Key Takeaways

- RVRC's robust digital infrastructure, rapid localization, and physical retail expansion uniquely position it for accelerated global market share and multi-channel growth.

- Strong brand loyalty, premiumization, and sustainability focus enable recurring revenue, higher margins, and outsized earnings power versus traditional retail competitors.

- Narrow product focus, growing competition, and rising regulatory and cost pressures threaten RVRC Holding's market share, margins, and long-term profitability.

Catalysts

About RVRC Holding- Engages in the e-commerce outdoor clothing business in Germany, Sweden, Finland, and internationally.

- While analyst consensus sees international expansion as a moderate growth driver, the breadth of RVRC Holding's digital D2C infrastructure and proven ability to rapidly localize webshops in 18 countries means the company is positioned to accelerate global market share gains far faster than peer expectations, which could unlock higher-than-anticipated revenue compounding as weak macro conditions recover.

- Analyst consensus highlights the successful Alpine Collection launch and ongoing category expansion, but is likely still underestimating the significant product and average order value uplift possible as RVRC leverages its in-house design capabilities and data-driven customer insights to premiumize new verticals such as footwear and lifestyle segments, directly boosting gross margin and overall earnings power.

- The overwhelmingly strong customer loyalty and online community of over 2 million followers, combined with more than 720,000 reviews averaging 4.6 out of 5, not only reduces customer acquisition costs but also creates the foundation for a powerful recurring revenue and cross-sell ecosystem, driving predictable revenue growth and margin upside well above traditional retail benchmarks.

- As global outdoor activity and adventure travel grow and consumers prioritize quality and sustainability, RVRC's reputation for high-quality, ethically produced gear positions it to command premium pricing and heightened customer preference, benefiting both top-line growth and long-term net margin expansion.

- The early success of RVRC's physical retail initiative opens access to the approximately 80% of outdoor apparel purchases that occur offline, with a hybrid retail model set to drive meaningful incremental revenue from new customer segments and geographies while simultaneously reducing logistics costs and returns, enhancing both net sales and profitability.

RVRC Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on RVRC Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming RVRC Holding's revenue will grow by 13.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.2% today to 17.3% in 3 years time.

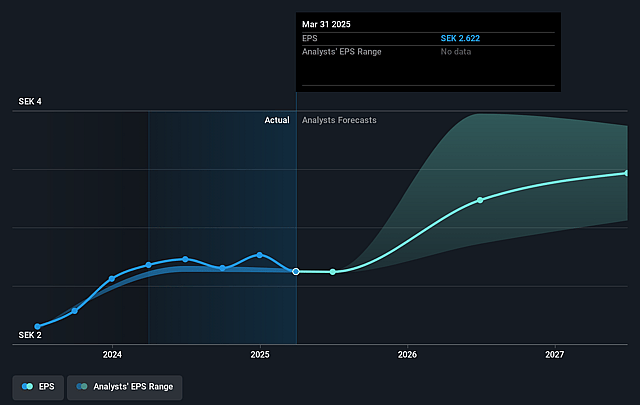

- The bullish analysts expect earnings to reach SEK 479.4 million (and earnings per share of SEK 4.47) by about August 2028, up from SEK 293.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, up from 16.2x today. This future PE is lower than the current PE for the SE Specialty Retail industry at 22.4x.

- Analysts expect the number of shares outstanding to decline by 3.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.11%, as per the Simply Wall St company report.

RVRC Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing frequency and severity of climate-related extreme weather events could suppress demand for outdoor apparel, narrowing RVRC Holding's addressable market and negatively impacting revenue growth over the long term.

- RVRC Holding's heavy reliance on a narrow product niche, primarily outdoor clothing for hiking and adventure, exposes it to shifting consumer preferences, which may lead to volatile sales and revenue concentration risks if trends move away from outdoor activities.

- The accelerating shift towards digital-first and direct-to-consumer models favors brands with greater technological and marketing resources; RVRC Holding's limited scale and brand recognition compared to global competitors may erode net margins and limit its ability to maintain market share.

- Heightened price competition from new entrants, such as Chinese low-cost platforms and global e-commerce giants, alongside a consumer focus on discounts, could lead to margin compression and put sustained pressure on profitability and future earnings.

- Increasing regulation and scrutiny around sustainability, labor, and supply chain, combined with ongoing supply chain volatility and potential inflationary pressures on raw materials, may drive up operating costs and reduce net margins for RVRC Holding over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for RVRC Holding is SEK68.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of RVRC Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK68.0, and the most bearish reporting a price target of just SEK51.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be SEK2.8 billion, earnings will come to SEK479.4 million, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 6.1%.

- Given the current share price of SEK44.08, the bullish analyst price target of SEK68.0 is 35.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.