Last Update 14 Oct 25

Fair value Decreased 3.10%Electrification And Energy Efficiency Will Fuel European Market Expansion

Analysts have lowered their fair value estimate for Lagercrantz Group from SEK 253 to SEK 245.17, citing modest adjustments to revenue growth assumptions and a slightly higher discount rate in their updated outlook.

Valuation Changes

- Fair Value: Decreased from SEK 253 to SEK 245.17. This reflects a modest downward adjustment.

- Discount Rate: Increased slightly from 6.34% to 6.49%.

- Revenue Growth: Lowered marginally from 10.48% to 10.36%.

- Net Profit Margin: Decreased slightly from 11.50% to 11.47%.

- Future P/E: Reduced from 42.05x to 41.18x.

Key Takeaways

- Focus on proprietary, high-value products and niche M&A drives superior margins, earnings quality, and resilient growth compared to more commoditized peers.

- Diversification across critical infrastructure, international markets, and digitalization trends mitigates risk and underpins sustained demand and recurring revenues.

- Heavy reliance on acquisitions, uneven organic growth, geopolitical volatility, innovation risks, and growing competition threaten margins, earnings stability, and balance sheet strength.

Catalysts

About Lagercrantz Group- Operates as a technology company in Sweden, Denmark, Norway, Finland, Germany, the United Kingdom, Benelux, Poland, rest of Europe, North America, Asia, and internationally.

- Lagercrantz's exposure to critical infrastructure, electrification, and energy efficiency-areas experiencing persistent investment tailwinds across Europe-supports continued robust demand for its Electrify division and proprietary products. This is likely to support above-average organic revenue growth and improved net margins due to higher value-add.

- The group's ongoing focus on building out proprietary, specialized, and exportable products (targeting 85% of revenues from such products) is expected to enhance pricing power and sustain higher margins versus more commoditized peers, with a medium-term impact on both margin expansion and earnings quality.

- Continued high pace of value-accretive M&A, taking advantage of subdued competition for targets in uncertain markets, is expected to drive inorganic revenue and EBITDA growth while successfully integrating companies in high-margin niches supports bottom-line growth and future EPS expansion.

- Expansion of the group's international presence outside the Nordics and into export markets-particularly in infrastructure, smart automation, and connectivity solutions-will diversify revenue streams, reduce market risk, and support long-term topline expansion.

- Investments in digitalization, automation, and IoT across industry verticals are accelerating, and Lagercrantz's niche positioning in these segments is well-aligned to benefit from these macro trends, supporting sustained demand and recurring revenue growth over the next several years.

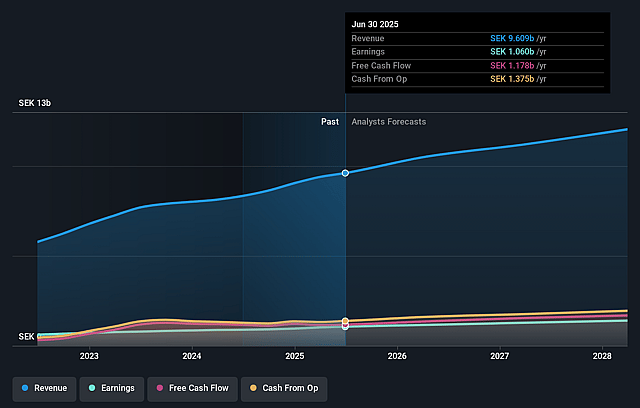

Lagercrantz Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lagercrantz Group's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.0% today to 11.5% in 3 years time.

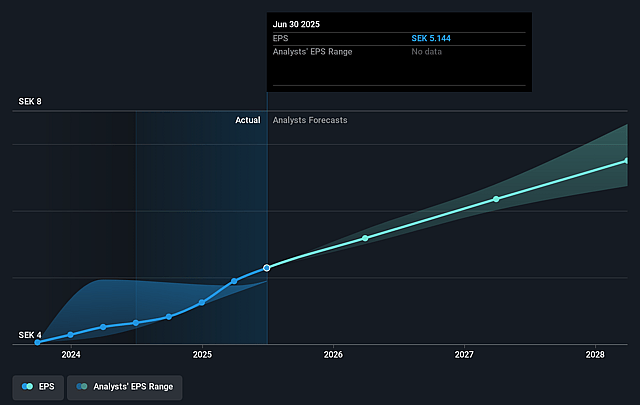

- Analysts expect earnings to reach SEK 1.5 billion (and earnings per share of SEK 6.61) by about September 2028, up from SEK 1.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.1x on those 2028 earnings, up from 41.8x today. This future PE is greater than the current PE for the GB Electronic industry at 27.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.34%, as per the Simply Wall St company report.

Lagercrantz Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on ongoing acquisitions to fuel growth increases integration risks and the potential for goodwill impairments, which could depress reported net income and elevate balance sheet risks if newly acquired businesses underperform.

- Organic growth is increasingly mixed, with segments like TecSec and construction-related businesses seeing declining revenues and sluggish demand, indicating possible stagnation in key mature areas and the risk of lower overall group-level organic revenue growth if R&D/execution in new niches falters.

- Persistent geopolitical uncertainty and market hesitation, cited as creating slower recovery and ongoing demand variance across segments and regions, could introduce volatility, delay orders, or raise input costs, directly impacting both revenue growth and net margins.

- Increased dependence on proprietary products (with a new target of 85%) may expose the company to accelerated rates of technological change and obsolescence risk; failure to keep pace with innovation could result in higher R&D costs and inventory write-downs, affecting net earnings.

- Intensifying competition-including from larger international players and potential industry consolidation-could erode pricing power in Lagercrantz's niches, leading to margin pressure and potential earnings volatility if customers or suppliers gain disproportionate bargaining power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK253.0 for Lagercrantz Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK305.0, and the most bearish reporting a price target of just SEK224.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK13.0 billion, earnings will come to SEK1.5 billion, and it would be trading on a PE ratio of 42.1x, assuming you use a discount rate of 6.3%.

- Given the current share price of SEK215.2, the analyst price target of SEK253.0 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.