Key Takeaways

- Recent acquisitions and property upgrades are likely to boost net operating income, revenue, and cash flow, enhancing overall earnings.

- Focusing on domestic demand with strong brand networks helps Pandox maintain stable cash flow and net income margins.

- Economic uncertainties, currency volatility, high competition, and high loan-to-value levels could negatively impact Pandox's profitability, revenue stability, and financial health.

Catalysts

About Pandox- A hotel property company, owns, develops, and leases hotel properties.

- Pandox's recent acquisitions, including Hotel Pullman Cologne and Elite Hotel Frost, are expected to achieve stabilized yields of 6.5% and 7%, respectively, which could potentially increase net operating income and overall earnings.

- The reclassification of Hotel Hubert in Brussels to a Leases segment with a new lease to Numa is anticipated to enhance property value, suggesting an uptick in revenue and cash flows from the property.

- Investments in upgrading properties in Own Operations, like the comprehensive upgrade of Leonardo Royal Hotel Baden-Baden, are aimed at capturing more demand and enhancing revenue potential during slower seasons.

- The advantage of Pandox's business model, which focuses on domestic demand and having a strong network of brands, is anticipated to maintain cash flow and income stability, potentially improving net margins.

- Strong occupancy growth trends in Nordic regional markets, as observed with Norway leading, hint at a promising RevPAR increase, positively impacting future revenue projections.

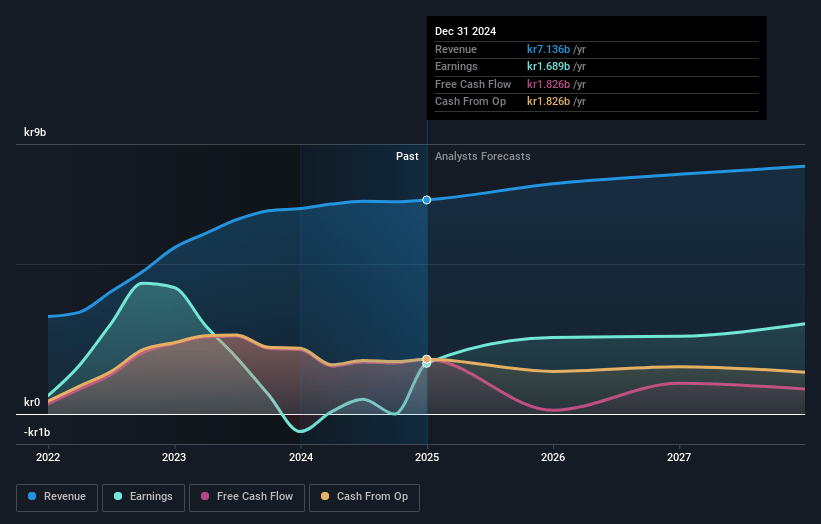

Pandox Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pandox's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.9% today to 34.0% in 3 years time.

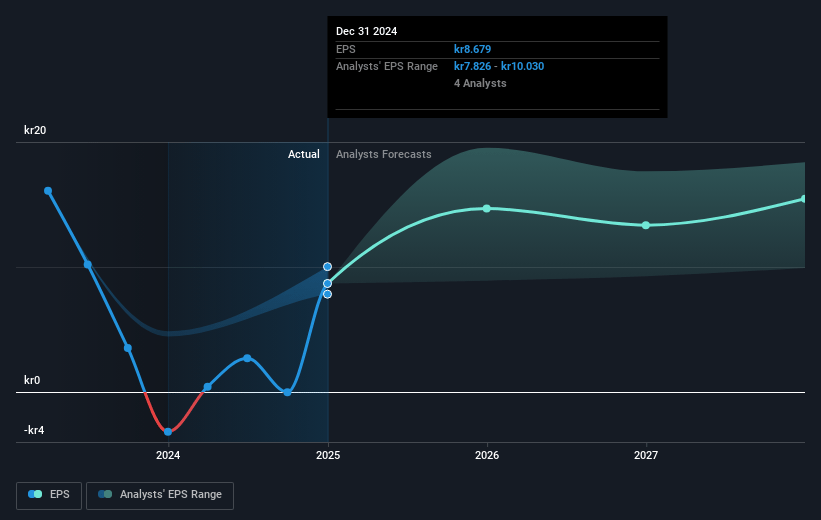

- Analysts expect earnings to reach SEK 2.9 billion (and earnings per share of SEK 13.31) by about May 2028, up from SEK 1.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting SEK3.5 billion in earnings, and the most bearish expecting SEK1.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, down from 23.2x today. This future PE is greater than the current PE for the GB Real Estate industry at 21.4x.

- Analysts expect the number of shares outstanding to grow by 5.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.09%, as per the Simply Wall St company report.

Pandox Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The financial performance in Pandox's Own Operations segment was negatively impacted by slower demand in Brussels and renovation effects, which could affect overall profitability if such trends continue. This would likely impact net margins and earnings.

- The Swedish krona's appreciation led to large negative currency translation effects for properties in foreign currencies, causing a decrease in EPRA NRV per share. Continued currency volatility could impact the company's balance sheet and perceived financial health.

- High competition in certain key markets, such as Brussels with increased capacity, could suppress occupancy and revenue per available room (RevPAR) growth, affecting overall revenue.

- Economic uncertainties, like fluctuating tariffs and international travel patterns, create an unpredictable business environment, which could hinder stable revenue growth and net income.

- Financing risks due to high loan-to-value levels (47.4% post-acquisition) and ongoing refinancing may pose interest rate risks, impacting net earnings and cash flow if market conditions worsen.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK211.667 for Pandox based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK8.5 billion, earnings will come to SEK2.9 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 9.1%.

- Given the current share price of SEK161.2, the analyst price target of SEK211.67 is 23.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.