market, suggests potential for increased sales and revenue growth, supported by a robust order backlog.

- Continued expansion into new regions, like Southeast Asia, for High Volume production indicates strategic geographic diversification, which may enhance revenue stability and long-term growth prospects.

- Increased R&D investments in Pattern Generators, with a focus on new product development and market opportunities such as inspection and quality control, could support long-term revenue growth and competitive positioning.

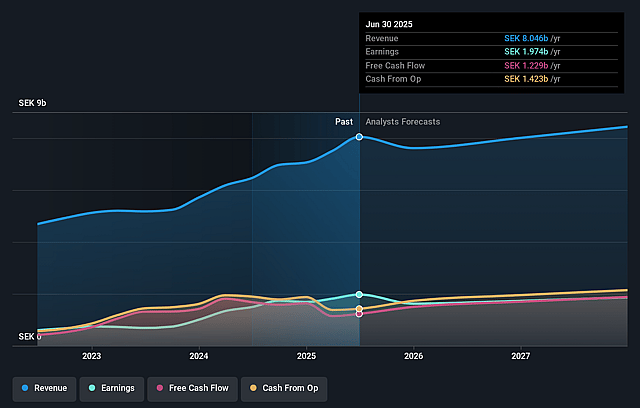

Mycronic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mycronic's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.5% today to 21.2% in 3 years time.

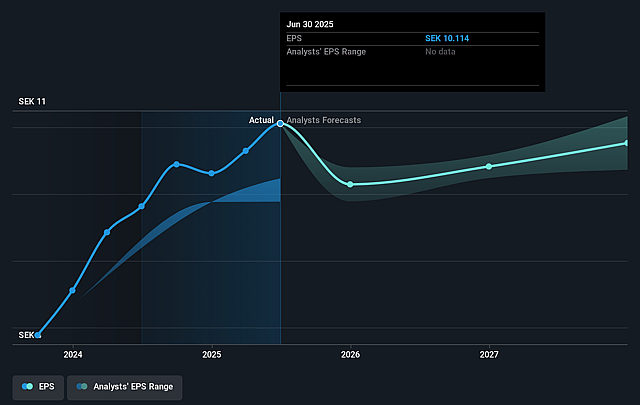

- Analysts expect earnings to reach SEK 1.8 billion (and earnings per share of SEK 9.53) by about August 2028, down from SEK 2.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as SEK2.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.2x on those 2028 earnings, up from 21.1x today. This future PE is greater than the current PE for the GB Electronic industry at 29.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.12%, as per the Simply Wall St company report.

Mycronic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of new tariffs in the U.S. has caused delays in deliveries within the High Flex division, negatively impacting quarterly earnings by SEK 15 million and potentially affecting future revenues due to hesitation in investments.

- There is noted weakness in demand within the High Flex division, particularly in Europe, leading to a decrease in order intake by 12% and negatively impacting net sales and earnings.

- The financial outlook is uncertain due to fluctuations in exchange rates and the potential indirect effects of tariffs, which could lead to lower projected sales and impact both revenue and net margins.

- Uncertainty in the investment climate and potential hesitation to invest due to market conditions and currency fluctuations could lead to volatility in order intake and revenues, especially in divisions with shorter lead times like High Flex.

- Dependency on a limited number of customers in some divisions, such as Die Bonding in the Global Technologies division, can lead to fluctuating order intake, impacting revenue stability and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK229.5 for Mycronic based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK8.4 billion, earnings will come to SEK1.8 billion, and it would be trading on a PE ratio of 30.2x, assuming you use a discount rate of 6.1%.

- Given the current share price of SEK213.15, the analyst price target of SEK229.5 is 7.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Mycronic?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.