Key Takeaways

- Strategic AI investments and workflow automation are driving ARR growth, client attraction, and efficiency, improving revenue and net margins.

- Robust subscription model and operational focus ensure revenue stability, cash flow positivity, and sustainable growth, enhancing investor confidence and potential valuation.

- Strategic pivot to AI amidst declining net sales and decreased EBITDA margin heightens earnings uncertainty, compounded by unclear AI pricing reception and unaddressed macroeconomic risks.

Catalysts

About Upsales Technology- Operates as a software-as-a-service company that develops and sells web-based business systems with a focus on sales, marketing, and analysis in Sweden and internationally.

- Upsales is strategically investing in AI to enhance its platform, positioning itself ahead of competitors by integrating AI throughout the entire product rather than as an add-on. This forward-looking strategy is likely to drive future ARR growth as more clients adopt the advanced AI features, impacting revenue positively.

- The release of AI agents that automate complex workflows, such as sales and finance tasks, is expected to attract new clients and increase the commitment from existing clients, driving further ARR growth and improving net margins through cost savings and efficiency gains.

- Upsales has a robust recurring revenue model, with over 95% of its revenue from subscriptions, which offers stability and predictability in revenues, and the expected switch to a more inclusive pricing model with AI features could further optimize their revenue streams.

- The AI initiatives are positioned to deliver high ROI for customers by leveraging best-in-class data and seamless integrations, which can lead to upselling opportunities and an expansion of Upsales' target market, positively affecting future earnings.

- Despite a macroeconomic environment that remains challenging, Upsales' operational focus on maintaining positive cash flows, zero debt, and a scalable business model positions the company for sustainable growth and resilience, potentially leading to increased investor confidence and future valuation uplift.

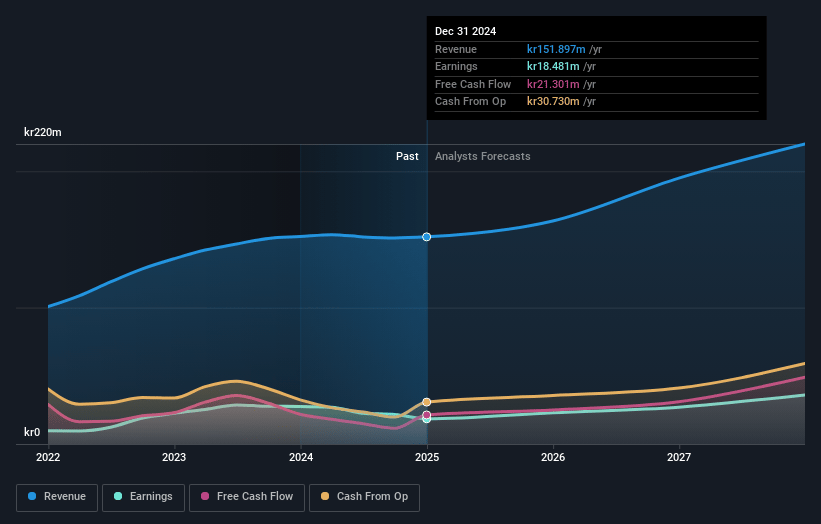

Upsales Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Upsales Technology's revenue will grow by 15.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.7% today to 16.1% in 3 years time.

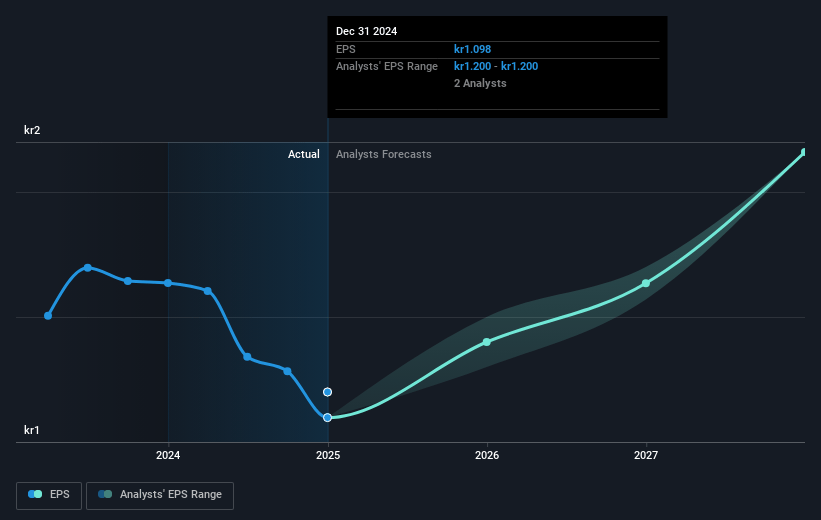

- Analysts expect earnings to reach SEK 37.1 million (and earnings per share of SEK 2.03) by about May 2028, up from SEK 16.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 31.6x today. This future PE is lower than the current PE for the SE Software industry at 33.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.19%, as per the Simply Wall St company report.

Upsales Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reported 6.5% ARR year-on-year growth is relatively modest, and net sales actually decreased compared to the previous year, which may indicate challenges in revenue growth and raising concerns about future revenue performance.

- The company's EBITDA margin decreased from 20% to 17.5% year-on-year, suggesting increased expenses or challenges in maintaining profitability, which could impact net margins.

- There is mention of increased CapEx linked to the AI project, indicating higher current investment costs, which might affect short-term earnings and cash flow.

- Upsales is undergoing a strategic pivot towards AI with no clear information on how their new AI pricing model will be received by the market, creating uncertainty about future revenue streams.

- Despite macroeconomic uncertainties that could influence their clients and sales environment, no specific strategies for mitigating these risks were mentioned, potentially affecting future revenue and overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK42.75 for Upsales Technology based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK229.9 million, earnings will come to SEK37.1 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 6.2%.

- Given the current share price of SEK30.5, the analyst price target of SEK42.75 is 28.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.