Key Takeaways

- Hemnet Max launch could enhance long-term growth by increasing average revenue per listing and overall sales through better seller visibility.

- Improved B2B offerings and agent relationships, alongside strategic investments, could boost margins and sustain revenue growth through enhanced engagement.

- Rising costs and competition, combined with macroeconomic uncertainties and declining user engagement, pose significant threats to Hemnet Group's profitability and market position.

Catalysts

About Hemnet Group- Operates a residential property platform in Sweden.

- The launch of Hemnet Max could drive long-term growth through increased revenue from sellers seeking maximum visibility and enhanced features, contributing to higher average revenue per listing (ARPL) and overall sales growth.

- Strengthening relationships with real estate agents and improving B2B offerings could enhance revenue streams and potentially improve net margins through better partnerships and increased agent engagement.

- Planned investments in product development and marketing, especially around digital marketing and user experience enhancements, may boost user engagement and retention, leading to sustainable revenue growth.

- Opportunities in dynamic and more sophisticated pricing models could increase monetization potential per listing, positively impacting revenue and earnings without necessarily increasing costs.

- The potential stabilization of interest rates and continued strong supply of listing volumes, coupled with a robust product portfolio, may drive consistent top-line growth despite macroeconomic uncertainties, ensuring steady margins.

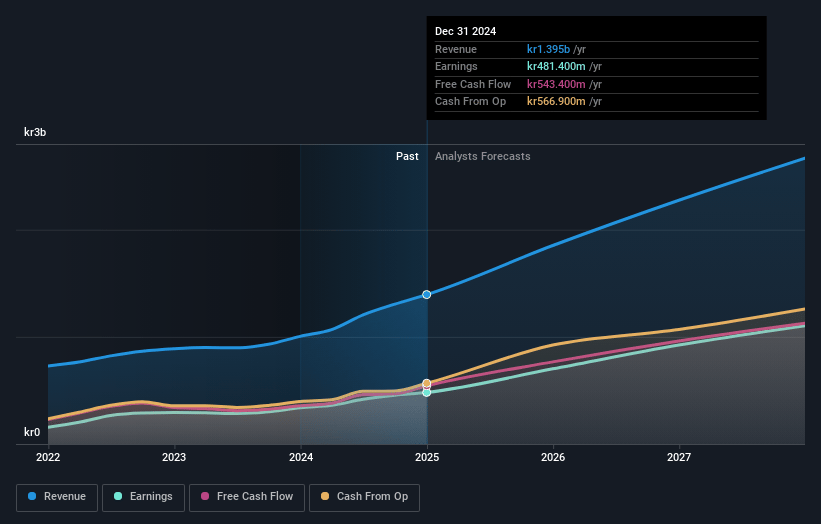

Hemnet Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hemnet Group's revenue will grow by 24.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 34.8% today to 41.8% in 3 years time.

- Analysts expect earnings to reach SEK 1.2 billion (and earnings per share of SEK 11.44) by about May 2028, up from SEK 511.9 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as SEK1.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.5x on those 2028 earnings, down from 61.5x today. This future PE is greater than the current PE for the SE Interactive Media and Services industry at 25.9x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.96%, as per the Simply Wall St company report.

Hemnet Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increase in cost expenditures, such as marketing investments and product development, suggests a trend that could pressure net margins, as the company foresees continued high costs impacting future profitability.

- The longer average listing time of 47 days introduces risk in revenue cycles, as extended time on market could potentially reduce the fluidity of transaction levels even though revenue remains stable.

- The decrease in sessions per user throughout 2024 implies a decline in customer engagement, which could impact future revenue growth if not addressed, as high engagement is crucial for attracting bidders.

- Macroeconomic uncertainties, especially related to interest rates, could adversely impact transaction volumes, thereby affecting revenue scales and creating potential earnings volatility.

- Increasing competition from alternative property platforms, combined with price sensitivities in the market, suggests both market share risks and potential downward pressure on average pricing models, impacting overall revenue predictions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK411.5 for Hemnet Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK473.0, and the most bearish reporting a price target of just SEK370.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK2.8 billion, earnings will come to SEK1.2 billion, and it would be trading on a PE ratio of 38.5x, assuming you use a discount rate of 6.0%.

- Given the current share price of SEK331.0, the analyst price target of SEK411.5 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.