Catalysts

About Mycronic

Mycronic develops and supplies advanced production equipment and aftermarket solutions for the global electronics and semiconductor industries.

What are the underlying business or industry changes driving this perspective?

- Robust long term demand for advanced displays, semiconductors and increasingly complex OLED and AMOLED panels supports a deep Pattern Generators backlog and aftermarket pipeline, which underpins sustained high revenue growth and structurally strong EBIT margins.

- Rising complexity in AI, data center and high end PCB applications is driving strong momentum in PCB test solutions, and this is positioning Global Technologies to capture higher value orders, mix improvement and expanding divisional margins.

- Resurgent innovation cycles in consumer electronics and China led high volume electronics production, where Mycronic holds leading share, are anticipated to drive continued order growth and better capacity utilization, which in turn supports top line expansion and operating leverage.

- Strategic acquisitions such as Surfx and Cowin add differentiated plasma and repair technologies and broaden the addressable market into high growth semiconductor and advanced packaging applications, which enhances both revenue potential and long term earnings power.

- Expanding the global footprint and production capacity, combined with a growing base of service contracts and upgrades, increases recurring aftermarket revenue and scales fixed costs more efficiently, which supports cash flow generation and higher net margins over time.

Assumptions

This narrative explores a more optimistic perspective on Mycronic compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

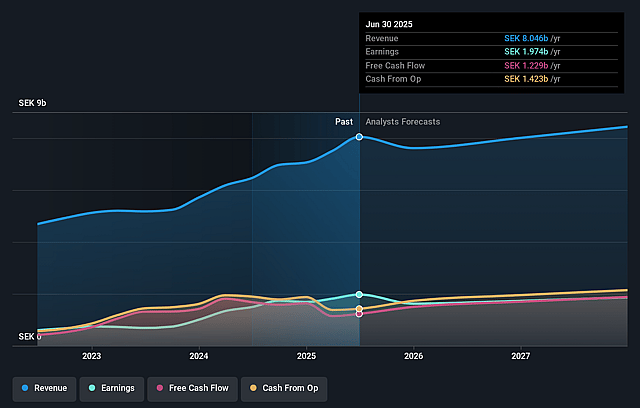

- The bullish analysts are assuming Mycronic's revenue will grow by 3.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 21.9% today to 23.9% in 3 years time.

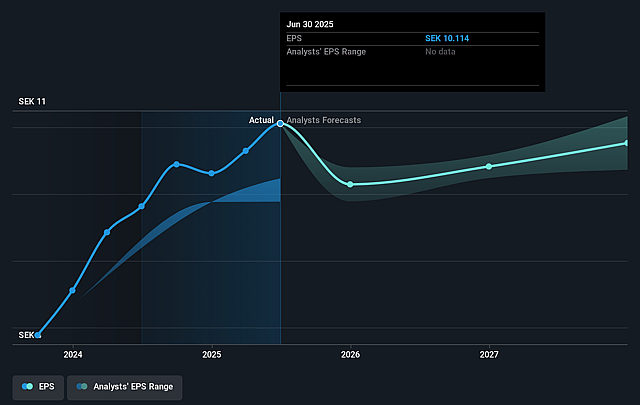

- The bullish analysts expect earnings to reach SEK 2.1 billion (and earnings per share of SEK 10.84) by about December 2028, up from SEK 1.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK1.8 billion.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.1x on those 2028 earnings, up from 24.5x today. This future PE is greater than the current PE for the GB Electronic industry at 26.3x.

- The bullish analysts expect the number of shares outstanding to decline by 0.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.41%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- A prolonged period with few or no new Pattern Generators system orders, like the quarter with zero PG system orders and an 84% decline in PG order intake to SEK 191 million, would eventually erode the currently strong backlog of SEK 2.3 billion and 19 systems, limiting future revenue growth and putting pressure on earnings.

- Weak and uncertain demand in PCB Assembly Solutions, particularly in Europe and the U.S. where investment appetite is being held back by tariffs and macro uncertainty, could persist longer than expected, capping divisional net sales and keeping EBIT margins around the low mid single digits, which would drag on group margins.

- The strategy of accelerated M&A in Global Technologies and Pattern Generators, including high price tags like the Surfx acquisition and Cowin’s historically volatile and underperforming display panel business, could fail to scale as planned, keeping acquired units loss making or only marginally profitable and diluting group EBIT margins from the current 27 to 30% range.

- Rising structural costs from higher R&D spending, expansion of the global footprint, capacity investments and integration expenses for multiple acquisitions increase the fixed cost base. If the high volume and AI or data center driven PCB test demand normalizes, the operating leverage could turn negative and compress net margins and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Mycronic is SEK255.0, which represents up to two standard deviations above the consensus price target of SEK218.67. This valuation is based on what can be assumed as the expectations of Mycronic's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK255.0, and the most bearish reporting a price target of just SEK161.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be SEK8.9 billion, earnings will come to SEK2.1 billion, and it would be trading on a PE ratio of 28.1x, assuming you use a discount rate of 6.4%.

- Given the current share price of SEK218.7, the analyst price target of SEK255.0 is 14.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Mycronic?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.