Key Takeaways

- Investment in shopping experience, enhancing digital presence, and high-profile marketing boosts brand perception, aiming to drive revenue and market share growth.

- Strategic portfolio adjustments, nearshoring, and supply chain improvements anticipate operational efficiency, potentially improving margins and reducing costs.

- Economic sensitivity, increased costs, and operational challenges threaten H&M's profitability, requiring careful navigation to maintain growth amid adverse conditions.

Catalysts

About H & M Hennes & Mauritz- Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

- H&M's focus on investing in the product offering, shopping experience, and marketing is expected to enhance brand perception and drive sales, aiming to support future revenue growth.

- The strategic decision to discontinue Afound and optimize the store portfolio by opening new stores in emerging markets and closing underperforming ones is set to improve operational efficiency and potentially lift net margins over time.

- H&M's enhanced digital presence with a revamped app experience across Europe and the U.S. is likely to boost online sales, contributing to higher revenue growth in digital channels.

- Increased marketing spend backed by high-profile collaborations and events aims to strengthen customer engagement and brand visibility, anticipated to positively impact sales and market share in 2024.

- Nearshoring and improvement in supply chain flexibility should position H&M to respond more efficiently to fashion trends, potentially improving gross margins and reducing inventory costs in the long term.

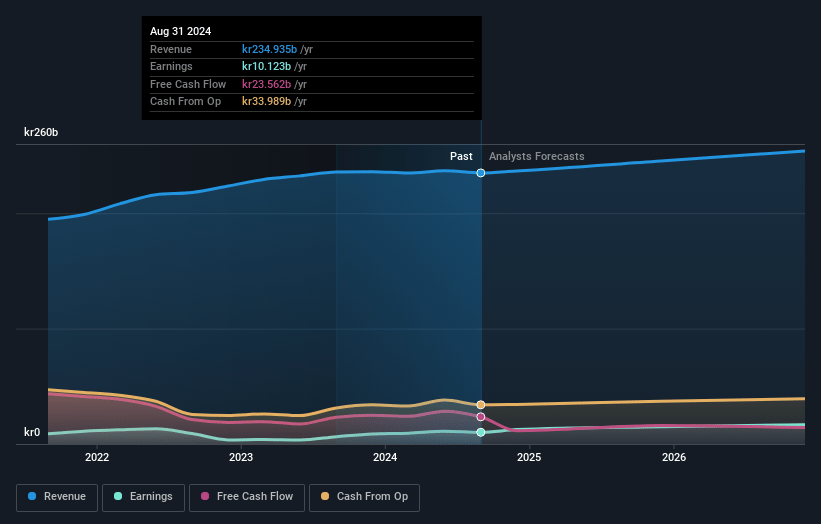

H & M Hennes & Mauritz Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming H & M Hennes & Mauritz's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 6.6% in 3 years time.

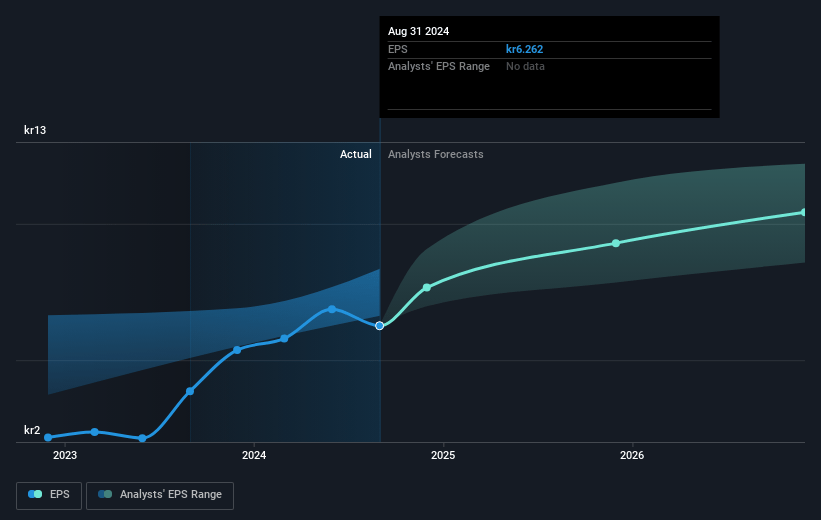

- Analysts expect earnings to reach SEK 17.4 billion (and earnings per share of SEK 10.81) by about January 2028, up from SEK 10.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK19.9 billion in earnings, and the most bearish expecting SEK12.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, down from 24.4x today. This future PE is lower than the current PE for the GB Specialty Retail industry at 19.8x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.98%, as per the Simply Wall St company report.

H & M Hennes & Mauritz Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- H&M faces potential revenue and margin challenges due to weaker sales in the early part of the quarter caused by cold weather in important European markets, indicating sensitivity to climate factors which can disrupt revenue performance.

- Increased operating costs from external factors, especially due to currency translation effects, negatively impacted H&M's operating profit, reflecting a vulnerability that could reduce net margins and earnings if similar trends persist.

- The store portfolio optimization plan involving a net reduction of approximately 100 stores might not immediately boost sales, potentially leading to stagnant revenue growth in the near term.

- Consumers facing lower purchasing power, along with an unexpected impact on sales revenues and purchasing costs, suggest that any economic downturn or continued inflation could further constrain H&M’s profitability and sales growth.

- Significant marketing investments, while showing positive indications, are not guaranteed to yield the expected return on investment if consumer sentiment or economic conditions worsen, potentially impacting earnings if these expenses do not convert to sales growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK164.23 for H & M Hennes & Mauritz based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK190.0, and the most bearish reporting a price target of just SEK120.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK263.5 billion, earnings will come to SEK17.4 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 6.0%.

- Given the current share price of SEK154.0, the analyst's price target of SEK164.23 is 6.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives