Last Update 01 May 25

Fair value Increased 0.73%Digital Transformation And Hexagon Partnership Will Unlock Future Potential

Key Takeaways

- Strategic focus on automation, AI, and cybersecurity for defense and industrial sectors enhances margin potential and supports recurring contract growth.

- Integration of acquisitions and partnerships drives operational efficiency, market expansion, and sustained profitability despite talent scarcity.

- Structural inefficiencies, heavy regional concentration, and rising competition threaten margins and growth, while talent shortages and slower client investment decisions undermine profitability and scalability.

Catalysts

About Prevas- Provides technical consultancy services in Sweden, Denmark, Finland, and internationally.

- Increasing demand for digital transformation and automation in the energy and defense sectors, shown by rising turnover shares (defense: 15% in H1 2025 vs 12% prior; energy: 12% vs 9.5%) and strong order intake, suggests Prevas is well-positioned to capitalize on long-term market expansion, driving multi-year revenue growth.

- Strategic focus on high-growth, complex solutions-such as automation, AI-driven image processing, sensor technology, and cybersecurity-for defense and industrial clients, reinforces margin potential due to higher value-added project mix and recurring contracts, supporting net margin improvement.

- Integration of recent acquisitions (e.g., OIM Sweden) and restructuring efforts in underperforming regions are expected to yield operational efficiencies, improve project delivery, and enhance profitability, directly benefitting future EBITA and net margins.

- Enhanced partnership with Hexagon to expand digital transformation services across the Nordics positions Prevas to benefit from large, multi-year digitalization projects and cross-selling opportunities, boosting revenue and earnings visibility.

- Scarcity of specialized engineering talent and Prevas' strong customer relationships (especially in defense and energy) bolster its pricing power and reduce competitive risks, underpinning improved earnings quality and supporting sustainable long-term margin expansion.

Prevas Future Earnings and Revenue Growth

Assumptions

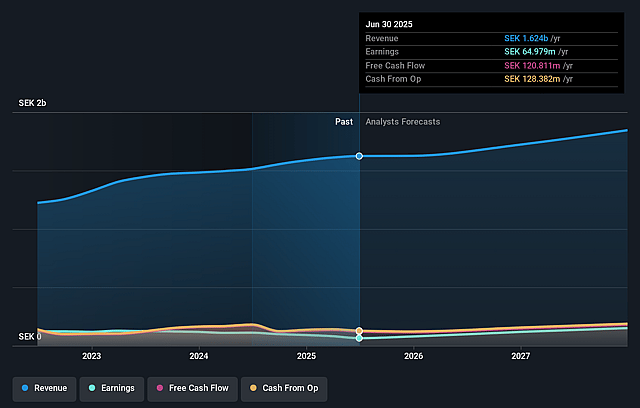

How have these above catalysts been quantified?- Analysts are assuming Prevas's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.0% today to 9.6% in 3 years time.

- Analysts expect earnings to reach SEK 180.0 million (and earnings per share of SEK 11.28) by about September 2028, up from SEK 65.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, down from 13.9x today. This future PE is lower than the current PE for the SE IT industry at 14.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

Prevas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent challenging and uncertain macroeconomic conditions are causing customers to delay large investment decisions, resulting in weaker demand visibility and persistent pressure on top-line revenue growth.

- Ongoing restructuring efforts, personnel reductions, and leadership changes indicate structural issues in operational efficiency and utilization; unless strategically resolved, these could restrain margin expansion and compress net earnings over the medium term.

- Heavy reliance on core Nordic markets and limited geographic diversification exposes Prevas to regional demand fluctuations and sector-specific shocks, constraining the company's ability to capture faster-growing international revenue streams.

- Increasing competition in IT and software consulting services-coupled with commoditization of standard offerings-may lead to downward pressure on pricing and profitability, especially for projects outside of high-demand verticals such as defense and energy, negatively impacting net margins.

- The company's business model remains highly dependent on the availability and retention of specialized consultants; rising labor costs and continued talent shortages in Europe risk further contraction in operating margins and limit scalability, impacting long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK132.5 for Prevas based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.9 billion, earnings will come to SEK180.0 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of SEK70.1, the analyst price target of SEK132.5 is 47.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.